Not to change the topic here:

Where did you work remotely during COVID-19? It matters for taxes

Many people who suddenly ended up working remotely during the pandemic in 2020 found themselves plopped at their kitchen table in front of a laptop.

But more people than you might imagine hit the road and worked out of someone else's kitchen or spare bedroom, maybe visiting a relative or a summer home, in another state.

* * *

"Working remotely in another state may — and often does — subject the individual to tax in that state," said James O'Rilley, CPA and tax director for Doeren Mayhew in Troy.

Real Estate Taxes and Lease Disputes

COVID-19 took many, many things, changed many other things, and brought a lot of new things. One of the new things COVID-19 brought was a whole host of lease disputes. Lease disputes – usually, but not always, tenants looking for a way out of a lease – are always a part of the legal landscape, but the frequency and creativity of lease disputes have been accelerating as of late. As such, we'll spend a little time in our next few posts on lease matters.

It's a common feature of commercial leases – and is a necessary ingredient of a "triple net" lease – for the tenant to pay all real estate taxes associated with the leased premises. In RME Management, LLC v. Chapel H.O.M. Assocs. , 251 N.C. App.

School of Community Health Sciences publishes study on sugar-sweetened beverage taxes |

“The beverage industry is aggressively attempting to preempt sugar-sweetened beverage taxes at the state level to prevent the diffusion of progressive polices at the local level throughout the United States,” Crosbie, an affiliate of the University’s Ozmen Institute for Global Studies, said. “Once preemption laws are enacted, they create a chilling effect that severely cripples local progress and are challenging to repeal.”

Many things are taking place:

Third stimulus check: Why some Americans should file their taxes ASAP for a bigger payment | Fox

Moody's Analytics chief markets economist John Lonski discusses how fiscal coronavirus relief will be difficult to reverse.

Congressional Democrats are barreling ahead with passing President Biden 's nearly $2 trillion coronavirus relief package, paving the way for a third stimulus check for millions of Americans – and households could start to receive the money in just a few weeks.

But the timing of the bill's passage – lawmakers are hoping to send the legislation to Biden's desk before March 14, when unemployment benefits for millions expire – has raised new questions about tax season, like when Americans should file their 2020 returns in order to maximize their payout.

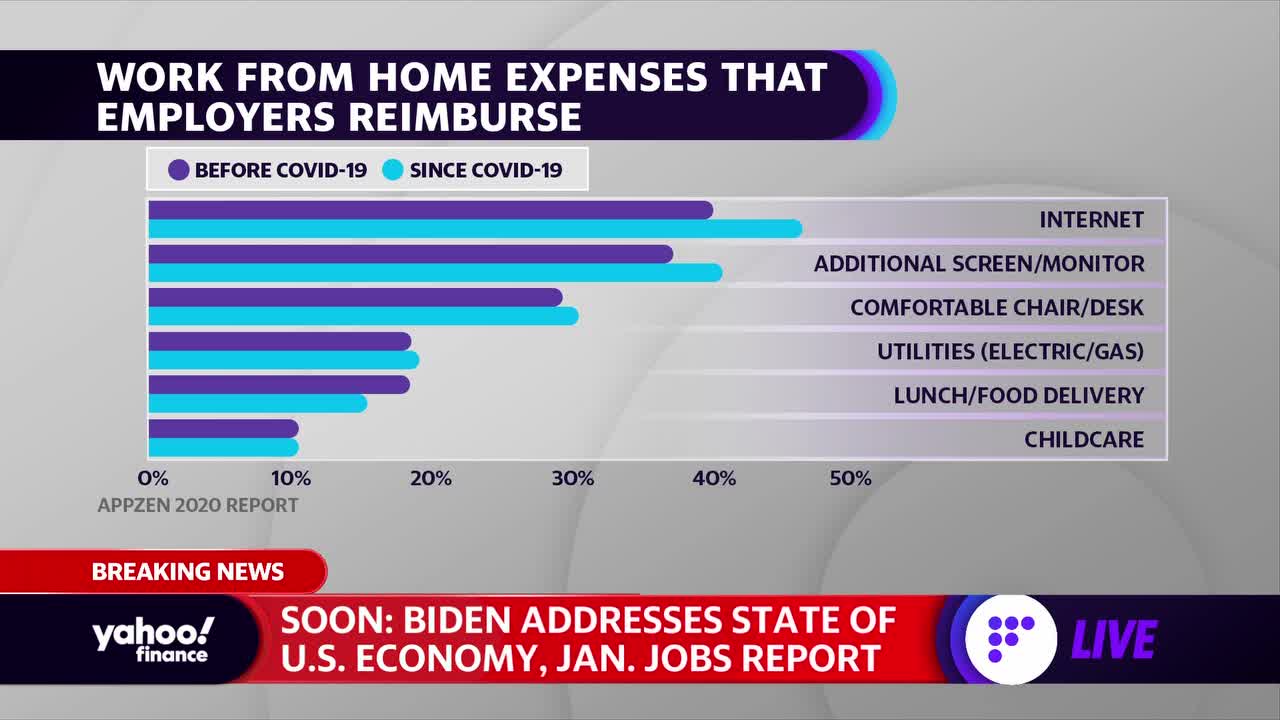

Deducting WFH expenses? There are fewer tax breaks than you might expect

The coronavirus pandemic forced millions of American workers to quickly transition to a work-from-home (WFH) setup, but not every worker had a turnkey office in their house or apartment.

So, many people bought new chairs, desks, and other office equipment out of pocket to accommodate their WFH arrangement.

* * *

"The answer depends on the status of individuals," Lewis Taub, a certified public accountant and director of tax services at the New York office of Berkowitz Pollack Brant Advisors, told Yahoo Money. "If they're employees who work at a company or if they are self-employed."

3 ways to handle unemployment benefits when it comes to income taxes

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/TMG5URH2YRHXPNIXKQCEWC6PEU.jpg)

After the COVID-19 pandemic swept the nation, many were left without jobs or income. In March 2020 alone, about 10 million Americans applied for unemployment, the Washington Post reported.

For those who turned to unemployment benefits last year, with tax season upon us, you might be wondering how it's all going to shake out when it comes to filing your income taxes.

Though the rules can vary in each state, for most, residents can qualify for unemployment if you became unemployed through no fault of your own.

When should you file your taxes to maximize your potential stimulus? Local tax expert weighs in

Dr. John Tarwater, Associate Professor of Finance at Cedarville University spoke with News Center 7′s James Brown about the potential stimulus check.

The amount each American would get would be based on their latest tax filing. With that being said, Dr. Tarwater suggests that if you made less in 2019, instead of filing your 2020 taxes early, use your 2019 returns for eligibility.

"In the latest CARES Act, there was a provision made that if you were eligible for something like the earned income credit and your income was less than the current year, that you could use the prior year's income rather than the current year's income in order to maximize that credit," Dr. Tarwater said.

Happening on Twitter

Spoke to HM Sultan Haitham bin Tarik of Oman. We discussed our Strategic Partnership, and our close cooperation dur… https://t.co/SGXe1FdUdP narendramodi (from India) Wed Feb 17 16:04:43 +0000 2021

Nigerian Yusuf Bilesanmi who has created a low-cost ventilator for COVID-19 patients is one of the top contenders f… https://t.co/Qidr4nm9TJ Reuters (from Around the world) Thu Feb 18 13:45:00 +0000 2021

:max_bytes(150000):strip_icc()/shutterstock_82082848-5bfc2b75c9e77c00519aa183.jpg)

No comments:

Post a Comment