Bonus depreciation is a pro-taxpayer measure Congress enacted in the early 2000s to reward businesses for investing in new property. It allows taxpayers to immediately deduct a certain percentage of their equipment costs in the year of purchase.

In 2017, the tax reform bill known as the Tax Cuts and Jobs Act (TCJA) expanded the bonus depreciation allowance by permitting taxpayers to recover 100% of their asset costs (up from the prior-year allowance of 50%) and to apply bonus depreciation to both new and used property. But the benefits didn't stop there.

While you're here, how about this:

Fact Check: Were 401(k)s Really An 'Accident Of History'?

"'401(k)s were never designed as the nation's primary retirement system,' said Anthony Webb, a research economist at the Center for Retirement Research. 'They came to be that as a historical accident.'"

"Even the 'father of the 401(k),' Ted Benna, tells The Journal with some regret that he 'helped open the door for Wall Street to make even more money than they were already making.'"

"The 401K name comes from a section of the IRS code. This section was added in 1978 but for 2 years no one paid much attention to it. A creative interpretation of that provision by a smart consultant gave birth to first 401k savings plan. The government tried to repeal the 401K provision twice once it realized the enormous tax loss from the 401K provision.

Small Business Development Center offering free tax workshops in Hays

The Small Business Development Center at Fort Hays State University will offer free tax services this month for small business owners.

Four different sessions will be held Wednesday, March 11, and Thursday, March 12, at FHSU's Sternberg Museum of Natural History, 3000 Sternberg Drive, Hays. Breakfast will be served to participants in Wednesday's morning session, and lunch will be provided for those staying for that afternoon's workshop.

Need to Know Tips on Tax Refund Advances | WHNT.com

Impatient for your tax refund? It usually takes about 21 days to receive your refund after filing, but tax preparers are increasingly offering ways to get your funds immediately. Better Business Bureau recommends waiting to receive your tax refund in the mail or by direct deposit from the IRS. However, if you cannot wait and choose to use a refund advance service, we are providing the following need to know tips regarding this type of service.

* * *

There are many different kinds of tax refund advances and promotional agreements, and each has its own set of pros and cons. To help you make a wise decision, here are some more details about the most common ways to receive your tax refund in advance.

Check out this next:

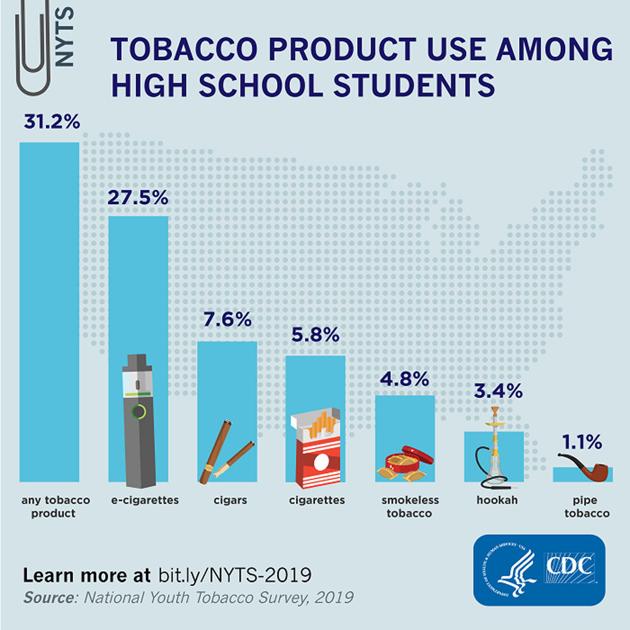

Local vape shops worried about tax measure in legislature | Business | state-journal.com

As the proposed increased excise and wholesale tax on e-cigarettes/nicotine vaporizers that passed the Kentucky House of Representatives sits in committee review in the Senate Appropriations and Revenue Committee, local vape shop owners are playing a waiting game.

* * *

The bill, which would increase wholesale taxes on both vaping liquids and equipment from 15% to 25%, coincides with Gov. Andy Beshear's budget proposal, which includes a 10-cent per-pack tax increase on cigarettes and other tobacco products and a 10-cent-per-milliliter tax increase on vape liquids.

ADAM N. MICHEL: Coronavirus doesn't change good economic policy | Columnists | scnow.com

The disruptions from a widespread pandemic are not fixable with checks from Washington or cheap money.

Large, new spending initiatives will disrupt the market signals business and consumers need to operate effectively, and they could make an economic downturn more severe and slow the inevitable recovery.

For now, we are still in the midst of the longest economic expansion in U.S. history. We've learned what works: pro-growth reforms that allow businesses to expand, invest and hire Americans of all skills and income levels.

IRS Weekly Regulations Update: February 24 – 28, 2020

Presented below is our summary of significant Internal Revenue Service (IRS) guidance and relevant tax matters for the week of February 24 – 28, 2020.

February 24, 2020: The IRS released final instructions to Form 8978, Partner's Additional Reporting Year Tax, to reflect changes to the audit procedures of partnerships under the 2015 BBA. Under IRC section 6226, a partnership may elect to have each reviewed year partner take into account the partner's share of the partnership's adjustments, instead of the partnership paying the imputed underpayment determined under Section 6221.

Newport councilors target higher property taxes for short-term rental homeowners - News - The

NEWPORT – City Council members want to set a separate property tax classification for non-owner occupied residential properties that are used for short-term rentals. The General Assembly would have to approve the move.

“If an owner has bought a home to use for short-term rentals that person should be taxed accordingly,” said Councilwoman Jeanne-Marie Napolitano. “They are essentially running a business, but I don’t know if they should pay the commercial tax rate. What the tax rate on short-term rental homes should be, is something we should talk about.”

No comments:

Post a Comment