/Primary_Image-ef9785af81244a12960e04f901cd4df8.jpg)

Small businesses that want to get to the next level need to have a firm grasp of their finances and the capacity to plan for growth. One great solution is hiring an online accounting firm that can fulfill the need for a reasonable budget.

Beyond general journal and ledger bookkeeping, an accounting firm can also perform account reconciliation, payroll processing, cash flow management, monthly statement preparation, and tax services. They can also provide additional layers of accounting functions to accommodate a growing business's expanding needs.

Quite a lot has been going on:

Extension, SCORE offer accounting workshop for farms | Lewiston Sun Journal

REGION — University of Maine Cooperative Extension and SCORE Maine will offer a four-session online accounting workshop for small farms and agricultural businesses using QuickBooks from 6–8:30 p.m. starting Feb. 15. The remaining dates for the webinar series are Feb. 17, Feb. 22 and Feb. 24.

"QuickBooks for Farms" includes basic principles of accounting; tracking sales, invoicing, payments and expenses; and reporting functions. Access to a desktop personal computer or laptop capable of running the software, made available to participants for the duration of the workshop, is required. SCORE Maine volunteer Michael Fortin will lead the workshop.

IMA CEO Thomson foresees 'megatrends' for accountants this year | Accounting Today

Institute of Management Accountants president and CEO Jeff Thomson is predicting six megatrends in the finance and accounting profession this year.

* * *

Many of the trends are ones seen in years past, but are likely to grow in importance this year as organizations deal with the ongoing COVID-19 pandemic and face challenges in implementing technology and responding to demands for a diverse workforce and the threats posed by climate change, he explained.

Accounting firm defies industry norms, grows rapidly | Business Observer | Business Observer

For a company that doesn’t have a sales team and doesn’t do much in the way of marketing and advertising, St. Petersburg tax and accounting firm Spoor Bunch Franz, founded in 2016, has crafted a profile that not only challenges industry norms and tropes but also wins it a steady stream of new business.

Since the merger that combined Spence Marston Bunch & Morris with Spoor & Associates, the firm — led by partners Stephen Bunch, Richard Franz III and W.G. Spoor II — has seen its revenue, built on a foundation of work for clients that specialize in affordable housing and opportunity zones, grow from $6 million in 2016 to a projected $9 million in 2020. Staffing-wise, in that time, it has increased from 45 to 65 employees.

Other things to check out:

People & firms on the move: KPMG names national ENRC leader | Accounting Today

Topel Forman appoints new managing partner; Armanino promotes record number of partners; and more CPA news.

IRS to delay tax season until Feb. 12 | Accounting Today

The Internal Revenue Service plans to open tax-filing season on Feb. 12, although it is making its Free File program available starting Friday.

The tax season normally begins in late January, but the ongoing COVID-19 pandemic, the distribution of the latest round of Economic Impact Payments, a backlog of work from last year, and changes in the tax laws seem to be delaying tax season this year. Nevertheless, the IRS announced earlier this week that all tax forms and instructions are ready and that last-minute changes to the tax laws have been included in all the tax forms and instructions.

Subscribe to read | Financial Times

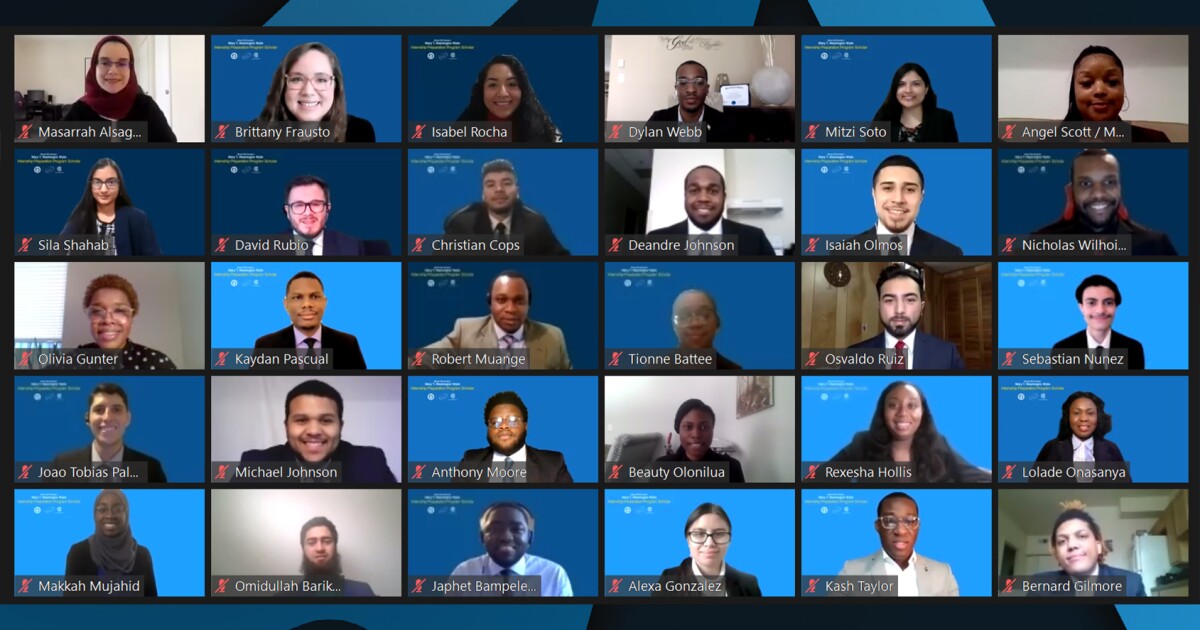

Illinois CPA Society names 2020 'Mary T. Washington' program grads | Accounting Today

The Illinois CPA Society announced that 30 minority accounting college students have graduated from its 2020 Mary T. Washington Wylie Internship Preparation Program.

Now in its ninth year, the Internship Preparation Program is funded by donations to the CPA Endowment Fund of Illinois' Mary T. Washington Wylie Opportunity Fund. The program honors the legacy of Mary T. Washington, the first African-American female CPA in the country, by advancing diversity in the profession and providing opportunities for minority accounting students to succeed.

No comments:

Post a Comment