Proper , an automated accounting and bookkeeping service for property managers, announced Wednesday it raised $9 million in Series A funding in a round led by QED.

Existing investors MetaProp, Expa and Bling Capital also participated in the round, which gives the San Francisco-based proptech company a total amount raised of $13.8 million. The company brought in $4.8 million of seed funding last August.

Back to Basics - Accounting Methods series - Lexology

Archford Accounting Donates 550 Lunches to Children in Need Through the Belleville Summer Sack

As an incentive for clients to electronically upload their documents to stay safe and healthy this tax season, Archford Accounting donated 550 lunches to the Belleville Summer Sack Lunch Program.

In an effort to keep clients and employees safe during tax season in the midst of an ongoing pandemic as well as be more environmentally sustainable, Archford Accounting encouraged clients to utilize their secure upload portal when sending in tax documents.

How CPAs can survive cash flow peaks and valleys | Accounting Today

Throughout the COVID-19 pandemic, CPAs have played a pivotal role in prioritizing and executing financial transactions so small businesses could stay afloat and avoid getting caught off guard by their finances.

When cash is tight, accounting firms can be forced to make some difficult decisions between important business priorities. That can mean having to choose between paying rent and paying employees, paying vendors or keeping the lights on.

Faye Business Systems Group Named to 2021 VAR 100 List by Accounting Today | Benzinga

![]()

For the Third Consecutive Year, Faye Earns a Spot in Accounting Today's Annual Ranking of the Leading Value-added Resellers in the Accounting Technology Space

Faye, a global leader in software strategy, deployment and integration, has announced it has earned a spot on the top 100 value-added resellers list by Accounting Today for the third consecutive year.

Accounting Methods Are Hot Topics for 2021 Tax Planning

The tumultuous 2020 tax year, combined with expected tax increases in the future, make 2021 a key year for tax planning. Ryan Vaughan and Andrew Kosoy of Mazars outline common accounting methods and considerations for business taxpayers regarding such methods.

Subscribe to read | Financial Times

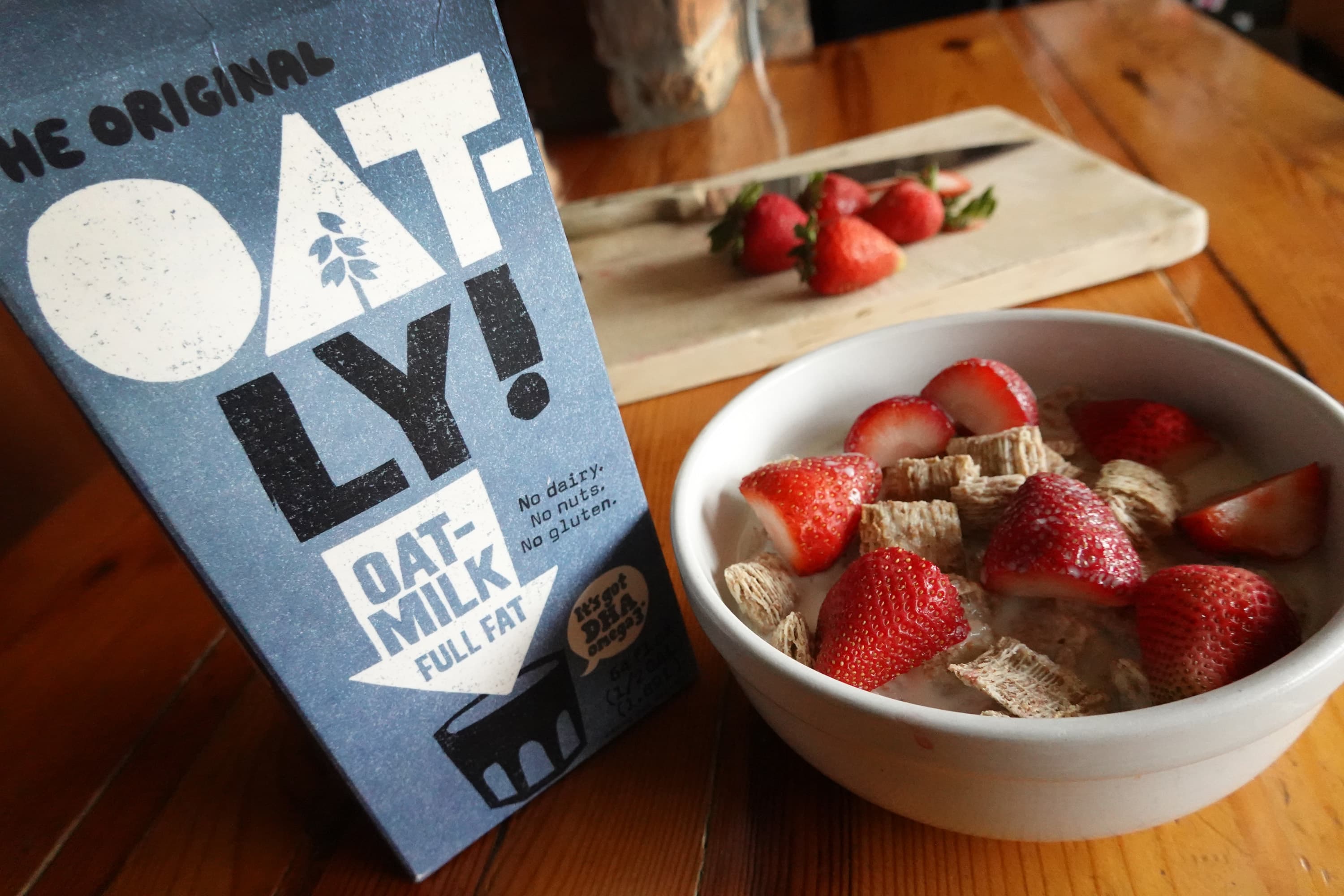

Oatly accused of overstating revenue and greenwashing by activist short Spruce Point

Activist short seller Spruce Point Capital Management has accused Oatly of shady accounting practices and misleading consumers and investors about its sustainability practices.

The firm, which has taken a short position against the maker of oat milk, called for Oatly's board to hire an independent forensic accountant to open an investigation into its claims. The company has denied the allegations, calling them "false and misleading."

Pandemic accounting: U.S.

The numbers: The U.S. federal budget deficit narrowed sharply to $174 billion in June from a record $864 billion in the same month last year , the Treasury Department said Tuesday. That's an improvement of $690 billion or 80%.

Stepping back, for the first nine months of the fiscal year, the deficit narrowed to $2.2 trillion, down from a $2.7 trillion deficit over the same period last year.

Happening on Twitter

As former MLB president Paul Beeston wrote, "Under generally accepted accounting principles, I could turn a $4 mill… https://t.co/iTrtspH9Zq doctorow (from Beautiful Downtown Burbank) Thu Jul 08 14:52:58 +0000 2021

No comments:

Post a Comment