Although the Tax Cuts and Jobs Act has been in effect for four tax seasons now, many taxpayers are still trying to get familiar with all the changes. When you look at the changes that occurred though, it's understandable how taxpayers can be overwhelmed.

These are a lot of changes, right? If you're unsure as to where to start, here are some useful tips to help you manage your taxes the right way.

News Briefs: County treasurer to collect property taxes in Woodville, Clyde

Kimberley Foreman, Sandusky County treasurer, will be at the following locations from 10 to 11:30 a.m. to collect property taxes for the first half of 2021 — for anyone who wishes to pay in person.

Taxpayers are asked to pay with check or money order only. No cash and no debit/credit cards will be accepted. The tax bill must be presented at the time of payment or payment cannot be accepted.

Tax Tip: Moving to a New Jurisdiction to Save Taxes

Earlier this year, our Insights and Commentary team asked what tax practitioners needed to know—from tax tips to topics to watch out for—to start the new year off right. This week, we're publishing some of the best submissions.

A significant trend that we expect to continue, especially if the proposed federal surtaxes are enacted, is the consideration by individual taxpayers of moving to a new state, moving out of a city that imposes income taxes, or moving to Puerto Rico to reduce their overall individual income taxes.

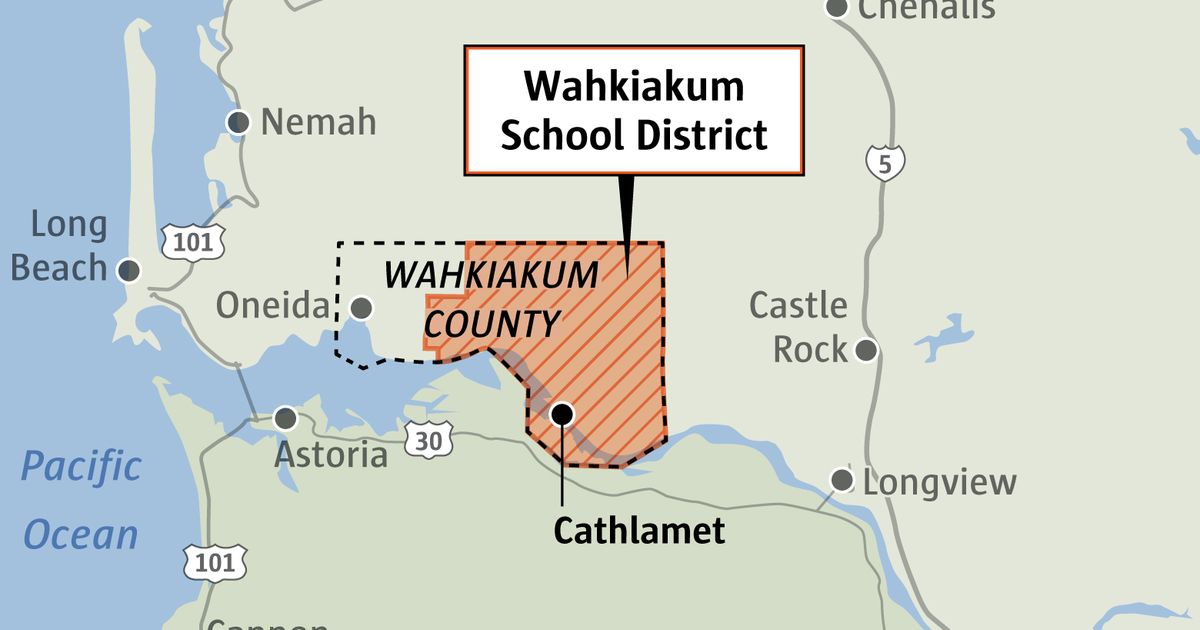

Small Washington district sues state for relying on local property taxes for school construction

Now, the lead lawyer in the McCleary case has filed a lawsuit on behalf of a small rural district in southwestern Washington, arguing the state is also violating the constitution by failing to ensure all students learn in safe and modern school buildings.

“Public education is supposed to be the great equalizer in our democracy,” reads the complaint filed Tuesday in Wahkiakum County Superior Court. “Our state government’s failure to amply fund the Wahkiakum School District’s capital needs, however, does the opposite.

Income from illegal activities, stolen property must be reported on taxes, IRS says

"If you steal property, you must report its fair market value in your income in the year you steal it unless you return it to its rightful owner in the same year," the IRS said.

Elon Musk owes $11 billion in taxes after wrapping up his Tesla stock sales - CNN

A Lavish Tax Dodge for the Ultrawealthy Is Easily Multiplied - The New York Times

In 2004, David Baszucki, fresh off a stint as a radio host in Santa Cruz, Calif., started a tiny video-game company. It was eligible for a tax break that lets investors in small businesses avoid millions of dollars in capital gains taxes if the start-ups hit it big.

Fox Chapel officials hold the line on real estate taxes, maintain recycling program | TribLIVE.com

Fox Chapel property owners will not have to pay more in real estate taxes as part of the borough’s 2022 budget.

Council recently approved its spending plan and tax ordinance maintaining the millage rate at 2.95 mills.

Bridgeville officials hold the line on taxes, garbage collection fees | TribLIVE.com

Bridgeville property owners will not have to pay more in real estate taxes as a result of the borough’s 2022 budget.

Council passed the $10.73 million budget in mid-December, 6-0, with Councilwoman Virginia Schneider absent.

The IRS extends deadline to file taxes in 2022 in some states - are you eligible?

THOUSANDS of people affected by the deadly December tornadoes will find a bit of relief from the Internal Revenue Service (IRS).

This isn't the first time the IRS is offering this extension to people affected by natural disasters.

Happening on Twitter

May Allah swt bless all you kind hearted extraordinary souls. Came across this. For those who wish to volunteer, so… https://t.co/0WUYtUP05w LisaSurihani Fri Dec 24 01:43:52 +0000 2021

🛡️ Looking for additional steps to protect your #privacy online? Check out these useful tips to help keep your pers… https://t.co/G5h5JSmGaw USCERT_gov (from Washington, DC) Thu Dec 23 17:25:01 +0000 2021

No comments:

Post a Comment