Everybody wants to get filing taxes over with quickly, with as little fuss as possible. That's why online tax software comes in very handy at tax time.

Most people want tax software that's either free or inexpensive. Plus, you want a trustworthy platform that won’t try and upsell you at inopportune moments.

Forbes Advisor has got you covered. We reviewed six of the top online tax software platforms to help you find the best software for your circumstances and checked out their free tax filing options, evaluated ease of use and customer service quality, and determined whether they were able to handle complicated returns.

This may worth something:

Pandemic heats up state tax competition to attract businesses, residents

The tax competition between states to attract and keep businesses and residents has been ongoing for decades. The national migration pattern has generally trended from cold, high-tax northern states to warm, low-tax southern and south western states.

Retirees, no longer tied to a workplace or raising children, have been a major part of the caravan of migrants heading south. However, for all but the wealthiest, taxes are usually not the main factor.

3 reasons you want to file your taxes as early as possible: Start this Friday, Feb. 12 - CNET

(If you're on the hook for taxes but you're owed stimulus check money, the amount you have to fork over will be reduced. So, if you were to owe $1,000 in taxes and you're missing $500 in stimulus check money, you'd owe $500 instead of $1,000.)

To figure out whether and how much money you're owed from a previous round of stimulus checks, first you have to determine how much you were owed for each previous payment, then subtract from that any amount you already received.

Gov. Lamont opposes raising taxes, despite pressure from some Democrats | News | wfsb.com

Quite a lot has been going on:

Governor Carney Signs Unemployment Tax Relief Legislation - State of Delaware News

AG Jennings' Consumer Protection Unit files Action Against Unlicensed Debt-Management Services Company

Date Posted: February 8, 2021

Governor Carney Signs Unemployment Tax Relief Legislation

Date Posted: February 8, 2021

Governor Carney, DPH, DEMA Announce Community COVID-19 Testing Sites

Date Posted: February 5, 2021

Treasurer Davis Named to National Board to Help Families Save for Education

Date Posted: February 4, 2021

David Leeper: Here are answers to common tax questions, penalties

Over the past several years, I have been frequently asked the same questions. So, today I'd like to answer a few of those questions in the hope it helps those who might be affected.

It is a common occurrence for a business to be unable to pay its payroll taxes. The thinking is that the business will turn around or a customer will pay and the business will then have the money to pay its past due payroll taxes.

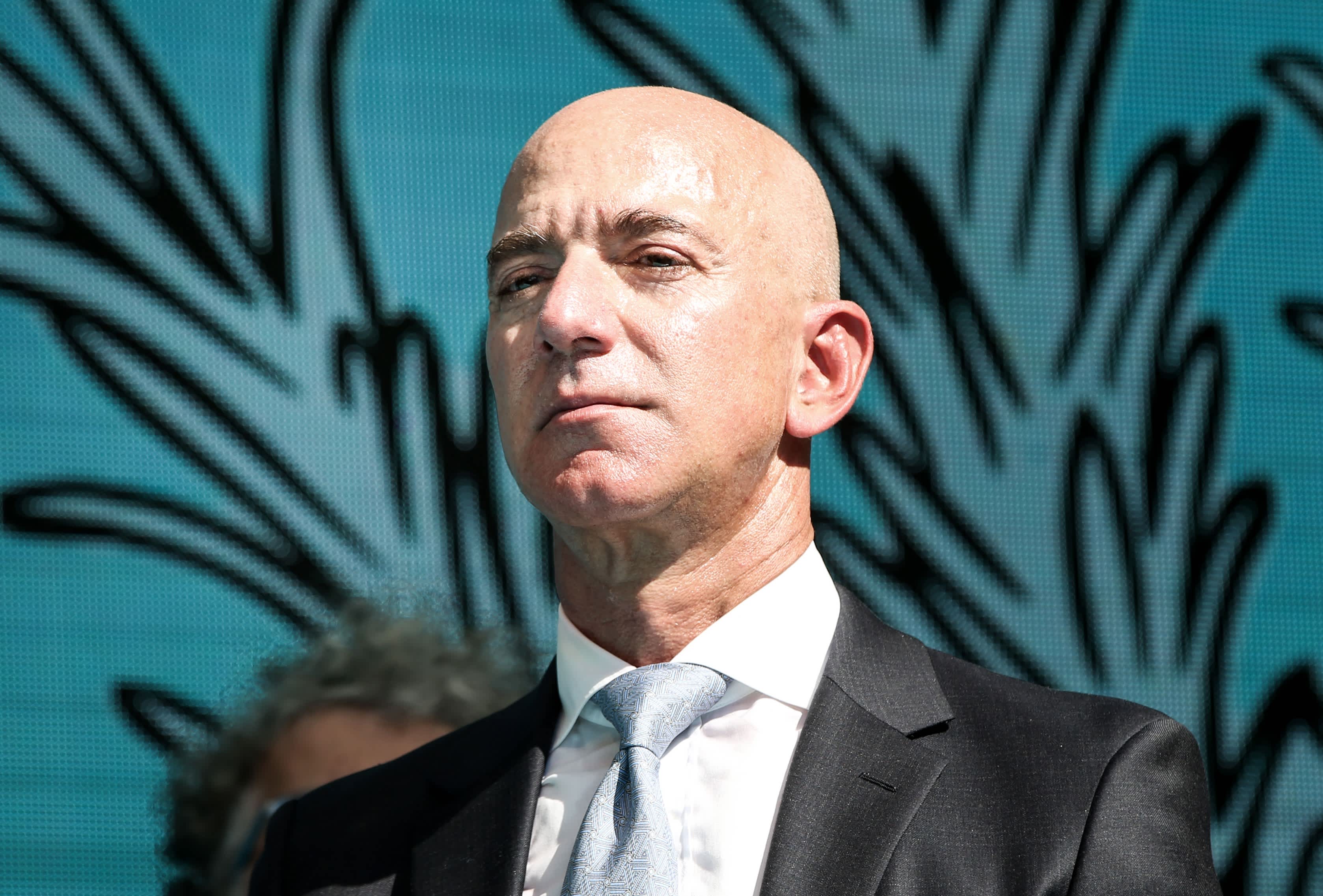

Jeff Bezos would owe $2 billion in state taxes under Washington wealth tax

Jeff Bezos would owe about $2 billion a year in state income taxes under Washington's proposed wealth tax, according to legislators.

As part of an effort to reduce inequality and offset the state's lack of an income tax, Washington state legislators are proposing a 1% levy on wealth over $1 billion. Lawmakers say the tax would raise about $2.5 billion a year in revenue and would only apply to so-called nontangible financial assets, or financial investments like stocks or options.

Oregon is taxing your stimulus check.

PORTLAND, Ore — It's tax season and this year's going to be a little wonky. We know you have questions about filing, like this one from Gen: "Is Oregon taxing the stimulus payments?"

Long story short: Yes. You'll probably owe some extra money to the state or get a smaller refund than usual.

Oregon is one of only a few states that lets you deduct the federal income taxes you pay from the income you pay state taxes on.

No comments:

Post a Comment