MANSFIELD - The foreman of the street department was the city's second-highest-paid employee last year.

While Benson was the lone city employee whose overtime pay exceeded base pay, four other street department workers made half — and in some cases more than half — of their base salaries in overtime.

John Hamilton, a utility maintenance dispatcher, made $38,335 in overtime on top of a base salary of $43,942. Michael Penney, a traffic technician, made $28,261 in overtime on top of a base salary of $45,008. Hamilton has been with the city for more than two decades while Penney has just under a decade under his belt.

Why HVAC Contractors Should Write Official Job Descriptions For Their Employees | 2021-05-09 |

Kingston Police Department's new Midtown effort could cost $15,000 in overtime | Local news |

KINGSTON, N.Y. — City police officers will hit the streets starting this week as part of a s…

Paul Kirby is a reporter for the Freeman, covering Kingston politics. He has been at the Freeman since August 1996.

Restaurants are Prime Targets for FLSA Lawsuits: 6 Tips for Employers Relying on the Tip Credit |

Anyone working in the food and beverage industry is likely aware of how servers and bartenders are typically paid by the restaurants and bars that employ them. Under federal and most state laws, employers may pay servers and other tipped employees an amount well below the standard minimum wage—currently $2.13 per hour under federal law—provided that the employer makes up the difference with tips earned by and paid to the employee.

The tip credit is a nuanced and complicated concept with many pitfalls for employers. Failing to strictly adhere to these requirements can invalidate the tip credit altogether and may expose the employer to federal FLSA or state wage-and-hour litigation and significant unpaid wage claims, liquidated damages, and attorneys’ fees, even where the employees ultimately received more than the required federal and state minimum wage.

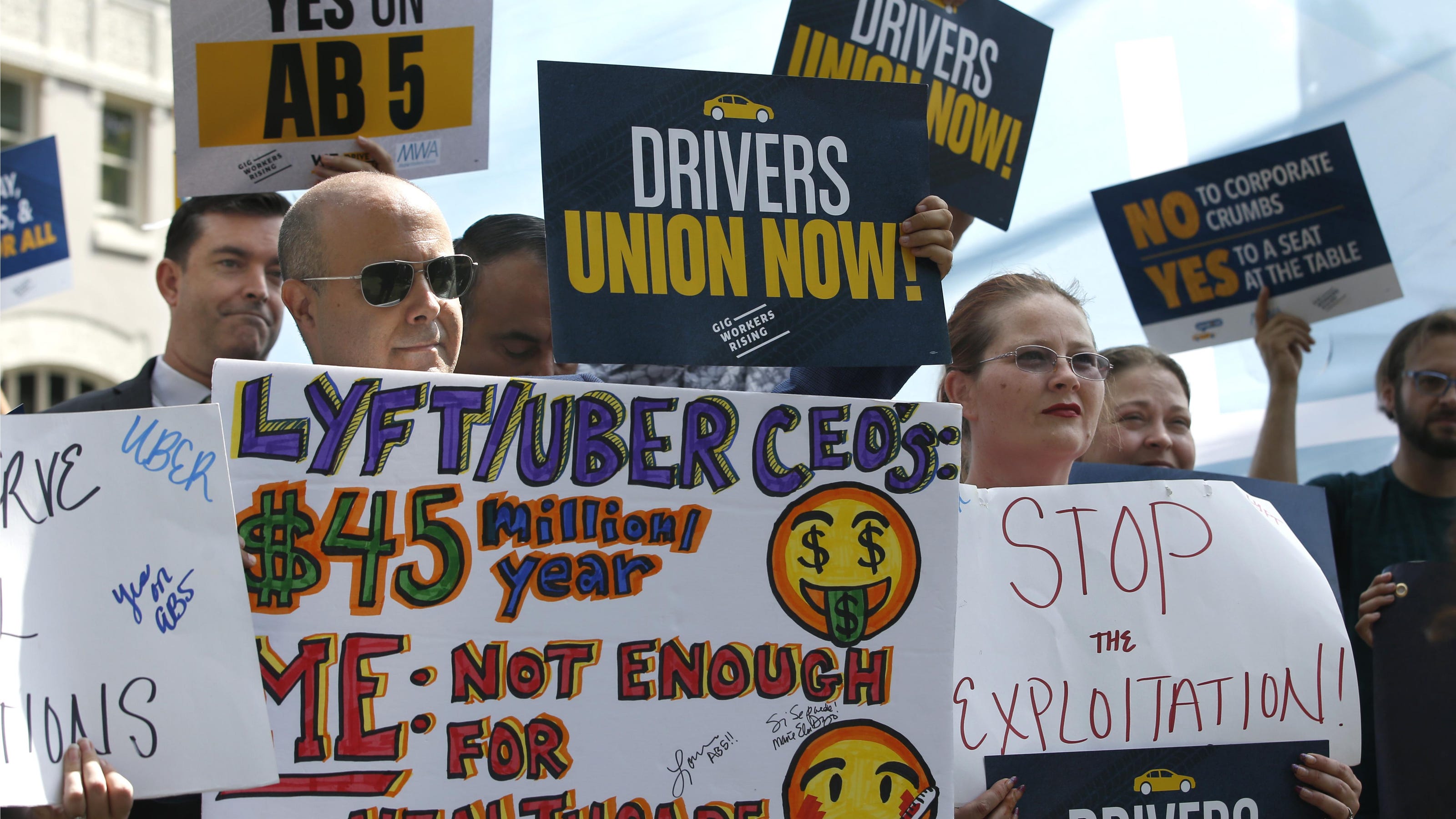

Independent contractor: It's now tougher to call workers contractors

The Labor Department is revoking a Trump administration rule that would have made it easier to classify workers as independent contractors, reshaping the parameters of the exploding gig economy.

Worker advocates say the Trump era rule would have allowed employers to deny workers minimum wage, overtime and other benefits afforded full-fledged employees.

But labor lawyers who represent companies say scrapping the rule will lead many employers to bring on fewer workers, many of whom prefer to be freelancers in the growing gig economy.

A Day Rate and a Dollar Short: The Fifth Circuit Continues to Make Key Wage and Hour Rulings |

Lawsuits alleging Fair Labor Standards Act (“FLSA”) violations continue to be among the more “popular” filings in federal district courts, with over 6,500 such cases filed between December 2019 and December 2020 .

Among the most common issues raised in FLSA lawsuits is whether an employer is compensating its employees on a “salary basis,” which is required for an employer to take advantage of the white-collar administrative, professional, and executive exemptions to overtime pay requirements under the FLSA.

Centene Care Workers Secure Settlement In Battle Over OT - Law360

In the legal profession, information is the key to success. You have to know what's happening with clients, competitors, practice areas, and industries. Law360 provides the intelligence you need to remain an expert and beat the competition.

Enter your details below and select your area(s) of interest to stay ahead of the curve and receive Law360's daily newsletters

Fifth Circ: Commute Time Compensable if Integral & Indispensable to Duties

Upholding the trial court's dismissal of an FLSA collective action, the Fifth Circuit Court of Appeals reiterated that an employee's commute time is compensable only when the commute is "integral and indispensable" to the employee's job duties. Bennett v. McDermott Int'l, Inc. , 2021 U.S. App. Lexis 10948 (5th Cir. Apr. 16, 2021). The Fifth Circuit has jurisdiction over the federal courts in Texas, Mississippi, and Louisiana.

The plaintiff-employees and their putative class members were employed under a contract related to a natural gas liquefaction facility in Hackberry, Louisiana. Because of the remote location of the facility, they were required by the company to travel to designated park-and-ride sites and then ride employer-provided buses to and from the facility.

Minimum-wage workers say Oakland should do more to stop labor violations

A message was painted on 45th Street in front of a McDonald’s in Oakland in July, after employees contracted COVID-19.

Despite Oakland’s adoption of worker protections before and during the pandemic, two Latina women say they experienced labor violations that the city hasn’t resolved.

Edith Diaz, a former housekeeping supervisor at a Holiday Inn in Oakland, alleged that she wasn’t getting paid the city-set minimum wage of $15.37 an hour for hotel workers before the pandemic and that she was laid off when she pushed for back pay. Now, she said, most of her coworkers have been rehired except her.

Happening on Twitter

The only thing more dangerous than the mendacity of TFGers is the passivity and glacial movement of Democrats. W… https://t.co/fZXFYTss0Y PamKeithFL (from Fort Pierce FL) Sat May 08 01:48:12 +0000 2021

Health falls under your govt. Makers of Sputnik have publicly announced they can supply upto 3.5 Cr doses in 6 mon… https://t.co/uZeXCTI4A3 Sootradhar (from Mumbai) Sat May 08 08:05:42 +0000 2021

No comments:

Post a Comment