The administration's $1 trillion proposed rescue plan, which forms the basis for fast-moving negotiations on Capitol Hill, includes sending two large checks to many Americans and devoting $300 billion towards helping small businesses avoid mass layoffs. Priorities laid out in a two-page Treasury Department document also include $50 billion to help rescue the airline industry and $150 billion to prop up other sectors, which could include hotels.

The White House is vetting these proposals with Senate GOP leaders before engaging more fully with Democrats, so the package is certain to evolve in coming days. Democrats, meanwhile, are eyeing their own priorities, largely aiming to shore up safety net programs and the public health infrastructure, as well as send money directly to American taxpayers, while shunning corporate bailouts. Rep. Maxine Waters (D-Calif.

Not to change the topic here:

IRS Hearing Likely Eases Cloud Tax Rules' Implementation - Law360

In the legal profession, information is the key to success. You have to know what's happening with clients, competitors, practice areas, and industries. Law360 provides the intelligence you need to remain an expert and beat the competition.

* * *

Enter your details below and select your area(s) of interest to stay ahead of the curve and receive Law360's daily newsletters

Herman Miller Reports Third Quarter Fiscal 2020 Results

Herman Miller , Inc. (NASDAQ: MLHR ) today announced results for its third quarter ended February 29, 2020. Net sales in the quarter totaled $665.7 million , an increase of 7.5% from the same quarter last fiscal year. New orders in the third quarter of $651.7 million were 6.3% above the prior year level.

On an organic basis, which excludes the impact of acquisitions and foreign currency translation, net sales and orders in the third quarter decreased by 0.5% and 1.4%, respectively, compared to the same quarter last fiscal year.

Yankee Institute policy suggestions for mitigating the economic impact of COVID-19 | Yankee

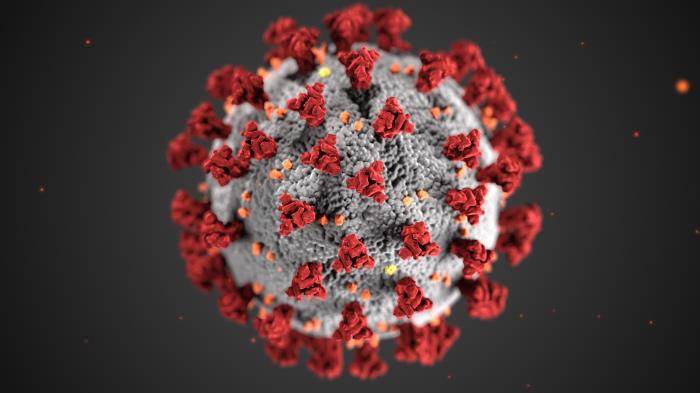

Yankee Institute is grateful to Gov. Ned Lamont and his team for their work, thus far, in trying to mitigate the economic damage being wrought on Connecticut during this time of crisis and for their response to the threat posed by the COVID-19 virus. The collapse of the financial markets and the closure of businesses and schools are certain to cause long-term economic problems for the country and, in particular, Connecticut.

1. A hold-harmless unemployment tax provision for small businesses forced lay off employees due to the COVID-19 virus. Restaurants, gyms, child care facilities and numerous other businesses, through no fault of their own, are being forced to close or are facing such massive downturns in sales that they will be forced to lay-off employees. Normally, this would increase the cost of their state unemployment insurance tax.

While you're here, how about this:

Improving innovation with omnibus bills - Thu, March 19 2020 - The Jakarta Post

Indonesia looks set to boost foreign investment and economic growth through the so-called omnibus bills on job creation and taxation. These long-awaited bills aim to revise several dozen laws in an effort to reduce overlapping and inconsistent rules in the current jungle of laws and regulations. Indonesia needs to maintain 5 percent or higher growth in order to join the high-income countries club.

Tech, Accounting Giants Seek Reversal of Altera Tax Ruling (1)

Tech and accounting giants implored the U.S. Supreme Court to reverse a Ninth Circuit decision upholding regulations that required Altera Corp. to include stock-based compensation among the assets it shifted overseas for tax purposes.

The high court hasn't yet decided whether it will take up Intel-owned Altera's case. If the court decides to hear the case, arguments could be held as early as this fall.

MEDIA ALERT – Taxpayer Implications Regarding Coronavirus: Examining Congressional Response to

Tax expert Mark Luscombe, JD, LL.M, CPA, Principal Analyst at Wolters Kluwer Tax & Accounting, can discuss the legislative actions taken in response to the Coronavirus COVID-19.

Please contact Wolters Kluwer Tax & Accounting to arrange interviews with Mark Luscombe or other federal and state tax experts on this or any other tax-related topic.

IRS Issues New Office in Compromise Regulations

The IRS has announced that it has issued new final regulations relating to its Offer in Compromise (OIC) program. This is vital news to some of your clients struggling to meet their tax obligations during the COVID-19 pandemic and others.

Briefly stated, an OIC is an agreement between a taxpayer and the IRS settling the taxpayer's tax liability for less than the full amount that is due. Generally, it may be an option for taxpayers who can't pay their full tax debt or those facing a financial hardship.

Happening on Twitter

Thanks Jim. And I'm in for any group you put together to represent the American Taxpayer in federal bailout, loan… https://t.co/reDv4SeqtY mcuban Wed Mar 18 13:19:29 +0000 2020

1/6: Word on the street is that common sense is breaking out & government may be privately recognising that #Brexit… https://t.co/miE2yVtcdn SimonFraser00 Tue Mar 17 20:47:18 +0000 2020

No comments:

Post a Comment