The Distilled Spirits Council of the United States is working with Congress and the Trump Administration to ease tax regulations that could force distillers producing desperately needed hand sanitizer to pay federal excise taxes on the alcohol used.

The Tax and Trade Bureau (TTB) eased regulations to permit distillers to make hand sanitizer, but were unable waive the federal excise tax for distillers using undenatured ethanol. Under the new TTB guidance, "Hand sanitizer products are not subject to Federal excise tax if made with denatured ethanol. However, if made with undenatured ethanol, Federal excise tax applies."

Not to change the topic here:

During COVID-19 Pandemic, MA Restaurant Owners Seek Relief Legislation - Eater Boston

In Massachusetts, all bars and restaurants have been shuttered for dine-in business until at least April 6 . In an industry that operates on razor-thin margins in the best of times — that is, when asses are in seats night after night, and when reservations are difficult to come by — shutting down for even a couple of days can be catastrophic.

"Sorry if there are typos, scrambling to close down my dream." Daniel Myers owns Loyal Nine , a restaurant in Cambridge cooking food sourced by local producers and inspired by colonial New England. He, like so many other restaurant owners across the country, has been blindsided by the outbreak of novel coronavirus and the havoc it has wreaked on his business.

Trump adopts the greatest hits of the 2020 Dems - POLITICO

Facing a severe crisis, Trump is latching onto approaches Democrats have popularized and many Republicans have lambasted.

President Donald Trump speaks at a White House news conference on coronavirus. | Alex Wong/Getty Images

* * *

A president who shaped his first three years in office trying to sell Americans on obscure corporate tax provisions, minute details of tariffs and the rollback of mind-numbing regulations has a new approach: Keep it simple.

CryptoTrader.tax CEO: Regulatory Clarity Alone Won't Drive Crypto Mainstream Adoption

In a recent interview with Insidebitcoins.com, David Kemmerer, co-founder and chief executive at CryptoTrader.tax has explained why he believes clear crypto regulations will not be the only catalyst for the mainstream adoption of digital currencies. During the interview, Kemmerer also gave his insights on how the IRS can tackle the complex cryptocurrency tax puzzle.

The chief executive further shared his thoughts on why it is near to impossible for crypto exchanges to give correct tax reports for users. Kemmerer also talked out CryptoTrader.tax future plans of partnering with exchanges and wallets to help users file taxes effectively.

Other things to check out:

Income tax payments extended to July, returns still due by April 15th | News | kmaland.com

COVID-19 – Federal and State Tax Updates | BakerHostetler - JDSupra

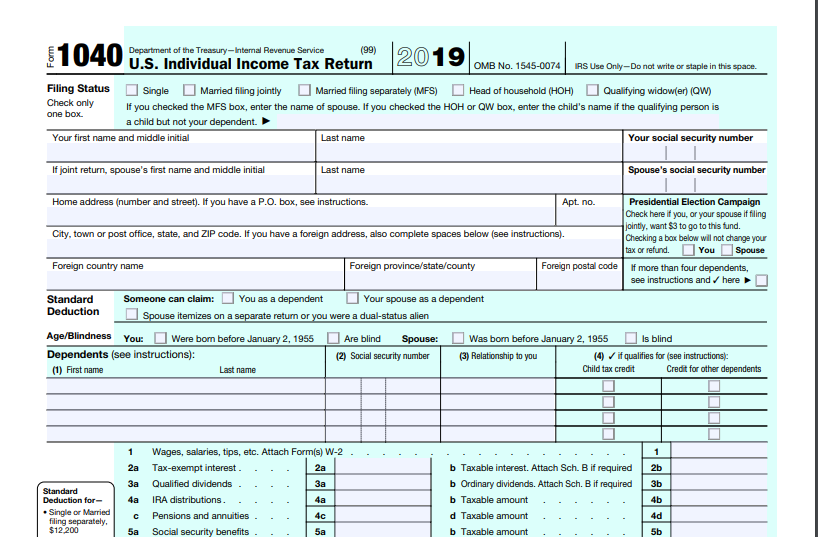

A – Treasury Secretary Steven Mnuchin announced on March 17, 2020, that payments of certain taxes to the federal government during 2020 may be deferred for up to 90 days after the April 15, 2020, filing deadline for C corporations and individuals without interest or penalties. As indicated in Notice 2020-17 , C corporation and individual U.S. federal income tax returns (or extensions) for the 2019 calendar year must be filed by their April 15, 2020, due date. Moreover, any other U.S.

Coronavirus: Massachusetts Gov.

Massachusetts will offer quicker unemployment benefits for laid off workers and extensions on tax collections for certain small businesses affected by the coronavirus pandemic, Gov. Charlie Baker announced Wednesday.

Baker signed into law legislation that waives the one-week waiting period for unemployment insurance to workers affected by the coronavirus outbreak or by the closures of restaurants and bars following the state of emergency declaration. The bill is part of a larger package filed in response to the pandemic.

Tax collection, underground economy and tax gap

In the context of economic development, the ability of a country to raise tax revenue is mainly determined by its tax system design and the efficiency of tax collection and management. From the perspective of taxation practices in various countries, designing the taxation system is reflected by the efficiency of tax collection and management.

A reasonable explanation for the introduction of value-added tax (VAT) by most developing countries in the world is to increase the taxpayer's compliance with tax payment through mutual supervision mechanism between taxpayers without increasing the cost imposed by the tax administration authorities. This consideration for the factors of taxation determines that developing countries can only adopt such tax system that is mainly based on turnover tax.

Happening on Twitter

Dixon's Distilled Spirits in Guelph started production on hand sanitizer with the priority of supplying frontline w… https://t.co/eswWyr5sZZ globalnews Wed Mar 18 23:45:43 +0000 2020

'I'm a moonshiner, but now I make hand sanitizer', Dixon's Distilled Spirits has shifted its production line… https://t.co/2v2BwYcY1W 570NEWS (from Kitchener, Ontario) Thu Mar 19 22:48:49 +0000 2020

/arc-anglerfish-arc2-prod-advancelocal.s3.amazonaws.com/public/OLSKEEK3TRCZBO7W6RPIUDY4BE.JPG)

No comments:

Post a Comment