The state's system of funding education – solely on the backs of home owners – is antiquated and needs to end.

We don't need another hearing or rally to express our outrage on how unjust this tax is in our state. The time for talk is over; now is the time to act. I remain fully committed to property tax elimination and will fight for that to happen.

There are many other legislative priorities, but most are centered on responsible spending with the upcoming 2020-2021 budget. The governor's proposed $34 billion general fund budget is unrealistic – and disappointing – in many aspects, mainly that his priorities do not align with those of the 33rd Senate District.

Other things to check out:

Opinion: Fareed Zakaria: Bernie Sanders’ Scandinavian fantasy – Boulder Daily Camera

Take billionaires. Sanders has been clear on the topic: “Billionaires should not exist.” But Sweden and Norway both have more billionaires per capita than the United States, Sweden with almost twice as many. Not only that, these billionaires are able to pass on their wealth to their children tax-free. Inheritance taxes in Sweden and Norway are zero and in Denmark 15%. The United States, by contrast, has the fourth-highest estate taxes in the industrialized world at 40%.

DEMOCRATIC CONGRESSIONAL CANDIDATE ROBERT TURKAVAGE OFFERS PROPOSAL TO RAISE THE STATE AND LOCAL

DEMOCRATIC CONGRESSIONAL CANDIDATE ROBERT TURKAVAGE OFFERS PROPOSAL TO RAISE THE STATE AND LOCAL INCOME TAX (SALT) DEDUCTION CAP FROM $10,000 TO $40,000, AND MAKE OTHER MODIFICATIONS TO THE 2017 TAX CUT LAW.

Today, I, Robert Turkavage offer a proposal to raise the Tax Cuts and Jobs Act of 2017 (TCJA) $10,000 SALT Deduction cap to $40,000. I propose to pay for this increase through certain income tax rate changes, and by eliminating certain corporate tax loopholes.

Avery Bourne, 95th House District - News - The State Journal-Register - Springfield, IL

I have fought for my constituents and I believe that my values are my constituents’ values. My approach to government is simple:

* * *

• Stick to basic government functions, including high quality schools, well-maintained roads, and keeping our communities safe

A: As a supporter of the Second Amendment, I oppose legislation that makes it more difficult for law-abiding gun owners to exercise their rights, like legislation that quadruples FOID fees and creates a fingerprint database of FOID holders.

Not to change the topic here:

PRIMARY ELECTION 2020: Newcomer Oliver takes on Bourne in 95th House district - News - The State

Specifically, it was tax increases supported by Rep. Avery Bourne, R-Morrisonville, a five-year incumbent.

“The incumbent promised not to vote for a tax increase the last election cycle and she did,” said Oliver, 65, a Republican from Dorsey. “It’s not just a gas tax. It’s 20 taxes, a package.”

* * *

That something is to mount a primary challenge to Bourne. It’s an uphill battle. Since being appointed to the seat in 2015, Bourne has easily defeated Democratic challengers in what is a strongly Republican district. Since then she’s risen to a leadership position of assistant Republican leader.

DoorDash, Postmates didn't collect Pa. sales tax as they should

Restaurant delivery powered by smartphone apps has become a fiercely competitive and fast-growing business, as DoorDash, GrubHub, Postmates, and Uber Eats go head-to-head in the streets of cities like Philadelphia for market share.

But behind the scenes, some of those companies are engaged in a dance with officials in Harrisburg and other state capitals over whether they are charging enough sales tax.

As of Tuesday, the four biggest food-delivery apps were charging sales tax on food, but industry leader DoorDash (which also owns Caviar) and Postmates were not collecting the tax on service and delivery fees. Even on the food, Postmates was charging just a 6% sales tax in Philadelphia, not the required 8%.

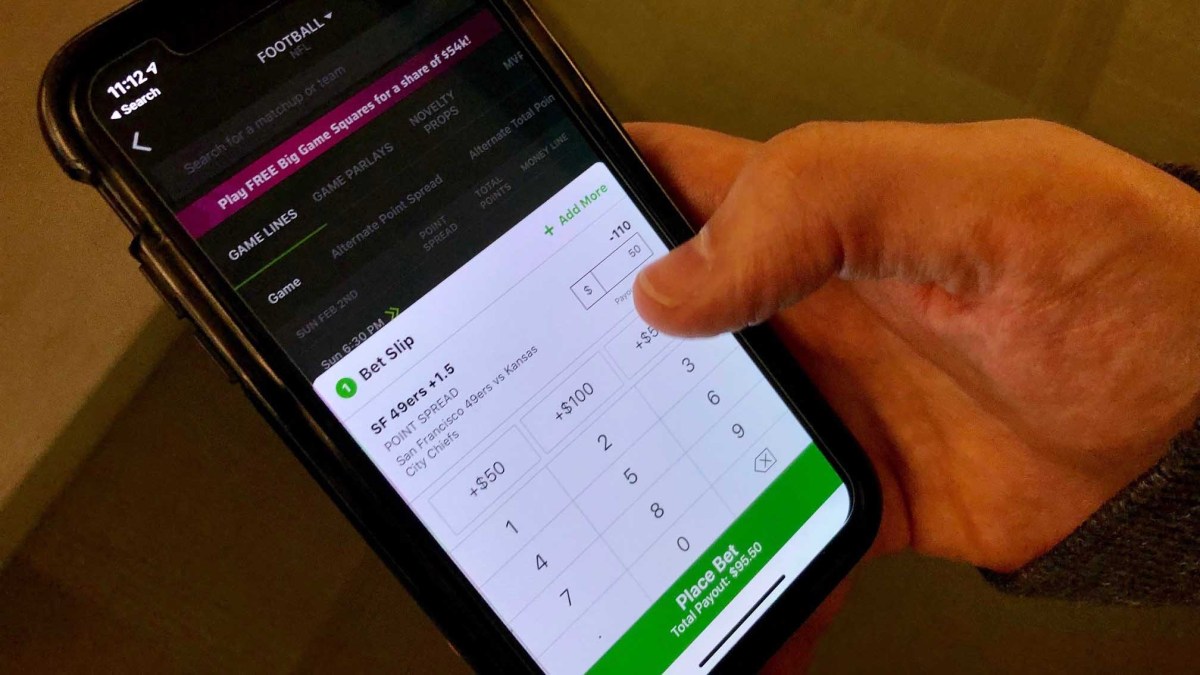

New Bill To Legalize Pro and College Sports Betting Advances – NBC Boston

Adults in Massachusetts would be able to bet on professional and Division I college sports in person and through web or mobile apps under legislation released Friday by a legislative panel that's been studying sports betting for a year.

* * *

While 17 other states, including neighboring Rhode Island and New Hampshire, have already authorized gamblers to place legal bets on sports, Massachusetts has been considering whether to similarly legalize betting since the U.S. Supreme Court in May 2018 ruled that the nearly-nationwide prohibition on sports wagering was unconstitutional and gave states the ability to legalize the activity.

Aberdeen Asia-Pacific Income Fund, Inc. Announces Payment Of Monthly Distribution

Under U.S. tax rules applicable to the Fund, the amount and character of distributable income for each fiscal year can be finally determined only as of the end of the Fund's fiscal year. However, under Section 19 of the Investment Company Act of 1940, as amended (the "1940 Act") and related Rules, the Fund may be required to indicate to shareholders the estimated source of certain distributions to shareholders.

The following table sets forth the estimated amounts of the sources of the distribution for purposes of Section 19 of the 1940 Act and the Rules adopted thereunder. The table has been computed based on generally accepted accounting principles.

Happening on Twitter

It is long last time to bring our troops home and stop the endless wars. I'm pleased to see this progress and am th… https://t.co/TDZt4O8OGc RandPaul (from Bowling Green, KY) Sat Feb 29 18:42:15 +0000 2020

Spend 10 minutes reading this please. The Supreme Court. That's what's at stake in 2020. Vote. Register people to v… https://t.co/0FS5oHoPJH WajahatAli (from D.C. by way of Fremontistan) Fri Feb 28 22:04:45 +0000 2020

Announcing the semifinalists for the Voting Gauntlet: AHR 2020 Finals event! The winning Hero will be gifted to all… https://t.co/tH2vXY0gaH FE_Heroes_EN Sun Mar 01 07:04:21 +0000 2020

No comments:

Post a Comment