FOX Business' Jackie DeAngelis provides insight into Tesla CEO Elon Musk threatening to move the company's headquarters out of California unless the plant can reopen.

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here .

* * *

Tesla CEO Elon Musk is reportedly considering setting up shop in Texas following a dispute with California over coronavirus -related health protections that required his plant to shutter – which could have some interesting implications on the company’s tax obligations.

While you're here, how about this:

When Sheltering in Place Puts Your Tax Strategy at Risk - The New York Times

These unplanned geographic dislocations could result in unforeseen tax bills for those who are not diligent in keeping records. Domicile jurisdiction is typically aimed at wealthy taxpayers who have multiple homes, but a wider swath of people could now be affected. Doctors and nurses who headed to New York to help, for example, could receive New York City and New York State tax bills.

"People are going to need to be very precise about their own activities but also know what the states have done," said Jordan Sprechman, head of U.S. wealth advisory for JPMorgan's private bank.

Sorry, Mr. President, Congress needs your taxes. Legislating includes oversight.

To start, the House's demands to see Trump's tax returns didn't just come out of thin air — they were made based on existing statutes. Neal sought the president's returns pursuant to 26 USC §6103(f)(1) and (4)(A) , which gives him the authority to subpoena any American's tax returns as long as it is for a legitimate purpose.

More broadly, the Supreme Court has held that although Congress's oversight power is implicit, rather than explicit, this oversight power flows directly from legislative power itself. As Justice Willis Van Devanter set out in the 1927 case McGrain v. Daugherty , "the power of inquiry — with process to enforce it — is an essential and appropriate auxiliary to the legislative function.

Firms that left U.S.

The seal of the Board of Governors of the U.S, Federal Reserve System, seen in Feb. 2018, lay embedded in the floor at the Marriner S. Eccles Federal Reserve Board Building in Washington.

American companies that moved their official headquarters offshore to avoid U.S. taxes could qualify for coronavirus aid from the Federal Reserve, tax lawyers say, raising new questions about which firms should get access to public money.

In case you are keeping track:

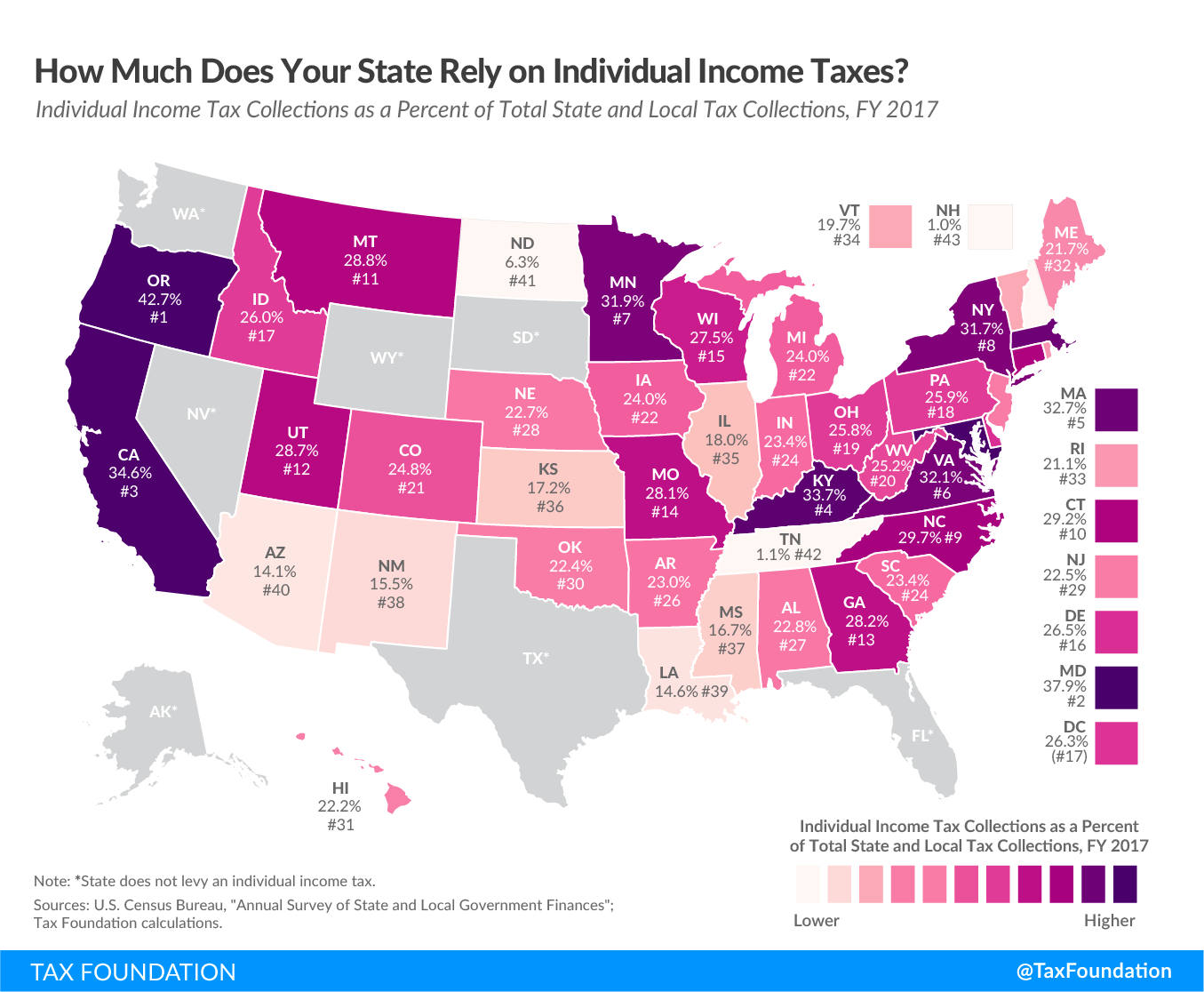

To What Extent Does Your State Rely on Individual Income Taxes?

State and localities rely heavily on the individual income tax, which comprised 23.3 percent of total U.S. state and local tax collections in fiscal year 2017, the latest year of data available. The individual income tax ranks just below the general sales tax (23.6 percent), both behind property taxes (31.9 percent) as the largest category of state and local revenue sources (See Facts & Figures Table 8).

Railing against auditor and taxes, Grand Rapids man charged in courthouse confrontation | Duluth

Where's my $1,200 stimulus check?

I was married and didn't qualify for the $1,200 stimulus check based on my 2018 tax returns. I am now divorced and filed my 2019 tax returns separately. It seems that millions of stimulus payments have already gone out. Where is my stimulus check? Will I ever receive one — or is it too late?

I didn't qualify under my 2018 taxes, but I DO qualify under my 2019 taxes. I filed about 10 days after the traditional filing date, so I missed the first round. If there is a second round of stimulus checks, will the Internal Revenue Service give me a check based on my 2019 return?

Use tax legislation stalls in Missouri | Coronavirus updates | joplinglobe.com

Happening on Twitter

Elon Musk could save billions in taxes if Tesla moves its headquarters to Nevada or Texas. Just saying. https://t.co/z1sxLGJ5qG GregAbbott_TX (from Austin, TX) Mon May 11 20:28:50 +0000 2020

#Tesla choosing RED STATE #Texas for it's next car #factory in #Austin 🤔 According to Texas-Electrek citing sources… https://t.co/TFDd6jiCX5 SusanLiTV (from AsiaPac/Europe/NAmerica) Fri May 15 19:12:24 +0000 2020

How about Knox County? We're a great place to live, work, and raise a family. Low taxes, business friendly, and an… https://t.co/RdwsAJKnT0 GlennJacobsTN (from Knoxville, TN) Sun May 10 13:30:40 +0000 2020

No comments:

Post a Comment