Perhaps you've already bought some cryptocurrency yourself. If so, you'll eventually need to find the right time to cash out on the cryptocurrency bonanza. But before you reach that point, you should think about how you're going to deal with crypto taxes. That's right – if you sell for a gain, Uncle Sam will most assuredly want his cut. So, while the virtual currencies might not actually exist, the tax payments you'll need to make most certainly do.

Do you have to pay taxes on withdrawals from 529 college-savings plans?

Are you among the many who have invested in a tax-favored Section 529 college savings plan for the benefit of a child or grandchild? If you did, it may finally be time to withdraw some money to pay for the account beneficiary's college expenses.

Qualified withdrawals, as defined by our beloved Internal Revenue Code, are always federal-income-tax-free. And usually state-income-tax-free too.

However, not all withdrawals are qualified withdrawals. So, there can be unexpected tax consequences.

Top Trump Executive Under Criminal Investigation Over Taxes - The New York Times

The New York attorney general's office has been criminally investigating the chief financial officer of former President Donald J. Trump's company for months over tax issues, according to people with knowledge of the matter.

The office of the attorney general, Letitia James, notified the Trump Organization in a January letter that it had opened a criminal investigation related to the chief financial officer, Allen Weisselberg , the people said. The investigators have examined whether taxes were paid on fringe benefits that Mr. Trump gave him, including cars and tens of thousands of dollars in private school tuition for at least one of Mr. Weisselberg's grandchildren.

Do Floridians pay the lowest taxes? A comparison with other states

Florida is a low tax state. Not as low as, say, Mississippi or South Dakota, but low enough to attract a lot of people looking to hang on to more of their money. But just how much more?

How did Florida measure up against the national average? The typical Floridian pays less in income, property and car taxes, but a little more in sales taxes.

But as a percentage of total taxes, Floridians pay a higher percentage toward property and sales taxes, which makes sense given that the state doesn't have an income tax.

Kentucky taxpayers affected by storms can delay paying taxes

FRANKFORT, Ky. (AP) - Kentucky taxpayers affected by storms that began Feb. 27 may be able to delay filing and paying their income taxes until the end of June.

The Kentucky Department of Revenue says it will honor the Internal Revenue Service special tax relief for taxpayers in an area designated by the Federal Emergency Management Agency as qualifying for individual assistance.

The Finance and Administration Cabinet says the extension doesn't apply to sales tax or other types of taxes, but taxpayers may contact the Department of Revenue to seek an extension or waiver of penalties.

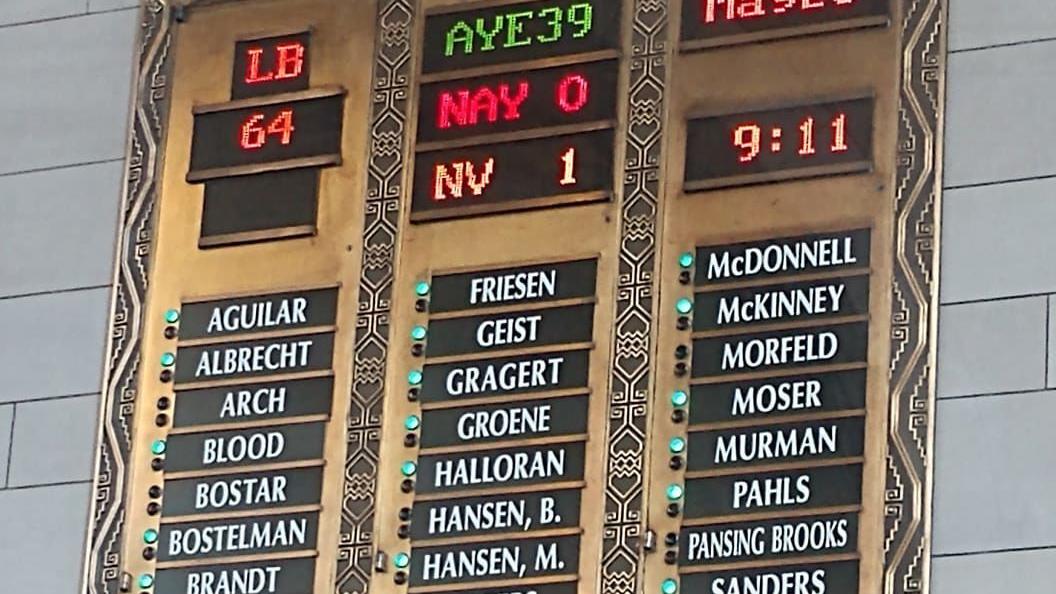

Social Security income tax exemption bill approved for Nebraska state taxes | Regional Government

The Legislature gave 41-0 final approval Thursday to a bill that will incrementally reduce the state income tax on Social Security income with a goal of total exemption by 2030.

The bill (LB64), sponsored by Sen. Brett Lindstrom of Omaha, would achieve a 50% tax reduction by 2025 with an expressed intention to achieve 100% reduction by 2030, subject to review by a future legislative session.

The built-in "guardrail" that allows a future Legislature to decide whether to continue with the annual 10% increased tax reduction after 2025 was attached to the bill by Sen. John Stinner of Gering, chairman of the Legislature's Appropriations Committee.

Fairer taxes on Big Tech could cover cost to vaccinate entire planet | Business| Economy and

International tax rules do not accurately reflect Big Tech's global economic presence, a human rights group has concluded. A global minimum tax rate could help discourage tax dodging.

Getting to peope in remote areas of the country is one of the challenges Colombia's vaccinations campaign is confronted with

G20 countries are losing out on as much as $32 billion (€26 billion) a year in tax revenue from the globe's five biggest tech companies, according to a study released Thursday by the human rights group ActionAid. These funds would cover the costs of two full-dose vaccinations against COVID-19 for every human being on the planet, the nongovernmental organization says.

Taxpayers avoided billions in withholding taxes | Accounting Today

Billions of dollars in underreported taxes by employers and backup withholding for their employees are helping fuel the tax gap, according to a new report.

"The continued noncompliance with backup withholding requirements and underreported taxes by employers and the IRS's lack of adequate actions to address this noncompliance contribute to the Tax Gap," said the TIGTA report.

Taxes will likely rise for wealthy regardless of President Biden's plans

President Joe Biden wants to raise taxes on wealthy households to fund part of his infrastructure agenda.

But some of those tax hikes are poised to happen even if Biden's legislative push isn't successful. That's due to the way in which lawmakers structured the 2017 Tax Cuts and Jobs Act.

That law broadly cut taxes for individuals — for example, by lowering the top income-tax rate and exempting more estates from tax. The benefits largely accrued to the top 1%, according to the Tax Foundation.

No comments:

Post a Comment