An experienced Liberian-born tax lawyer, David Farhat, Jr., has joined Skadden, a top global accounting firm based in Washington, D.C., as a partner in the tax group.

The move, according to Skadden, signals a strengthening of the group's services in an area of tax law, transfer pricing, and tax controversy increasingly important to multinational corporations.

Farhat’s appointment places Liberia on the global spotlight of financial competence and creates room to tap on his expertise in strengthening its tax law and improving financial competence, if necessary.

Aquinas College launches accounting and auditing program - Grand Rapids Business Journal

Aquinas College is offering a new accounting and auditing certificate program in response to an increasing demand for nonaccounting professionals to partner with financial teams.

The Accounting and Auditing Certificate Program will provide training for non-CPA professionals in financial accounting, accounting systems and auditing.

Aquinas said IT professionals and engineers who work with accountants in corporations, government and nonprofits will benefit from the program.

WHO head slams 'scandalous inequity' in COVID vaccines with 10 countries accounting for 75% of

The head of the World Health Organization slammed wealthy countries for a "scandalous inequity" in COVID-19 vaccines that is prolonging the coronavirus pandemic, and said 10 countries account for 75% of the vaccine doses that have so far been administered.

"There is no diplomatic way to say it: a small group of countries that make and buy the majority of the world's vaccines control the fate of the rest of the world," Tedros Adhanom Ghebreyesus said in opening comments at the WHO's annual assembly on Monday.

1 in 5 Private Company Execs Feel Unprepared on Lease Accounting as Effective Date Nears on Dec.

The good news: 27.7% of those polled feel prepared to comply -- the highest private entity executive confidence rate in six years.

The following questions can help privately held organizations assess how close they are to completing their lease accounting implementation efforts:

Torr concluded, "While some private entities may have as few as 20 equipment and real estate leases in their portfolios, we still advocate for rigor in the standard's adoption. Focusing on getting lease accounting right should be a top priority for U.S. privately held organizations in the months ahead."

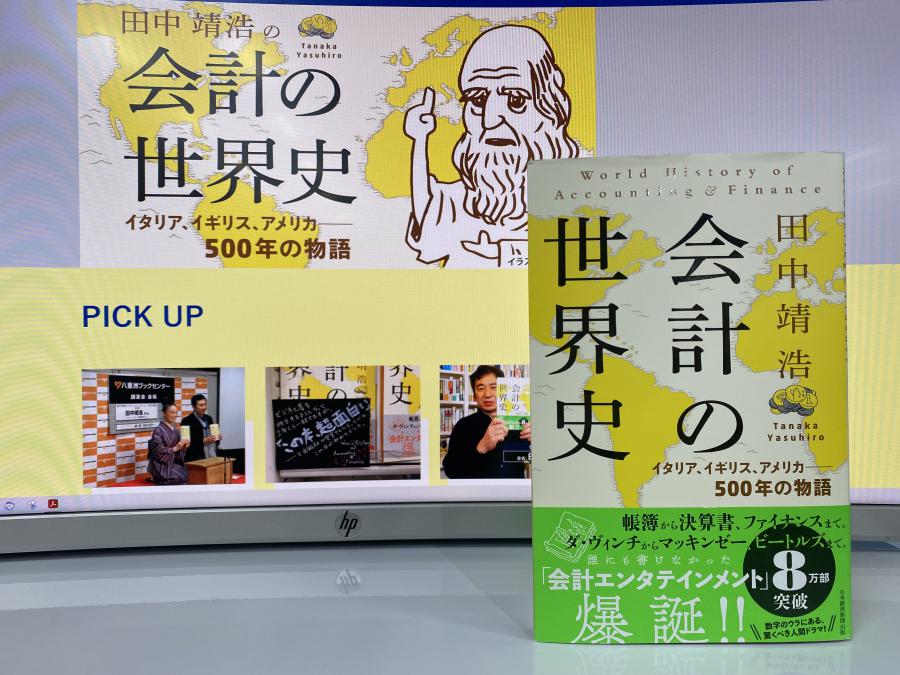

Japan's top-selling accounting guide features exciting stories on John F.

EIN Presswire's priority is source transparency. We do not allow opaque clients, and our editors try to be careful about weeding out false and misleading content. As a user, if you see something we have missed, please do bring it to our attention. Your help is welcome. EIN Presswire, Everyone's Internet News Presswire™, tries to define some of the boundaries that are reasonable in today's world. Please see our Editorial Guidelines for more information.

UNT accounting students take first place in regional competition | Education | dentonrc.com

Accounting, finance grads face different road to fill CFO shoes | CFO Dive

New entrants to the business world are expected to bring data analytics, risk management, cybersecurity and business modeling to the table, say academic specialists.

Greater opportunities and pressures are facing Class of '21 grads than did a great many of today's CFOs when they got their undergraduate degrees in the 1980s and 1990s.

"Today, the breadth of potential industries and companies a college graduate can join is much wider. College graduates can choose from a wide range of industries and size of firms to begin their career," said Paul Clancy, senior visiting lecturer of finance at Cornell University's Cornell SC Johnson College of Business.

Art of Accounting: Client surveys | Accounting Today

Tax season has the largest concentration of clients and presents the best opportunity to find out what clients think about your services. It also creates an opportunity for additional services.

Many firms are reluctant to ask clients to present their opinions of their performance because they fear a negative response, but that is actually the best reason for providing that opportunity. Clients who complain usually do not want to terminate the relationship, but want it to improve. Clients who do not want to salvage the relationship will not respond; they will just leave when it suits their situation.

Avalara provides tax content feed for POS systems | Accounting Today

Avalara, which provides tax automation solutions, now offers a tax content generation tool for point-of-sale systems.

Avalara Content Generation for POS feeds real-time tax content to POS systems so businesses can manage complex tax scenarios as they happen, including accounting for sales tax holidays, multiple locations, threshold taxes and more.

Xero ecosystem now 1,000 apps strong, and more | Accounting Today

Anduin provides its billing solution to BDO firms, and TaxDome software updates improve e-sig capabilities.

No comments:

Post a Comment