Other things to check out:

Tax Incentives Are No Way to Drive Energy Innovation. Here's Why. | The Heritage Foundation

The best ways to tame environmentally harmful emissions is to allow the private sector to innovate cleaner and more efficient ways to produce and use energy.

Previous government directed attempts to get carbon capture and storage technology off the ground also squandered hundreds of millions in taxpayer money.

Tax subsidies look more like corporate welfare for politically connected industries, and much less effective at spurring a dominant, world-class energy sector.

A closer look at TP compliance for businesses in Latin America | International Tax Review

There are transfer pricing (TP) documentation obligations adopted by Latin American countries that need to be complied with under Action 13 of the OECD's BEPS Action Plan.

This article provides an overview of TP developments in Latin America focussing on countries with TP documentation requirements as set out in Action 13, and countries without TP documentation requirements.

TP regulations in Argentina are regulated by the Income Tax Law, whose scope of application is limited to transactions carried out with related parties abroad and/or parties resident in non-cooperating jurisdictions.

Hope for Resolution of Digital Services Tax with Biden Administration and OECD Persistence

A new administration in the U.S. and OECD persistance may bring a better chance for resolution of the digital services tax quandary. Anshu Khanna of Nangia Andersen LLP in San Francisco outlines some of the issues, illustrates the growth of digital services around the globe, and outlines actions and proposals from several jurisdications for the implementation of DSTs.

Digitalization of everything is the motto of 2021. With Covid-19, there has been a significant acceleration in the growth of online world. All eyes are on the Biden Administration as more and more countries join the digital tax bandwagon, and the OECD struggles to find consensus for digital service taxes (DST). As an important trade partner for the world, and the country with the most companies impacted by the DST wave, the U.S.'s actions now will have large ramifications.

Not to change the topic here:

Climate change: American Petroleum Institute endorses carbon pricing

The oil and gas industry's largest trade group on Thursday endorsed a price on planet-warming carbon emissions, marking a major shift after the group long resisted regulatory action on climate change.

The American Petroleum Institute's move comes as President Joe Biden prepares to unveil a sweeping infrastructure proposal focused on curbing greenhouse gas emissions and transitioning to clean energy.

In a virtual meeting with White House officials on Monday , industry leaders from companies such as ExxonMobil, BP, Chevron and ConocoPhillips, along with API, also signaled support for market-based carbon pricing.

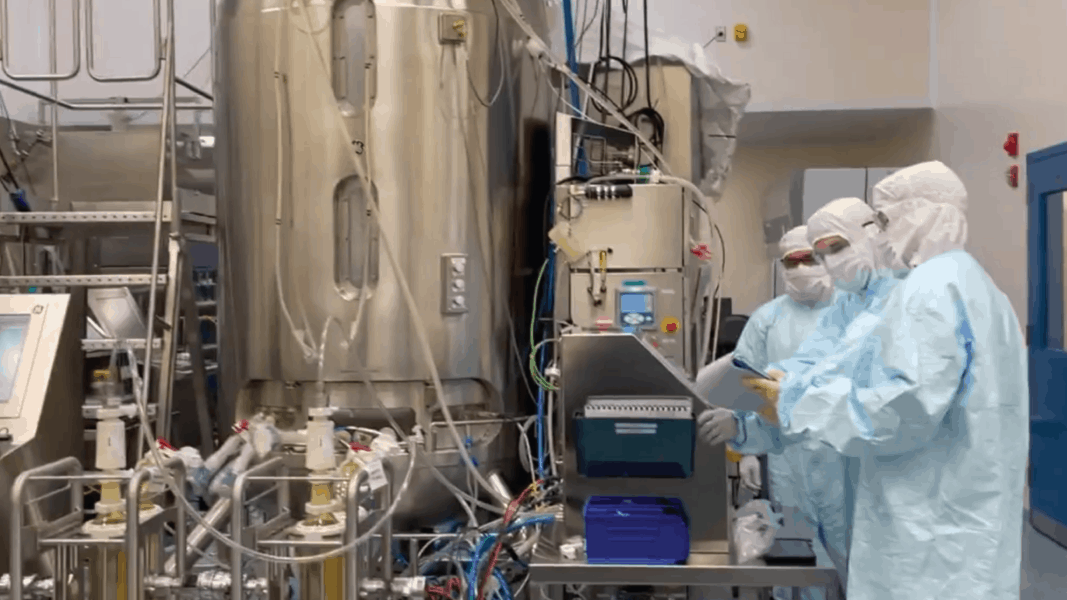

What It Takes to Manufacture a Vaccine | NAM

How the vaccine works: The complexity begins with the vaccines themselves, which are amazing feats of bioengineering. The two vaccines have broadly similar structures, though they are made by separate, quarantined production lines in the Emergent facility. (As Kirk says, you can't even take a wrench from one production suite to the other.)

* * *

So how do you make it? As you might guess, making such a precise vaccine is itself a complicated and delicate process.

Georgia Dilutes Judicial Deference to Tax Agency Regulations (1)

Georgia courts will have wider authority to interpret the state tax code under a bill headed to Republican Gov. Brian Kemp, rolling back decades of judicial deference to the state's revenue department.

The Georgia House approved S.B. 185 , which dilutes the principles of "Chevron deference" in state court tax cases and disputes before the Georgia Tax Tribunal on Monday. Chevron deference is a principle of administrative law compelling courts to defer to agency interpretations of ambiguous statutes that an agency must administer.

Housing Advocates Say Rule Stalls Tax Credit Deals - Law360

In the legal profession, information is the key to success. You have to know what's happening with clients, competitors, practice areas, and industries. Law360 provides the intelligence you need to remain an expert and beat the competition.

* * *

Enter your details below and select your area(s) of interest to stay ahead of the curve and receive Law360's daily newsletters

Happening on Twitter

📢📢Calling for young researchers for local peacebuilding! 5 young researchers will be deployed as national special… https://t.co/wC5ru0dHbN UNPeacebuilding (from Across the Globe) Wed Mar 24 20:17:29 +0000 2021

The responses to this Tweet offers a case study in the swarm/comment approach to opinion projection. Very consisten… https://t.co/rZzEjw8d9q paulmozur (from Taipei) Thu Mar 25 09:22:44 +0000 2021

The complex process of winemaking, coupled with how the liquid ages in the bottle, make wine a fascinating case stu… https://t.co/AVPCwdFES6 euronews (from Europe) Thu Mar 25 08:41:58 +0000 2021

Kan katanya TREND CATUR akan NAIK. Pertanyaannya adalah untuk berapa hari? seberapa naik? Ada yang mau coba jawab… https://t.co/DHzxskAOXf Eno_Bening (from Depok - Jakarta - Bandung) Wed Mar 24 06:26:22 +0000 2021

No comments:

Post a Comment