:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/d1vhqlrjc8h82r.cloudfront.net/05-21-2020/t_1911f255f6424f989c51991e1340f568_name_san_antonio_2.jpg)

The City of San Antonio received $270 million in CRF money through the CARES Act that it can use to respond to the COVID-19 public health emergency. The so-called "COVID-19 Recovery and Resilience Plan" focuses on how some of the money could be channeled, along with other funding sources, for community support.

The plan was presented more as a framework, based on four major pillars: workforce development, small business support, digital divide and housing security.

Were you following this:

IRS will allow people to save more money in health savings accounts

Next year, the IRS will allow people to put away even more money in health savings accounts, a tax-advantaged account you can use for medical expenses .

Health savings accounts work alongside high deductible health plans. You can save money on a pretax or tax-deductible basis, have it grow tax free and then use the money to cover health care costs free of taxes.

Workplace HSAs have a fourth surprise benefit: Pretax contributions you make to your HSA, as well as contributions your employer makes to the account, avoid Social Security and Medicare taxes.

Can a nursing home take my stimulus money? - MarketWatch

Most of us know that residents at nursing homes are at a higher risk of complications if they contract the coronavirus — but they're also vulnerable to the possibility of having their stimulus checks taken from them, a recent Federal Trade Commission report suggested.

Some facilities are trying to siphon the government-issued checks from residents on Medicaid, the FTC said. "They're claiming that, because the person is on Medicaid, the facility gets to keep the stimulus payment," the agency said.

Telecommuting Breaks Transportation, Pt. 3: House Money

The holy grail of sales opportunities is the house money scenario, in which a customer's investment in your solution presents zero financial risk because their dollars are currently being dumped wastefully into the very problem you're solving. The rub, of course, lies in whether both parties agree on what is considered waste — and a lack of agreement there often stems from a misunderstanding about whose house you're in.

Not so with telecommuting. Working from home has its macroeconomic implications, without a doubt. But the relevance of its microeconomic impact hits home like no other, and as a result, makes it the most dangerous behavioral alternative in transportation.

Check out this next:

Following the CARES ACT Money: Why Some Small Businesses See Little to No Relief – NBC Bay

Recipients of SBA money include software companies, chain restaurants, an investment group that owns more than a half dozen boutique wineries, a memorabilia authenticator and the owner of a peer to peer lending app employing more 400 workers.

* * *

"(Big Companies) are getting it easy. They have a team that they can put together to handle all the (paperwork) and everything, so they can get that money very easily as opposed to us," said Alameda-based small business owner David Molenberg.

4 mortgage refinancing mistakes that can cost you money | Fox Business

With mortgages rates in decline, millions of Americans are mulling over a mortgage refinancing deal. ( iStock )

Uncle Sam is working overtime to get Americans to borrow money – and for financial institutions to lend it.

* * *

MORTGAGE RATES HIT A NEW RECORD LOW – HOW REFINANCING NOW COULD SAVE YOU MORE MONEY

In this low-interest rate environment , mortgage refinancing deals from mortgage lenders are easier to come by.

Social security coronavirus stimulus money is on the way - Los Angeles Times

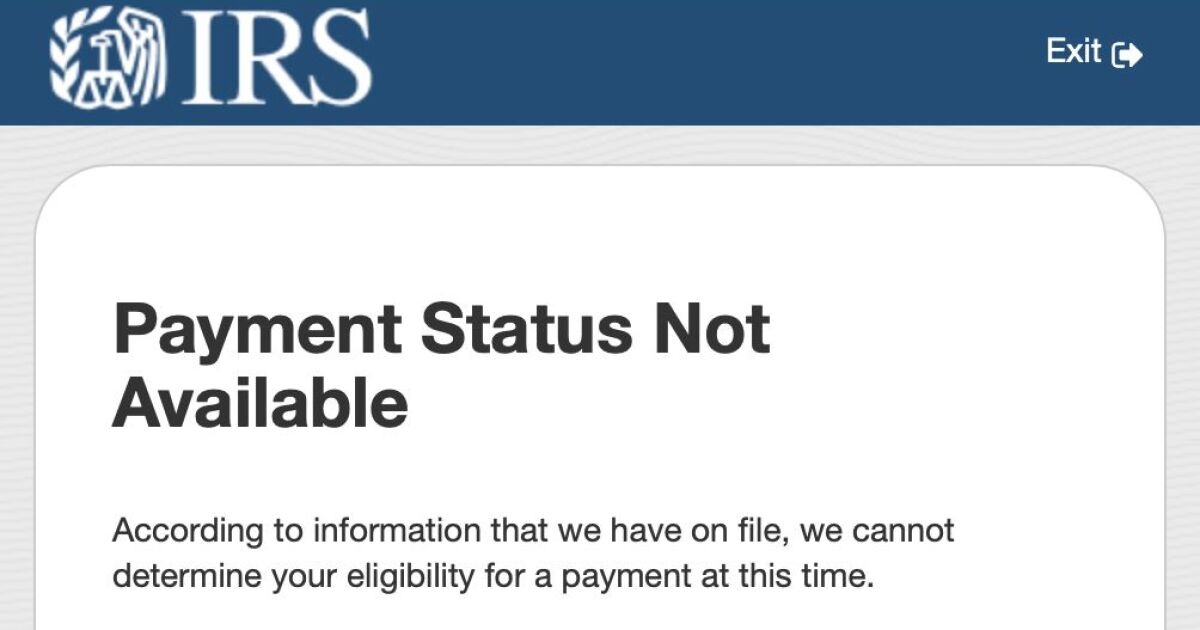

Dear Liz: My mother filed a paper return for 2019 in early March but hasn't received her refund yet. Also, she hasn't received the stimulus check to which she is entitled. She receives Supplemental Security Income via direct deposit and she included her banking info on her tax return for direct deposit. Given the IRS' limited staffing, when might she receive her money? Will she still receive her stimulus check if many more months pass before the IRS processes her tax return?

Money expert Phil Town says ditch this common investment strategy

When it comes to investing, financial institutions spend millions, if not billions, of dollars on marketing campaigns trying to convince investors that without their expertise and knowledge, all their investments will go bust and leave them penniless.

Phil Town believes otherwise. The former Grand Canyon rafting guide turned professional investor thinks that ordinary investors simply need to educate themselves on the market and quit feeling intimidated. "The biggest mistake people make is to assume that all of these people who are experts in the market know more than you do."

Happening on Twitter

The city of Kelso is considering defying Washington Gov. Jay Inslee's stay-at-home orders. https://t.co/gGtuYPPLBb KATUNews (from Portland, Oregon) Tue May 19 15:37:29 +0000 2020

Dallas City Council considers plan for soccer fields under downtown elevated highway https://t.co/BPlOGa6KKL FOX4 (from Dallas - Fort Worth) Tue May 19 02:00:00 +0000 2020

TUT considers cancelling exams as varsities scramble to save academic year | @City_Press https://t.co/ZVn2CzjvC8 https://t.co/CkPQK2jYPq News24 (from South Africa) Thu May 14 06:45:04 +0000 2020

TUT considers plans to defer exams to early 2021 | @City_Press https://t.co/AwdbGZqTh6 https://t.co/8VgYOuMYoY News24 (from South Africa) Sat May 16 12:00:54 +0000 2020

No comments:

Post a Comment