/cloudfront-us-east-2.images.arcpublishing.com/reuters/GBRVUEDXAVPNHCXHFLZIFUESSM.jpg)

Euro and U.S. dollar banknotes are seen in this picture illustration taken in Prague January 23, 2013. REUTERS/David W Cerny

LONDON, Sept 20 (Reuters) - And so it begins: Taxes in the world's wealthiest countries are rising. Inevitable perhaps given the unprecedented COVID-era debt surge and, according to some investors, even a good thing if it helps close the wealth gaps the pandemic has exacerbated.

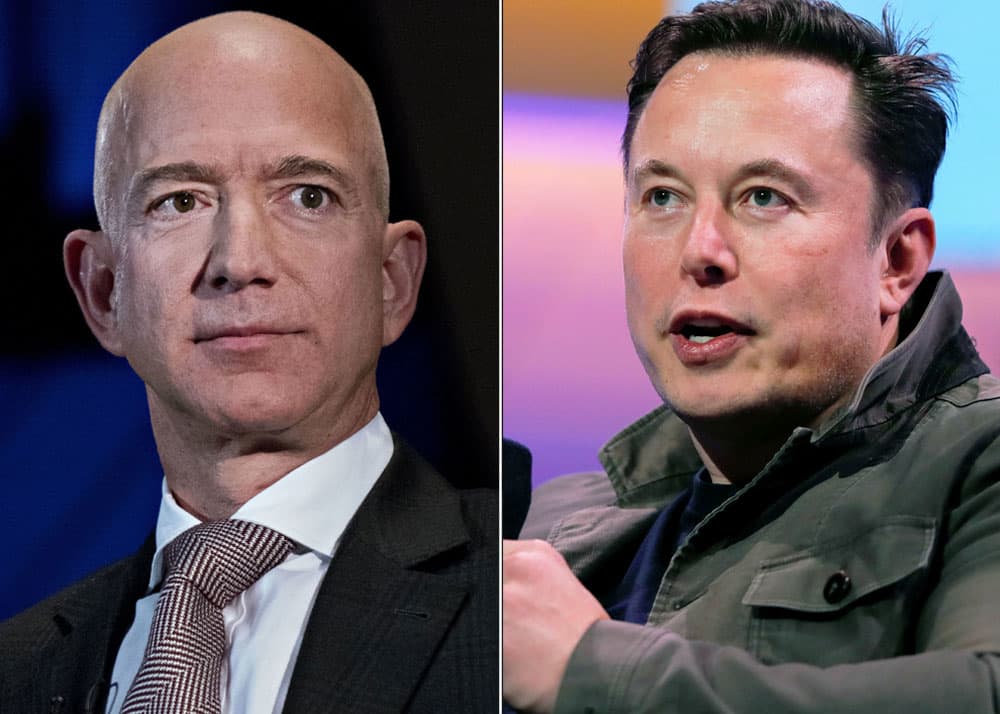

The wealthy may avoid $163 billion in annual taxes. How they do it

The wealthiest Americans may be dodging as much as $163 billion in income taxes every year , according to the U.S. Department of the Treasury, and many leverage tax laws to do it legally, financial experts say.

Although U.S. levies increase with income, the ultra-wealthy often finesse the tax code to reduce how much they owe. And some billionaires, such as Amazon founder Jeff Bezos and Tesla CEO Elon Musk , pay little to no taxes compared with their wealth , a ProPublica report found.

Federal Tobacco Tax Proposal May Result in 50% Increase in State Taxes

Much has been written about the House Democrats' proposal to increase tobacco and nicotine products taxes over the last week.

The federal government is not the only government entity to tax tobacco products—all states and many localities tax tobacco as well. Every state taxes cigarettes by quantity, but a majority tax other tobacco products (OTP) by price ( ad valorem ).

California Taxes Residents—Even Temporary Ones

California regulations say that whether the purpose an individual is in the state is temporary or transitory depends on the facts and circumstances. Passing through is OK.

There don't appear to be many cases in which this rule has been tested. However, there are some authorities applying this provision to taxpayers who have entered or left California for a temporary or indefinite work assignment.

Democrats tackling flash points of taxes, health, climate | WFXL

The deadline to pay property taxes is drawing near. Here's what to know if you miss it

The deadline to pay the first installment of Fiscal Year 2022 property taxes without interest is drawing near.

The first half of property tax is due by Sept. 1 of each year. Late interest will accrue starting Oct. 1st, unless the last day falls on a Saturday or Sunday, in which cases taxes become delinquent the second business day of October.

Boris Johnson Plans to Confront Amazon's Jeff Bezos Over Taxes | Barron's

Aides to U.K. Prime Minister Boris Johnson said he plans to confront Amazon (ticker: AMZN) founder and executive chairman Jeff Bezos on the tax record of the U.S. online retail giant, when the two men meet Monday in New York.

Johnson, who will be in the U.S. for the United Nations General Assembly, will also later travel to Washington for talks with President Joe Biden and Vice President Kamala Harris.

Lightfoot’s 2022 Budget Proposes No New Taxes, Relies on Federal Funds – NBC Chicago

Chicago Mayor Lori Lightfoot delivered her 2022 budget address during Monday's City Council meeting, where she proposed plans to help close a $733 million shortfall without increasing taxes.

The $16.7 billion plan relies heavily on federal funds distributed during the coronavirus pandemic as part of the American Rescue Plan.

Wealthkare Investment Center : Biggest Mistake, Ignoring Taxes | ABC27

HARRISBURG, Pa. (WHTM) -- Monday's hometown heroes are hosting a party for current and future dog owners. The 16th annual Woofstock takes place this Sunday, Sept. 26, along Riverfront Park in Harrisburg.

PENNSYLVANIA (WHTM) -- Social media abounds with ideas for COVID-19 treatments, but experts warn against self-treating with untested and potentially dangerous substances.

Congress needs to increase my taxes - Roll Call

Our tax code is one of the biggest scams in America, and the wealthy have been taking advantage of it for years. The worst part of this scam is that it is all legal. I would know because my family benefits from it.

In America, my story is possible, but it is growing more improbable in large part because our tax system has grown more and more unequal. How is it that a coffee shop barista pays 12 percent in taxes a year when Elon Musk paid less than 3 percent ?

Happening on Twitter

Analysis: Higher taxes are coming and for markets, that could be a good thing https://t.co/sUQOLBSQsA https://t.co/ZIdBvcEe04 Reuters (from Around the world) Mon Sep 20 14:50:04 +0000 2021

NOTE: When I wrote this analysis a couple of weeks back, the first version of the graph put the highest bracket jus… https://t.co/dDE2cNHsYY charles_gaba (from Bloomfield Township, MI) Mon Sep 20 15:15:50 +0000 2021

No comments:

Post a Comment