Sen. Shelley Hughes, R-Palmer, presides over a hearing of the Senate Community and Regional Affairs committee on Thursday, May 27, 2021 at the Alaska State Capitol in Juneau. The committee was hearing discussion of Gov. Mike Dunleavy's plan to change the formula for the Permanent Fund dividend. (James Brooks / ADN)

JUNEAU — Gov. Mike Dunleavy's plan to constitutionally guarantee a Permanent Fund dividend is dead in the Alaska Legislature for the time being.

Lawmakers want most COVID benefits exempt from La. income taxes | News | ktbs.com

(The Center Square) – Louisiana lawmakers have voted to exclude any COVID-19 relief from state income taxes outside of unemployment benefits.

The bill names several examples, such as the state's Main Street Recovery Program and Critical Infrastructure Worker's Hazard Pay Rebate, but makes clear that it's not necessarily an exhaustive list. Only unemployment benefits, which the federal government has enhanced during the pandemic, are excluded.

Biden's $6T Budget: Social Spending, Taxes on Business | Chicago News | WTTW

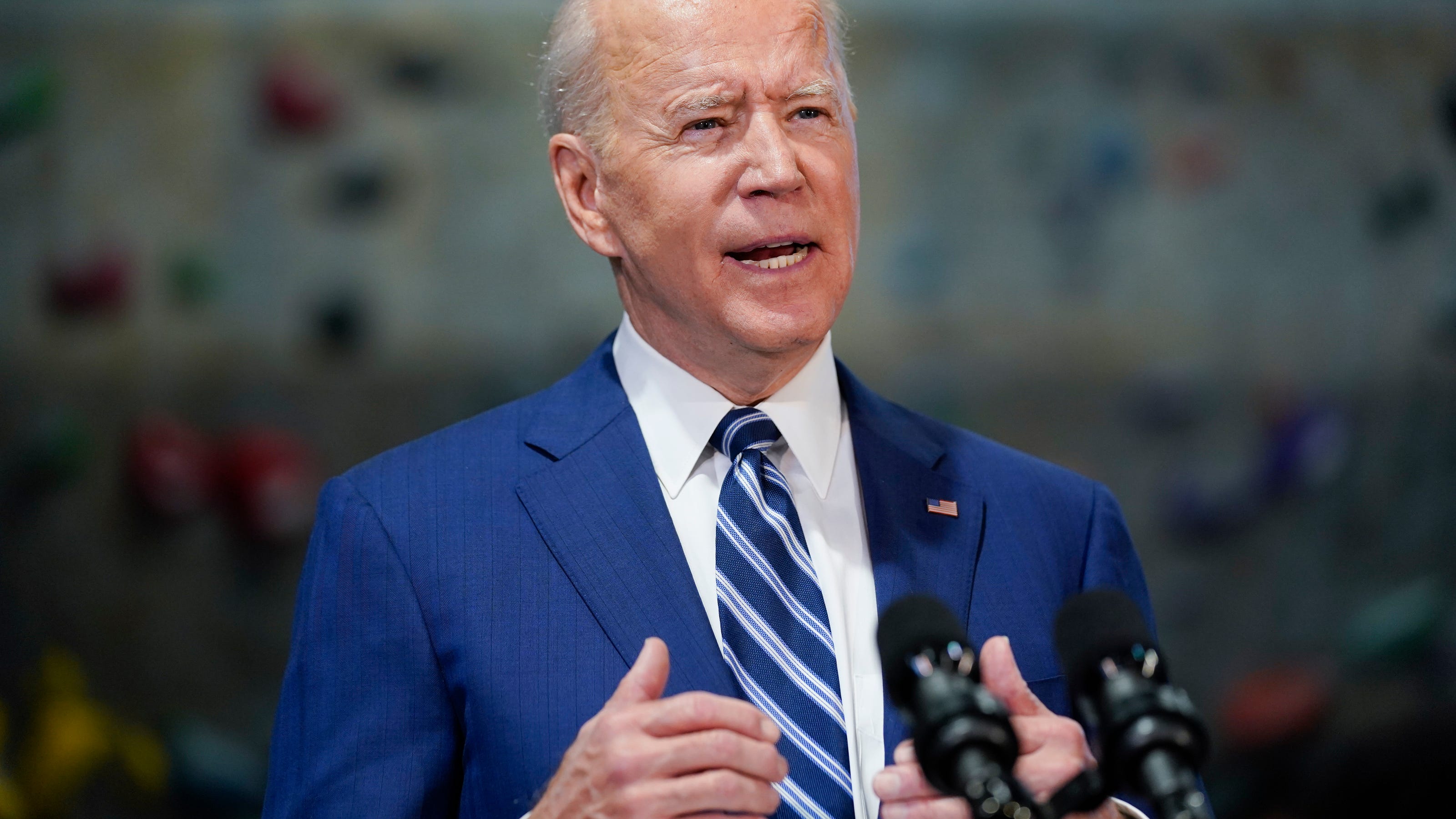

President Joe Biden delivers remarks on the economy at the Cuyahoga Community College Metropolitan Campus, Thursday, May 27, 2021, in Cleveland. (AP Photo / Evan Vucci)

WASHINGTON (AP) — President Joe Biden on Friday unveiled a $6 trillion budget for next year that's piled high with new safety net programs for the poor and middle class, but his generosity depends on taxing corporations and the wealthy to keep the nation's spiking debt from spiraling totally out of control.

Biden plans retroactive hike in capital-gains taxes, so it may be already too late for investors

President Joe Biden's proposed budget for the upcoming fiscal year assumes that a hike in the capital-gains tax rate took effect in late April, meaning that it already would be too late for high-income investors to realize gains at lower tax rates, according to a Wall Street Journal report out Thursday citing people familiar with the proposal.

Biden plans to increase the top tax rate on capital gains to 43.4% from 23.8% for households with income over $1 million, though Congress must OK any hikes and retroactive effective dates, the report added.

Money Now, Taxes Later With Prepaid Forward Contracts

You also don't want to learn later that you cannot deduct a big payment of proceeds to the funder, or somehow offset it against income from the transaction that generated the proceeds. A prepaid forward contract may involve the sale of stock or other assets. It may involve the assignment of some or all of a lawsuit claim or its proceeds. Many fact patterns are possible with stock sales or litigation finance. But the tax issues are nuanced and can be confusing.

Money changes hands, but there should be no immediate taxable event to the seller if the future sale involves a variable amount of proceeds. Until the closing, it is impossible to determine how the advance payments should be reported. The key IRS tax authority is Revenue Ruling 2003-7, 2003-5 IRB 1, where the IRS approved open transaction treatment for a variable prepaid forward contract involving the sale of stock.

Takeaways from Biden's budget: record debt, looming fight on taxes

The budget projects the federal debt would increase, relative to the size of the economy, to a higher level than during World War II.

During the World War II era, debt peaked at 106% of gross domestic product in 1946. Under Biden's plan, debt is projected to rise to 117% of the size of the economy by 2031. Without changes, it's expected to grow to 113% of GDP.

Battle continues regarding where remote workers pay taxes

The right of cities to tax remote employees during the pandemic continues to face opposition on multiple fronts.

A bill that would allow remote workers to pay income tax to their home municipalities rather than where their employers are located and seek refunds for 2021 taxes passed the Ohio House, Wednesday, May 26.

The nonprofit, right-leaning legal organization announced Thursday, May 27, that its attorneys had filed an appeal with Ohio's Tenth District Court of Appeals in Buckeye v. Kilgore, a case filed against the city auditor of Columbus for collecting taxes from a remote worker in 2020.

Monday Night Is Deadline To Pay Property Taxes Before Tax Certificate Sale : NorthEscambia.com

In order to prevent a tax certificate from being issued, property owners with delinquent taxes must make payment online at EscambiaTaxCollector.com by 8 p.m Monday, May 31 at EscambiaTaxCollector.com

According to Escambia County Tax Collector Scott Lunsford, the tax certificate sale is an annual online auction where bidders can purchase a delinquent taxpayer's debt in exchange for an annual interest rate, ensuring the majority of unpaid taxes are collected and distributed to taxing authorities. Last year, more than 7,400 certificates were sold for a total of over $9.7 million, recovering 97.5 percent of delinquent taxes.

No comments:

Post a Comment