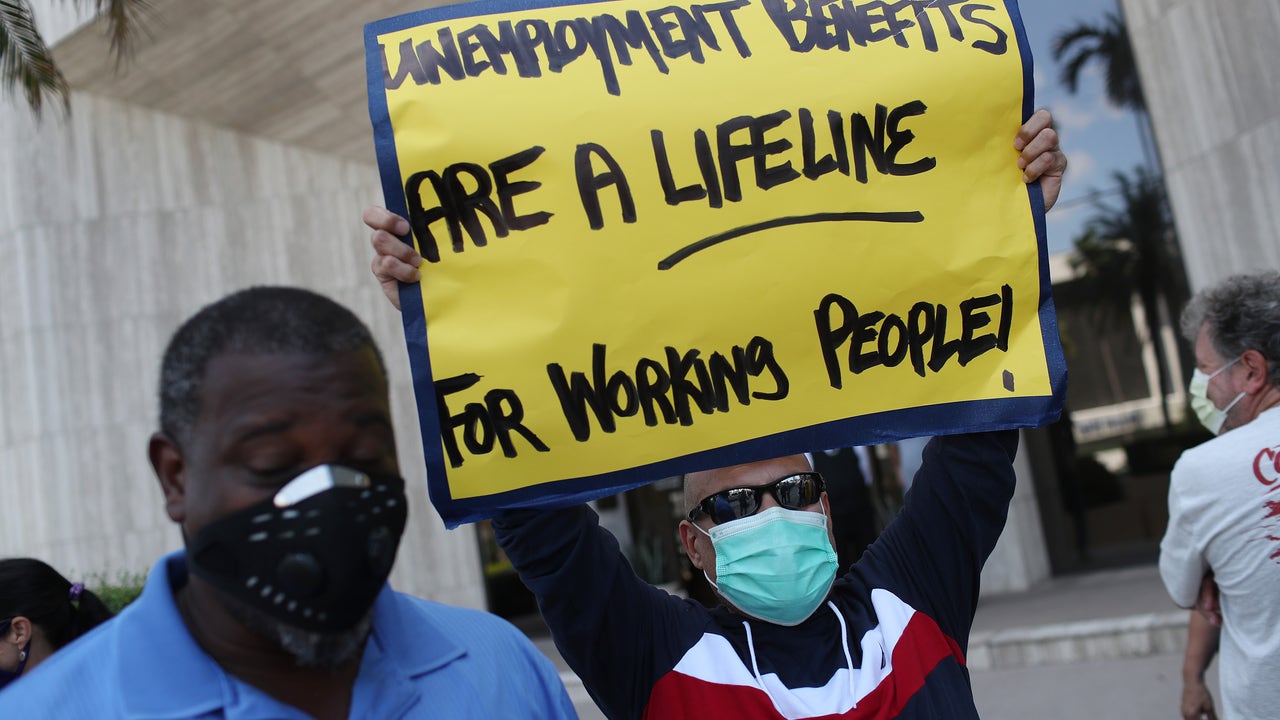

Many jobless workers are about to find out they could owe federal and state taxes on their 2020 unemployment income.

The news might be particularly unexpected for independent contractors and self-employed people who normally aren't eligible for state benefits, but may have received Pandemic Unemployment Assistance through the CARES Act.

"People who didn't have any taxes withheld from those unemployment payments are going to be in for a surprise," said Nayo Carter-Gray, enrolled agent and founder of 1 st Step Accounting in Towson, Maryland.

Quite a lot has been going on:

Agencies Outline How Feds Will Repay Payroll Taxes That Have Been Deferred - Government Executive

Federal payroll processors have begun announcing plans for how they will recoup federal employees' Social Security taxes deferred as part of a controversial Trump administration program between last September and December.

Last year, President Trump issued a memorandum allowing employers to defer payment of payroll taxes between September and December 2020. Although the vast majority of private sector employers—and federal employers outside of the executive branch—declined to do so, the administration forced all executive branch employees and members of the military to defer their payroll taxes.

Cutting your property taxes in half and other Texas dreams during the 87th Legislature | wfaa.com

"Property taxes have gotten way out of control," Tarrant County Judge Glen Whitley said. "We're the 13th highest right now in property taxes when you compare us to the other 50 states. And that's just got to change. We've got to cut it. Not just reduce the growth, but we've got to find a way to cut it."

* * *

Judge Glen B. Whitely and Sen. Nathan Johnson joined Y'all-itics about some of the other legislative priorities for 2021.

Taxes on unemployment money coming due soon, surprising many

In California, unemployment benefits, including the supplemental $600 and $300 aid, are subject to a federal tax.

OAKLAND, Calif. - Many jobseekers who are collecting unemployment benefits may be hit with a nasty surprise come tax season. Those who have been collecting supplement payments may be unprepared for a tax bill on their benefits in April.

Many jobseekers across the state are confused about the tax opt-in system, and many more report that they simply can’t afford to put aside any money when they don’t have enough to begin with.

And here's another article:

Proposed corporate tax hike in California would aid homeless - ABC News

Supporters say Assembly Bill 71 would reinvent California's approach to solving homelessness — providing for the first time an ongoing, sufficient state funding source to get people off the streets. Opponents say it would contribute to the perception that California is hostile to business.

At the same time, Gov. Gavin Newsom rejected higher taxes on the wealthy when he released his budget plan last week, saying that those taxes are "not part of the conversation." That's despite the Democratic governor dedicating his State of the State address last year to homelessness and using the pandemic to secure thousands of hotel rooms that he hopes will lead to additional housing for an estimated 150,000 people.

Bill seeks to waive state taxes on unemployment checks | Delaware First Media

Listen

Listening...

/ 1:00

Listen to this story

* * *

Over a hundred thousand Delawareans received unemployment benefits this past year, and tax season is coming up.

What many people might not know is they're expected to pay state and federal taxes on unemployment benefits.

"In the State of Delaware, you cannot withhold state taxes from your unemployment benefits. You can withhold federal taxes from your benefits," State Rep. Ed Osienski (D-Brookside).

A Warm Welcome to the Tax Trotter | Sullivan & Worcester - JDSupra

On the U.S. tax front, we got about 110 proposed and final regulations, 59 notices and 42 revenue procedures in 2020. As the Treasury and the IRS work hard to complete the 2017 Tax Reform guidance, questions remain and Administrative Procedure Act challenges are starting to roll in. The Trotter is looking forward to the district court ruling in FedEx’s tax refund claim. FedEx is challenging the validity of Treasury Regulation § 1.965-5(c)(1)(ii) and seeking an $89 million refund.

COVID-19 relief efforts may impact taxes

(WAOW)— Tax season has begun, and working Americans can expect some COVID-19 relief efforts to impact their filings.

* * *

To anyone that received one or both stimulus checks, there's good news: it's not taxable and is a credit on tax returns.

"Our job as preparers' are to do the tax returns and reconcile the amount each person should have gotten based on income and family size versus what they received," said Ben Hauser the CEO of Northland CPAs.

Happening on Twitter

How being unemployed in 2020 could lead to a surprise tax bill https://t.co/Hh27yrpn0Q CNBC (from Englewood Cliffs, NJ) Wed Jan 13 18:21:44 +0000 2021

How being unemployed in 2020 could lead to a surprise tax bill https://t.co/lpNuu6LGGJ h/t @NayoCarterGray @JaredWalczak @HRBlock Darla_Mercado (from Jersey City, NJ) Wed Jan 13 18:19:15 +0000 2021

My favorite thing about Congress is that there is *nothing* more important to them than being on vacation in times… https://t.co/h8cqf4H0pW jules_su (from he/him) Thu Jan 07 20:07:41 +0000 2021

No comments:

Post a Comment