The Final Regulations became effective January 15, 2021, but they will apply only for tax years that start after December 31, 2021. Until then:

Taxpayers may rely on the interim guidance under Notice 2019-09 or the Proposed Regulations, or the Final Regulations, but only if they apply the rules in their entirety; and

The IRS will continue to allow a reasonable, good faith interpretation of the statute, if interpretation takes into account the legislative history. The Notice and the Proposed Regulations include a list of positions that the IRS considers to be an unreasonable (not good faith) interpretation of the statute.

Not to change the topic here:

Tax business, River North restaurant cited for COVID-19 violations - Chicago Tribune

A South Side tax preparation business has been cited for violating COVID-19 regulations by allegedly operating an illegal club that featured a DJ, dancers and cover charge where guests did not practice social distancing or wear face coverings, city officials said.

Loves Tax LLC (10305 S. Martin Luther King Drive) was also cited for operating a club without the proper licenses, allowing indoor smoking and interfering with the investigation by refusing to answer questions, according to the city's office of Business Affairs and Consumer Protection.

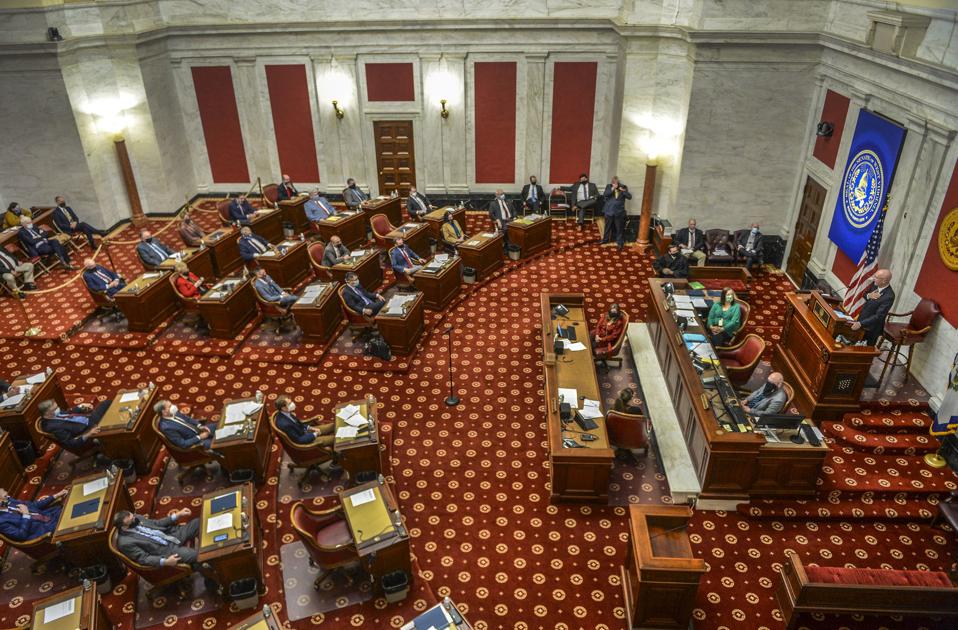

Senate leaders plan aggressive agenda of tax cuts, regulatory and licensing rollbacks, and more |

Tech workers sound off on Washington state’s proposed ‘billionaire tax’ at

Tech workers showed up to a virtual hearing Tuesday to voice their opinion on a proposed tax on Washington state's wealthiest residents .

"I'm not fortunate enough to qualify for this wealth tax but I do occasionally meet with billionaires who would," said Ned Friend, a product lead for Microsoft during the hearing. "We meet to discuss how new software can make the world a better place. I trust they would be proud to contribute in this other way."

In case you are keeping track:

Biden's regulation costs outweigh likely benefits | Commentary - Orlando Sentinel

Free-market economists spent four exhausting years trying to explain to our students and anyone who would listen why Donald Trump's anti-immigration and nationalistic trade policies were damaging to the American economy.

At the same time, we were wary of the litany of tax and regulatory proposals coming out of the Biden camp. When someone runs for president during a recession and calls for even more punitive capital gains and income taxes, along with anti-business, and anti-employment rules, it makes you wonder about their economic literacy.

Regulations for tax on houses, luxury cars to be announced soon - Tehran Times

TEHRAN- The head of Iran National Tax Administration (INTA) said that the regulations for the tax on houses and luxury cars will be announced soon, adding that this annual tax has been collected and a heavy fine has been imposed on those who run away from it.

Regarding the reason for the delay in approving the bylaws for the mentioned tax, Omid-Ali Parsa said: "The bylaws were sent to the government by the INTA a long time ago and have recently been approved by the government's economy committee."

Idaho House Green Lights Bill Cutting Regulations, Taxes For Youth-Run Businesses | Boise State

Youth-run businesses, like lemonade stands, wouldn't have to pay sales taxes or get business permits under a bill passed by the Idaho House Monday morning. Sales can't exceed more than $10,000 per year to qualify.

* * *

From time to time, Idaho officials have tried to force kids to comply with state regulations while running their own businesses.

Rep. Ron Nate (R-Rexburg), who's sponsoring the bill, mentioned a case out of Lewiston in 2010 where the state tax commission told a family their kids couldn't sell pumpkins without a permit.

Transfer pricing for related party transactions: an analysis of customs valuation cases in China

In the case of import/export of goods, a related party transaction (Related Party Transaction) refers to a transaction method and form commonly used by multinational enterprises in world trade.

In addition, in judging or evaluating whether the prices of imported/exported goods are fair or not, the customs needs to abide by the WTO Valuation Agreement and the domestic valuation laws and regulations formulated by the country's legislature to implement the WTO Valuation Agreement.

However, in practice, due to the limitations of information exchange and other reasons, it is rather difficult to prove the fairness of Related Party Transaction prices from the perspective of customs valuation, and a different understanding and knowledge is prone to arise between enterprises and customs.

No comments:

Post a Comment