The U.S. shale industry is bracing for pay cuts and more layoffs as several of the biggest energy companies in Houston continue to cut their budgets amid record low oil prices and and the economic impacts of the coronavirus pandemic.

California oil major Chevron, which as recently as 2018 employed 8,000 workers and contractors in Houston, said Tuesday that it would cut more than $8 billion from its budget, including $2 billion on shale projects primarily in Texas’ Permian Basin.

And here's another article:

Phillips 66 suspends several projects, cuts budget as oil prices tighten - Houston Chronicle

Houston pipeline and refinery operator Phillips 66 is planning to cut more than $3 billion from the company's budget and suspend several projects as crude oil prices remain stuck at record lows.

* * *

Phillips 66 reported Monday that the company is cutting $700 million from its capital expenditure budget, eliminating $500 million of operating costs and suspending a stock repurchase program that still had $2.1 billion left on the books.

As part of the budget cuts, Phillips 66 is suspending the development of a new natural gas liquids processing at its Sweeny Refinery southwest of Houston and the Red Oak Pipeline, a project to move crude oil from the Permian Basin of West Texas and storage terminals in Cushing, Oklahoma to multiple locations along the Gulf Coast.

Senate aid package quietly sets aside $17 billion for Boeing - The Washington Post

Senate aims to vote Wednesday on $2 trillion coronavirus bill after landmark agreement with White House

In a Tuesday interview on Fox, Boeing chief executive Dave Calhoun said he would not be willing to give the government an equity stake in the company in exchange for a bailout, implying the company would only accept assistance on its own terms. President Trump has said he would support the idea, suggested by his economic adviser, of taking an equity stake in companies that receive assistance in the package.

CBD beauty brands grapple with brick-and-mortar closures – Glossy

CBD beauty companies are reeling from the sudden closure of brick-and-mortar retailers after heavily leaning on them in the past year.

For a brand like Cannuka , the pivot has had to come quickly. Nearly 97% of its 2019 revenue was from brick-and-mortar, said Michael Bumgarner, Cannuka founder, who has been candid about the need for retail due to constraints with online advertising. The brand is in over 2,000 doors through partners like Ulta, Nordstrom and Neiman Marcus. Cannuka projected between 600% and 1,000% sales growth in 2020; as of this week, the company has not determined what new projections will be.

Quite a lot has been going on:

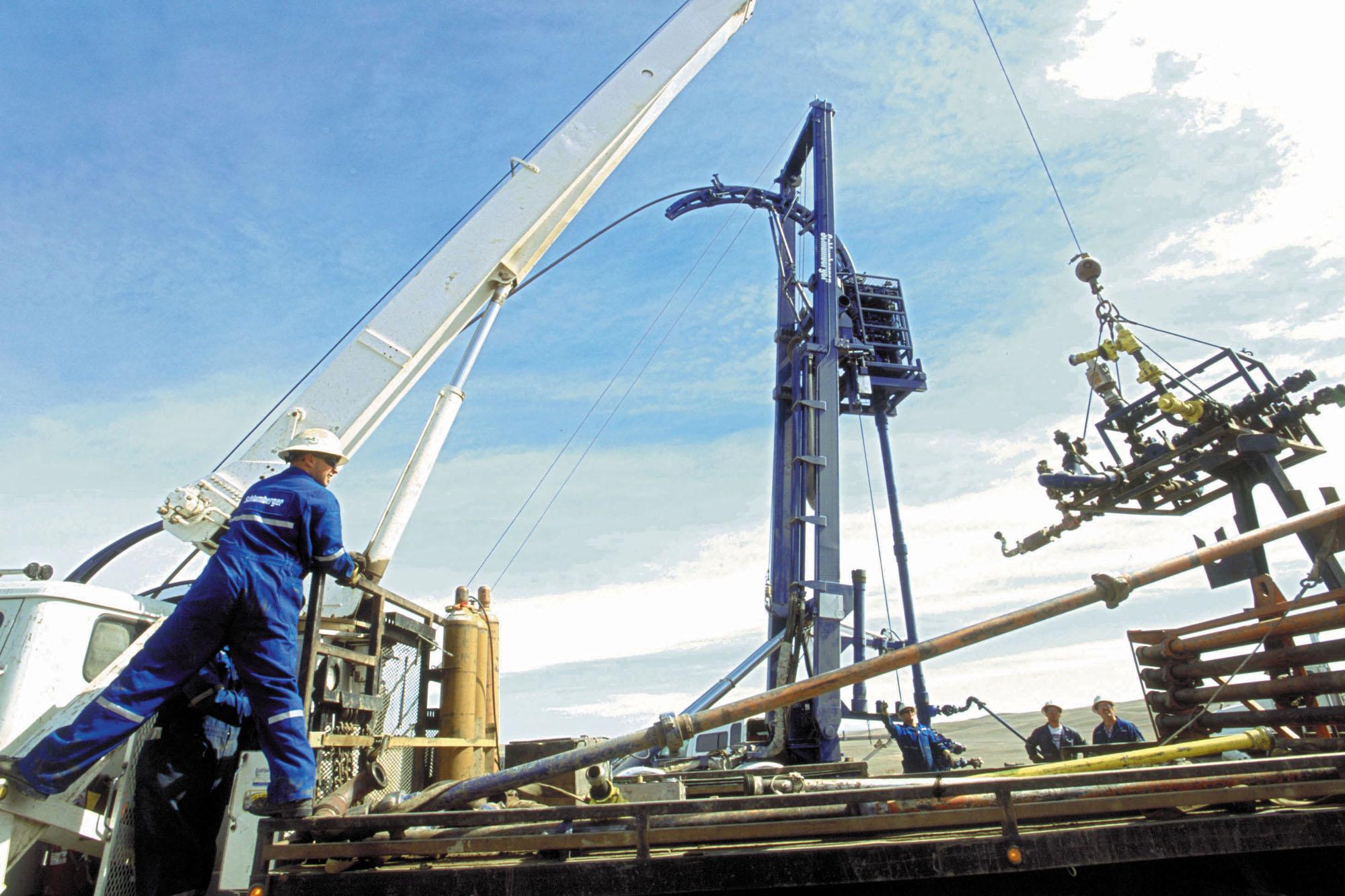

Layoffs, pay cuts loom as Schlumberger plans to cut up to 30 percent from budget -

Schlumberger, the largest oilfield service company in the world, plans to cut up to 30 percent from its budget as crumbling oil prices and the coronavirus pandemic weigh on the industry.

The company also expects to layoff workers and reduce compensation as part of restructuring efforts in North America, CEO Olivier Le Peuch said at the Scotia Howard Weil Energy Conference in New Orleans.

The magnitude of the budget cuts depends on changes to customers' plans, Le Peuch said. A full 30 percent cut would leave the company with a $1.2 billion capital budget for the year. The company spent $1.7 billion on capital projects in 2019.

Energy companies slash another $19 billion as oil price remain near 20-year lows -

Eleven energy companies over the past several days said they would cut a combined $18.6 billion dollars from their budgets as oil prices remain near 20-year lows, setting the stage for tens of thousands additional layoffs.

West Texas Intermediate crude closed at $23.36 per barrel Monday, a price not seen since March 2002 as Russia and Saudi Arabia flood global markets and the coronavirus pandemic crushes demand.

Energy companies big and small — including Conoco Phillips, Exxon Mobil, Marathon Oil, Hess and Halliburton — have responded by slashing spending for new projects and operations, halting stock buy back programs, putting deals on hold and selling assets.

Chevron Plans Cuts to Capital Budget - WSJ

Chevron Corp. is cutting $4 billion from its capital budget as it confronts plummeting petroleum demand and an oil-price rout, the latest major energy company to ax its spending to shore up its balance sheet.

The oil giant said Tuesday it would reduce its 2020 spending by 20% to about $16 billion, with the biggest cut to come in the largest U.S. oil field, the Permian Basin in West Texas and New Mexico. Chevron will also suspend stock buybacks but promised to protect its dividend and said oil production would be flat.

Suncor cuts $1.5 billion from budget to cope with low oil prices, virus impact – Red Deer

The Calgary-based producer, refiner and operator of Petro-Canada service stations is slashing its 2020 capital spending budget by $1.5 billion to a range between $3.9 billion and $4.5 billion.

“The simultaneous supply and demand shocks are having a significant impact on the global oil industry,” said Suncor CEO said Mark Little in a statement late Monday.

“We are adjusting our spending and operational plans to be prepared in the event the current business environment persists for an extended period of time.”

Happening on Twitter

There may be more U.S. shale bankruptcies this time around than five years ago. "Wall Street is shut to the industr… https://t.co/UXkJ634cFd lisaabramowicz1 (from New York) Tue Mar 24 17:39:03 +0000 2020

No comments:

Post a Comment