Hello and welcome back to Equity , TechCrunch's venture capital-focused podcast, where we unpack the numbers behind the headlines.

What a week. Are you still standing? Did you make it? If you are upright and typing, congratulations, you’re top-decile. If you’re reading this from bed, that’s fine too. We understand.

The week was so busy that we actually ran a bit long this week, with lots left on the cutting room floor. So, with the full team aboard this week ( Danny , Natasha , Chris , Alex ), we got into the following:

While you're here, how about this:

Boeing Says No to Government Money. What It's Doing Instead. - Barron's

Commercial aerospace giant Boeing announced a huge $25 billion bond offering. It will use the liquidity to help itself and its suppliers through the Covid-19 induced aerospace crisis. Just as important, with the cash, expected to arrive in early May, Boeing says it won't need a government bailout .

"As a result of the [bond offering] response, and pending the closure of this transaction ...we do not plan to seek additional funding through the capital markets or the U.S. government options at this time," reads the company's news release .

Selecting An Investor: Why It Isn't Just About The Money

The right partner makes a big difference. Consider all aspects of your partnership before making ... [+] your decision.

When raising capital, not all startups have options—they only receive one term sheet from one interested investor. And that should be celebrated. However, some startups are "hot" enough to attract multiple VCs.

On the surface, going with the higher valuation makes a lot of sense, since there will be less dilution of your ownership of the business that you've built. For example, a $2 million investment into a company valued at $10 million post money buys a larger percentage (20%) of the business than the same $2 million invested in a company valued at $20 million post money (10%).

Central Bank Digital Currencies: Changing the Architecture of Money

Once a niche enthusiasm with the launch of Bitcoin ( BTC ), digital money powered by blockchain technology has matured rapidly in just a few short years. The market is now highly diverse. For example, audited stablecoins, along with fixed use digital cash projects introduced by Wells Fargo and JP Morgan last year, stand in stark contrast to cryptocurrencies that fluctuate as much as 10% a day.

Central bank digital currencies are now in active pilot programs by many central banks across the world (see our recent report here ). The People’s Bank of China has embarked on its own “digital yuan” project and Sweden’s central bank, Sveriges Riksbank, has announced a pilot for a digital version of its currency for retail use, dubbed the e-krona.

Many things are taking place:

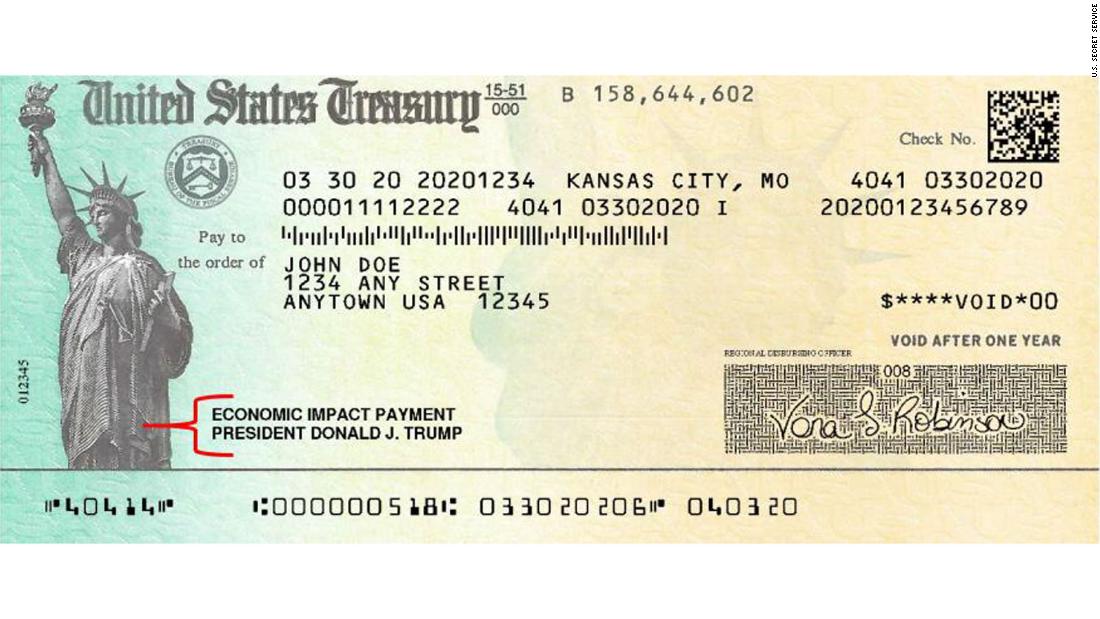

Stimulus checks: Still waiting for your money? Here's why - CNNPolitics

A Mobile Wallet Could Cause You to Spend More Money

With every new technology we must find balance. Here is how to keep your mobile wallet spending under control.

While the rocket trip might stretch most people's budgets, many of us spend money on many of these items. But it's that last one -- mobile wallets -- that could lead us to spend more money than we normally would.

* * *

Researchers from the University of Illinois at Urbana-Champaign set out to find out whether using a mobile wallet inspires us to spend more money. Because mobile wallets have become a mainstay in parts of Asia and Europe, they researched transaction data from China. They found that once consumers began to use mobile wallets, their total number of transactions rose by 23.5%, primarily spent on low-cost items. Overall, spending increased by 2.4%.

Why you should create a daily money mindfulness practice

CNBC Make It is posting a new financial task to tackle each day for a month. These are all meant to be simple, time-sensitive activities to take your mind off of the news for a moment and, hopefully, put you on sturdier financial footing. This is day 23 of 30.

Today, do something to ease that financial stress. You're already tracking your spending and getting your account balances texted to you each day. Now, take it one step further: Institute a short, daily financial routine in which you set aside time to review your daily account alerts and log in to the accounts to review your transactions and payments.

Congress presses for more ag money - POLITICO

— Negotiations on another emergency coronavirus aid package are expected to ramp up as the Senate returns on Monday. Lawmakers are pushing for more money to rescue the agriculture industry that's been hit hard by the pandemic.

* * *

— Agriculture Secretary Sonny Perdue believes meatpacking plants will reopen in just a few days. USDA says it's working with companies to draft protective plans for workers.

— President Donald Trump is considering ways to punish China for its alleged responsibility for spreading the coronavirus, potentially risking the countries' initial trade deal they just signed earlier this year.

Happening on Twitter

There is money in design tools, but do designers have a target on their backs? https://t.co/6BMOZpGpUV by @alex TechCrunch (from San Francisco, CA) Fri May 01 14:07:03 +0000 2020

No comments:

Post a Comment