In most states, taxpayers who are granted a federal extension to file automatically receive an equivalent extension to file their state income tax return.

Your state tax return deadline was likely the same as the federal return deadline: May 17. (Last year, most states extended their deadlines to July 15 to match the federal government's delayed deadline.

Perryville raises property taxes - The Advocate-Messenger | The Advocate-Messenger

The Perryville City Council on Tuesday evening made the unanimous vote to approve a first reading of an ordinance to set property tax rates, increasing the tax rate on real property by 4% for the fiscal year.

This was following a public hearing the same night. Per a request from a member of the public during the hearing, Mayor Brian Caldwell and City Attorney Justin Johnson explained the reasoning behind the increase, as well as how much of an increase the new tax rate would be.

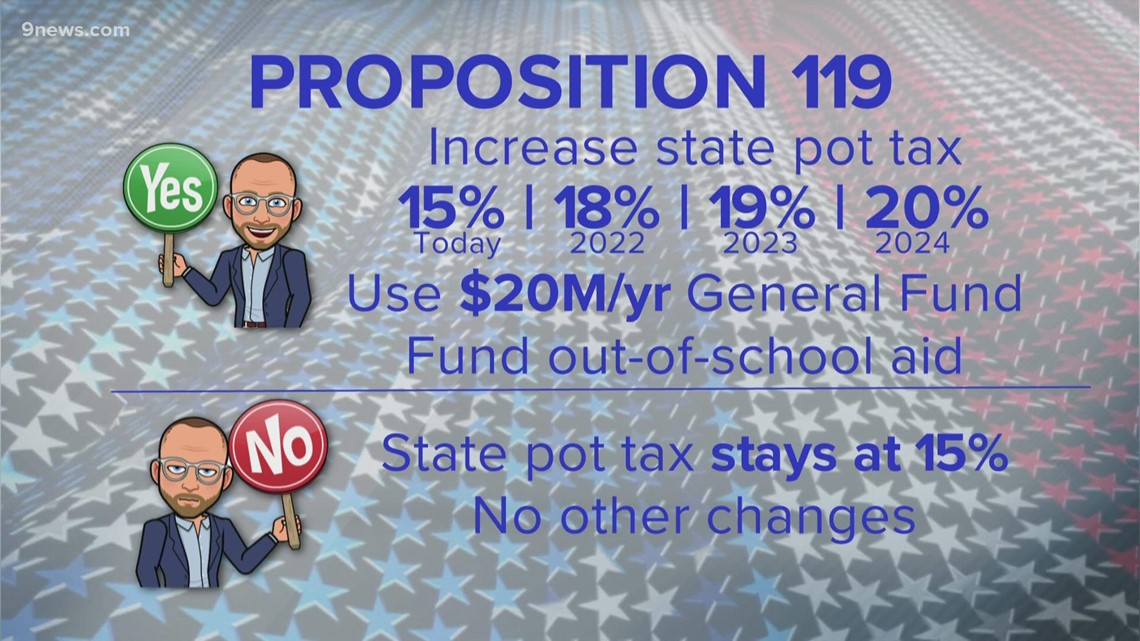

What does Colorado Proposition 119 mean for education, taxes? | 9news.com

COLORADO, USA — This story is part of a series of statewide ballot issue reviews for Next with Kyle Clark we're calling "We Don't Have To Agree, But Let's Just Vote ." We'll continue to look at statewide ballot initiatives on Colorado's ballot and how they would impact you.

Dutch government to lower energy taxes amid surge in prices

THE HAGUE, Netherlands (AP) — The Dutch government is planning a multibillion euro package to help households cope with soaring energy bills, a minister said Friday. The Netherlands is the latest European nation to seek to deal with the effects of surging prices for electricity and gas.

'Tampon tax' could end after Michigan House passes bills to end sales taxes on feminine hygiene

Members of the state House of Representatives gather on Tuesday, Sept. 10, 2019. (Jake May | MLive.com) Jake May | MLive.com

LANSING, MI — Feminine hygiene products would be exempt from the state's 6% sales and use taxes under a bill package that advanced through the Michigan House of Representatives on Thursday.

Craig Cowles Sentenced for Evading Over $250,000 in Taxes | USAO-VT | Department of Justice

According to court records, Cowles is the owner of Cowles Excavating, an earth-moving business located in Richmond. Between 2012 and 2017, Cowles generated approximately $2.8 million in gross revenue from Cowles Excavating and other businesses he operated.

Court records also reflect that Cowles structured financial transactions to avoid federal currency reporting requirements.

Bloomberg - Are you a robot?

U.S., European Nations Claim Progress on Path to Removing Digital Taxes - WSJ

The U.S. and five European countries have reached an agreement on how those countries' digital-service taxes would be withdrawn as a broader international agreement moves forward, French Finance Minister Bruno Le Maire said on Thursday.

Race for tax collector in Greenwich focuses on delinquent property taxes owed to the town

GREENWICH — The race for tax collector in Greenwich is coming down to a decision on how to best collect unpaid property taxes — the same issue that defined the election two years ago.

After Republican Heather Smeriglio was elected tax collector in 2019, she pulled the plug on a process started by her predecessor Howard Richman , whom she had defeated in the election, that threatened to hold a "tax sale" to force delinquent accounts to pay up.

No comments:

Post a Comment