If you have cash parked in a money market fund that invests in non-U.S. Treasury debt, the Federal Reserve says it's got your back.

"The Fed is doing all it can to make sure the system's plumbing is working," said certified financial planner Mike Hennessy, founder and CEO of Harbor Crest Wealth Advisors in Fort Lauderdale, Florida.

The Fed's move came on the heels of yet another rough day on Wall Street as the Dow Jones Industrial Average closed Wednesday down nearly 6% at 19,936.90 (although on Thursday it was climbing). That's on top of other large drops over the last several weeks that have put the index more than 30% off its Feb. 12 high of 29,551.

While you're here, how about this:

10 Major Money Don'ts From Dave Ramsey

The money-management guru has doled out his signature blend of tough-love financial advice and Biblical wisdom since 1992. He learned it all the hard way: In his 20s, Ramsey built a million-dollar fortune flipping houses but lost it all when banks started calling in his debts. He had to buckle down to build back up from bankruptcy.

Now his radio show is syndicated on more than 600 stations, and he's authored several books teaching Americans how to stop stumbling into debt.

As coronavirus outbreak threatens economy, FDIC assures customers money is safe | Fox Business

One of the nation's regulators responsible for protecting U.S. bank deposits assured Americans that their money is safe in federally insured banks, even as the coronavirus pandemic threatens to cause an economic catastrophe that rivals the 2008 financial crisis.

* * *

The Federal Deposit Insurance Corporation (FDIC) issued a statement Wednesday reminding Americans that FDIC-insured banks remain the "safest place to keep their money."

"Since 1933, no depositor has ever lost a penny of FDIC-insured funds," the agency said its statement.

Money Fund Facility Shows Fed Trying to Preempt Credit Crunch

The Federal Reserve is not waiting to see flames before hosing down corners of the money market with emergency liquidity.

"We were seeing some prime funds facing more liquidity issues," Eric Rosengren, president of the Boston Fed, said Thursday in an interview with Bloomberg News. "Rather than wait until the problem became critical we thought it was important to help provide some liquidity. The goal was to nip this in the bud."

Prime funds are those money funds eligible to invest in debt not backed by the U.S. government. They hold about $1 trillion of the $4.2 trillion industry, according to Crane Data LLC. Most of the rest is parked in funds dedicated to short-term Treasuries and other government-backed debt, with a small fraction invested in short-term municipal debt. Government-only funds have been receiving inflows in recent days.

Quite a lot has been going on:

Cramer: 'We can not have the fat cats make money at the expense of the workers'

CNBC's Jim Cramer said Thursday that whatever happens on the other side of the coronavirus crisis CEOs should not benefit more than their employees.

* * *

"I like anything that protects the workers," Cramer said on "Squawk on the Street." "We cannot have the fat cats make money at the expense of the workers."

The "Mad Money" host was lamenting the moral hazards of the 2008 financial crisis, when companies got bailouts and chief executives got incentives as many workers lost their jobs.

Experts share coronavirus money tips: Savings, taxes and more | Fox Business

Sen. Rick Scott, R-Fla., is currently on self-quarantine but says the economy will recover once the country defeats coronavirus.

The sudden economic slowdown caused by the coronavirus pandemic has many Americans thinking about their daily finances .

* * *

Money experts Andrea Woroch and Allison Kade shared their tips for making the most of your budget.

"There is a lot of panic happening right now — from food shortages at grocery stores to health concerns to income and financial worries," Woroch told FOX Business. "The best thing you can do for yourself right now is to make a financial plan to help you get through these tough times."

Millions of Americans will soon run out of money.

The coronavirus has infected the global economy and millions of Americans now out of work are trying to figure out what to do with no paycheck coming in.

"A lot of people don't have a safety net right now," said Bruce McClary, the vice president of communications at the National Foundation for Credit Counseling . "About 40 percent of all Americans don't have enough savings to cover a $400 emergency . What are they going to do if they have weeks of reduced work or no work at all?"

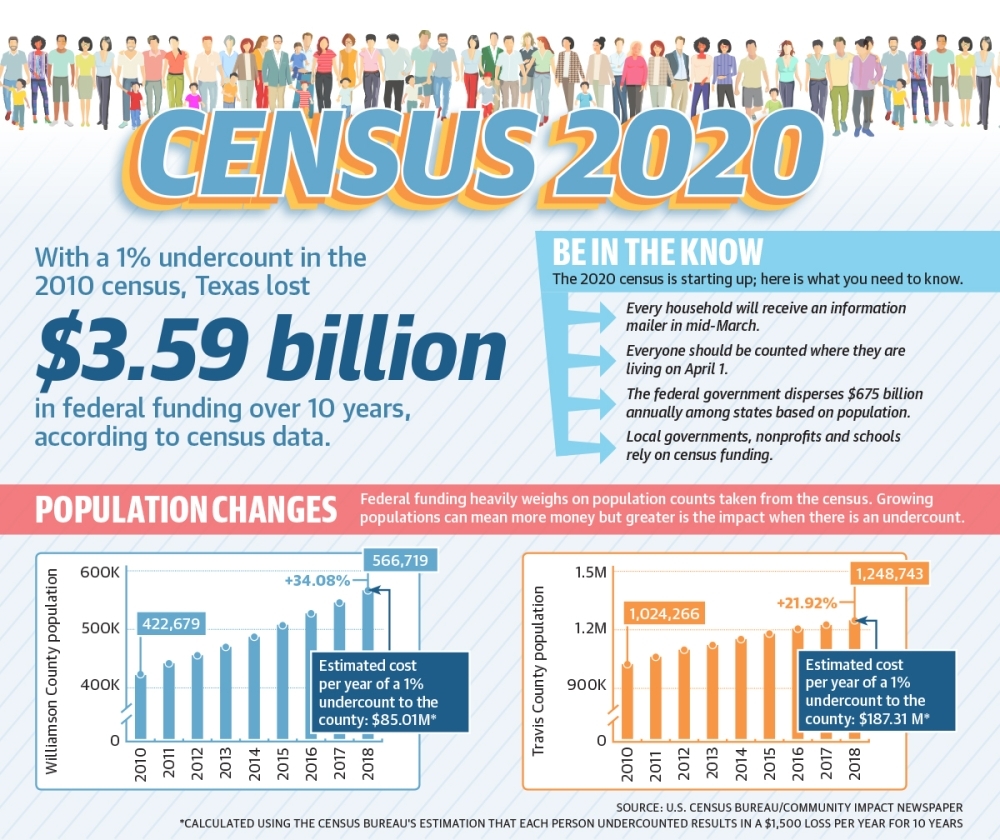

Money, power, business at stake in the 2020 Census | Community Impact Newspaper

Gov. Greg Abbott on March 19 took sweeping action to contain the spread of the coronavirus across Texas, issuing an executive order that will close restaurants and schools, among other things.

Local resources are still available for seniors amid coronavirus concerns and despite changes in services.

The university said it will be reaching out to representatives of the graduating class to find a way to honor students and their achievements.

Happening on Twitter

The Fed is propping up money market funds. Here's what that means for investors https://t.co/JH5oEagQEC CNBC (from Englewood Cliffs, NJ) Thu Mar 19 19:40:08 +0000 2020

No comments:

Post a Comment