(CNN) Major parts of the Democrats' plan to tax the rich are in jeopardy of falling out of their sweeping proposal to expand the nation's social safety net as negotiations continue.

Kentuckians could see a rise in taxes

/cloudfront-us-east-1.images.arcpublishing.com/gray/JNA2VWR4NNGMDBHTZSJXNC3HGY.jpg)

The League of Cities is asking lawmakers to consider proposing a bill that would write an amendment to the state's constitution to instate a local sales tax.

Currently, Kentucky has a state sales and revenue tax, but not a local sales tax. At the state level, Kentuckians pay 6% of the goods they purchase.

A Guide To Understanding How Taxes Work When Buying A Property : South Florida Caribbean News

You are here: Home » Business » A Guide To Understanding How Taxes Work When Buying A Property

If you're a first-time buyer, deducted mortgage interest may be doable, so it's usually not a problem to start with. What you need to think about is the amount of taxes you have to pay in the upcoming year. Read through our guide to understand how taxes work when investing in a new property.

Illinois Supreme Court rules Cook County gun, ammunition taxes unconstitutional - Chicago

State Supreme Court Justice Mary Jane Theis wrote that the taxes violate the constitution's uniformity clause and "impose a burden on the exercise of a fundamental right protected by the second amendment."

Two Cook County taxes targeting firearms and ammunition are in jeopardy after the Illinois Supreme Court found they violate the state constitution.

As Mid-Valley home values spike, so do property taxes

Though the real market value of homes in Salem and most of the Willamette Valley are skyrocketing, most property owners will see minimal increases in their 2021-22 tax bills.

The real market value of all properties in Marion County jumped 7.6% from a year earlier, to $57 billion. In Polk County, the real market value rose by 9% from 2020, to $12.8 billion.

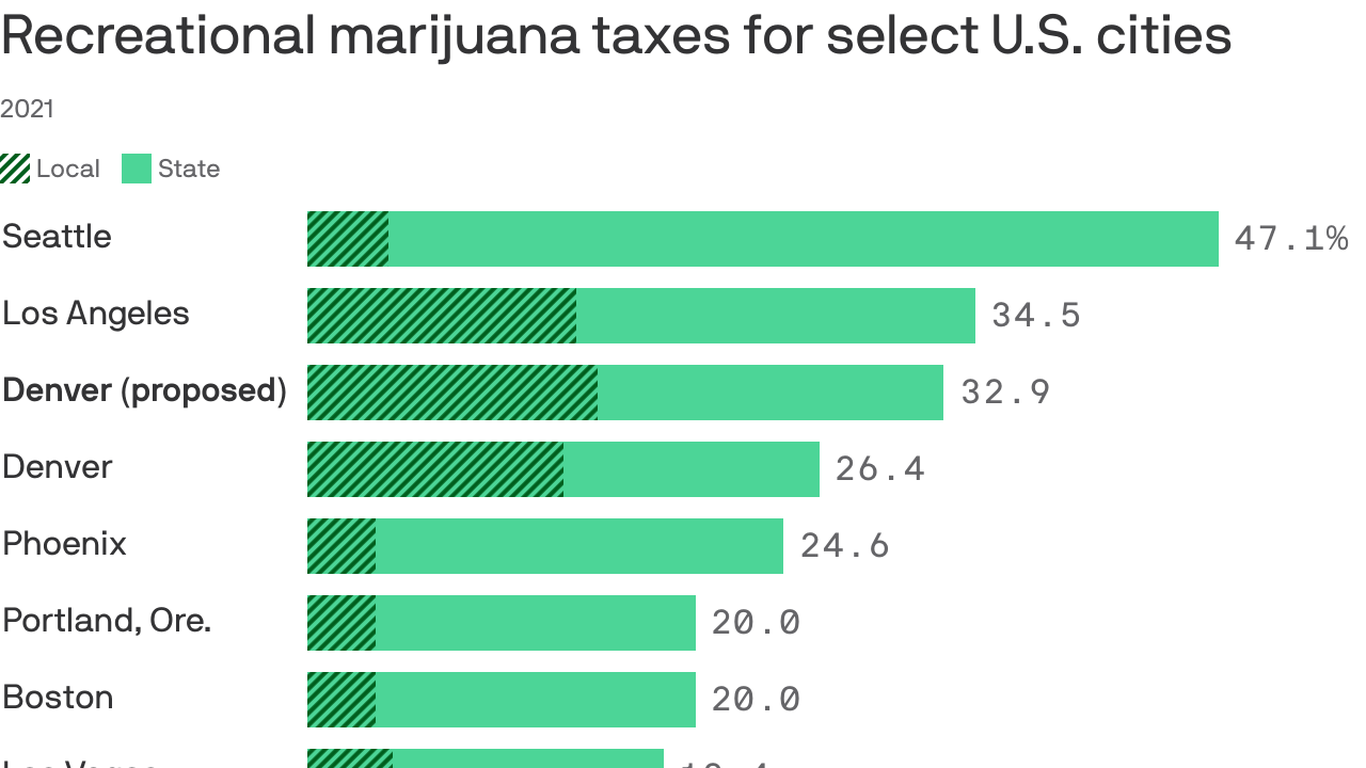

How pot taxes Colorado and Denver compare nationally as voters consider increases - Axios Denver

Recreational marijuana users in Denver pay some of the highest taxes in the nation — and it's only going to get more expensive if voters approve two November ballot measures.

By the numbers: Denver's marijuana taxes would become the highest in the country among the largest cities where retail pot sales are legal.

Ohio GOP owed delinquent taxes on its Columbus HQ; debt paid Thursday

The Ohio Republican Party owed delinquent property taxes on its Columbus headquarters for the past 18 months, but the political party paid off its remaining debt Thursday.

The party's headquarters on East Rich Street owed about $15,150 in delinquent taxes at the end of 2019 and $48,900 at the end of 2020, according to the Franklin County treasurer's office. No tax payments were reported between January 2020 and August 2021.

Spirits industry pushes for states to lower taxes on canned cocktails

John Granata, co-founder of Jersey Spirits Distilling and president of the New Jersey Craft Distillers Guild, has been pushing for lower excise taxes in New Jersey for years. For the first time, however, it seems like state legislators are finally listening.

No comments:

Post a Comment