Officials in Washington Township, whose fire department serves the city of Dublin, knew when voters approved a renewal levy for fire and EMS services on March 11, 2020 that there were enough excess cash reserves to sustain the department for at least a year..

But it wasn't until the end of April of this year that township trustees voted to stop collecting on four existing, continuing fire levies originally enacted in the 1970s as a way to draw down those reserves.

Trump Organization schemed to dodge taxes, indictment charges

The 15-count indictment, which was broader in scope than many legal observers expected, is the first set of criminal charges to emerge from probes of Trump and his company by the Manhattan District Attorney's office and the New York state Attorney General's office.

The indictment says the Trump Organization and Weisselberg devised the scheme to compensate Weisselberg and other company executives in an "off the books" manner, allowing them to receive "substantial portions of their income through indirect and disguised means."

States are so flush with funds, many are cutting taxes - CNNPolitics

(CNN) While states feared the coronavirus pandemic would wreak havoc on their budgets and force them to slash services, it turns out that many are doing far better than they predicted.

States are so flush with funds, many are cutting taxes More people looking for — but not taking — jobs after unemployment benefits end early IRS adds tools to help parents claim expanded child tax credit payments $6 trillion stimulus: Who got relief money so far

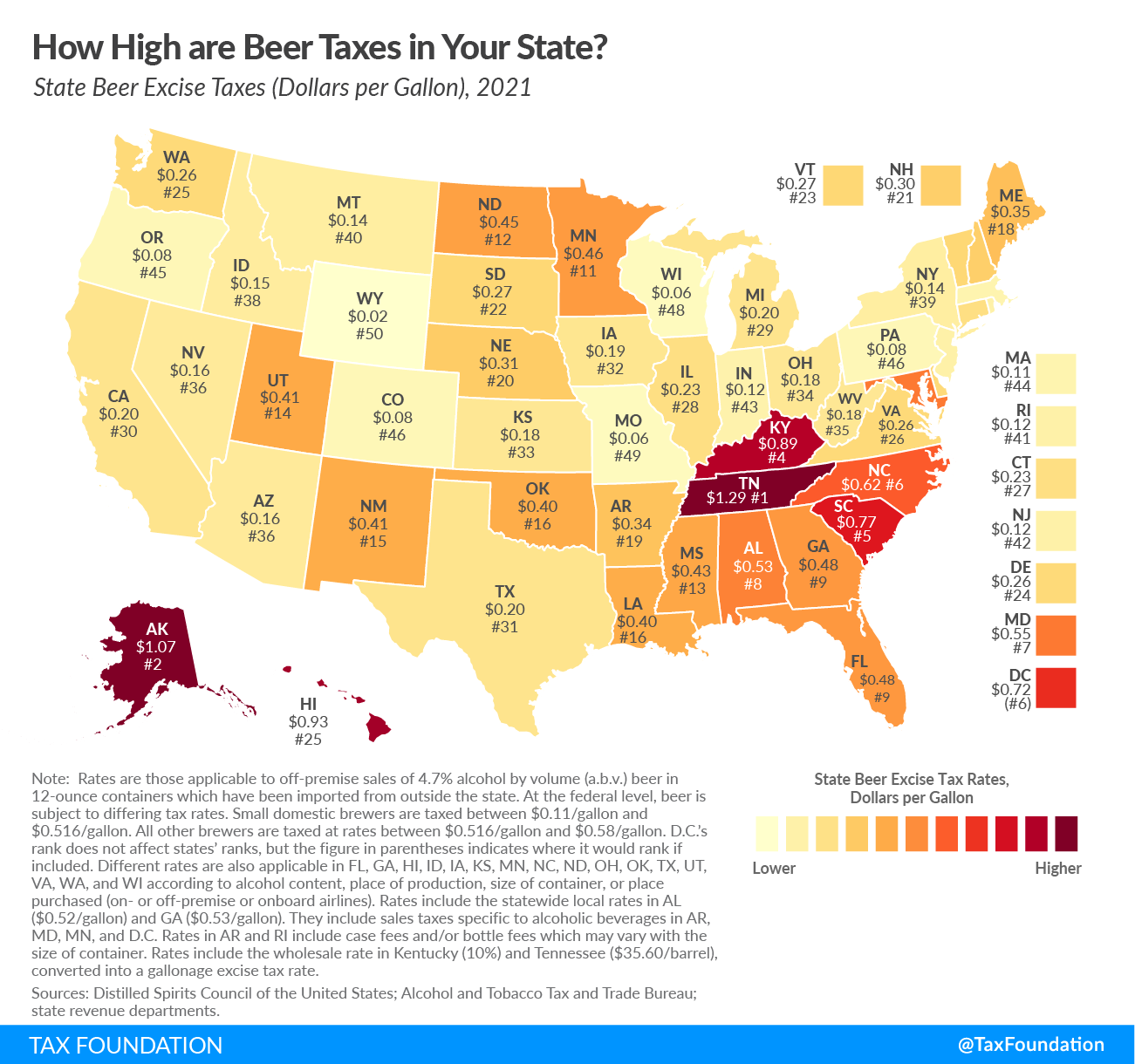

2021 State Beer Taxes | State Beer Excise Tax Rates | Tax Foundation

'Tis the season to crack open a cold one, and as the country is reopening, doing so at a cookout or a baseball game is back on the schedule. In the midst of summer's usual uptick in beer sales, take a minute to discover how much of your cash is actually going toward the cost of a brew.

Would Joe Biden's proposals raise taxes on 60 percent of Americans? Not directly

Critics of President Joe Biden are saying that his proposal to increase corporate tax rates could break one of the highest-profile promises of his 2020 presidential campaign — that "if you make less than $400,000, you won't pay a single penny more in taxes."

St. Landry School Board to hold public hearings on proposed taxes

The proposed property taxes would pay for employee pay raises; capital improvements to the system's athletic and recreational facilities; and building or improving school buildings.

The hearing will be held before the regular board meeting on Thursday, July 1, 2021 at the Supplementary Resource Center, 1013 Creswell Lane, Opelousas. The meeting is scheduled to begin at 5 p.m.

Bloomberg - Are you a robot?

Allentown School District taxes going up 3% despite more funding - The Morning Call

The Allentown School Board on Wednesday adopted a $375 million budget for 2021-22 that raises real estate taxes by 3% to 21.5036 mills.

The hike means the owner of a home assessed at $100,000 will pay $2,150 in real estate taxes, about $63 more.

Michael J. Francis: Investors should expect inflation, higher taxes

In the short-term, the unprecedented amount of monetary and fiscal stimulus has helped push financial assets to all-time record highs. In the longer-term, it's likely to cause inflation and ultimately, when the bill comes due, higher taxes.

Former Construction Executive Sentenced To More Than 4 Years In Prison For Tax Evasion And

Audrey Strauss, the United States Attorney for the Southern District of New York, announced that VITO NIGRO, a former construction project manager at Turner Construction Company ("Turner"), was sentenced today in Manhattan federal court to 51 months in prison for evading taxes on more than $1.8

Happening on Twitter

UEFA got the cash and was happy to accept Russia's fake Covid stats. It's criminal to believe any data put out by P… https://t.co/KBYo84C48O Kasparov63 (from New York) Sun Jun 27 19:37:00 +0000 2021

No comments:

Post a Comment