Tax rates can increase year to year but how high will they be when you’re ready to retire? Bruce Smith from WealthKare Investment Center is back with a free online course and special offer for Good Day PA viewers.

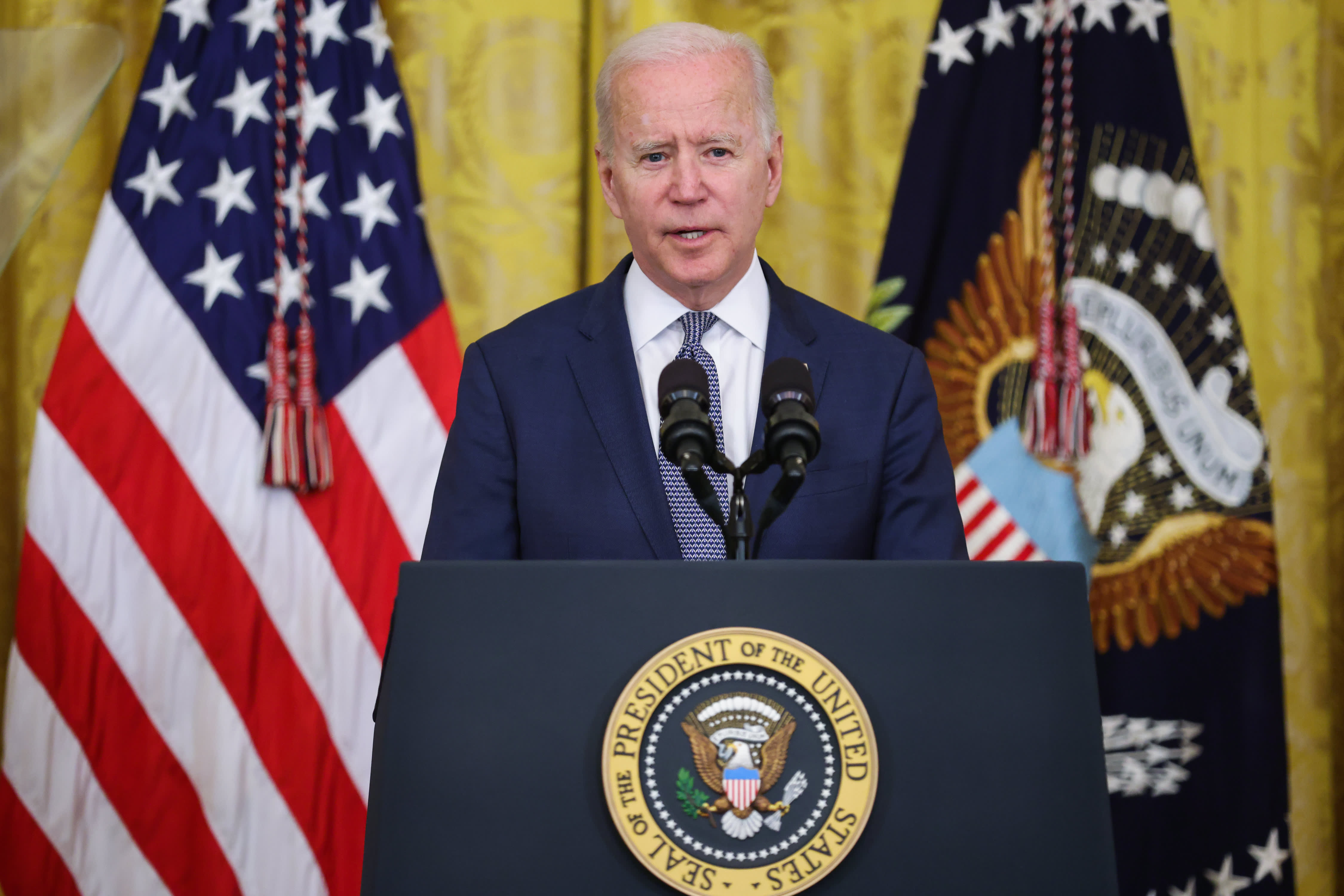

"Presidential historians and history buffs that go to presidential libraries, to home towns of presidents. All of these types of things. So we're going to see some tourism based on being the hometown of President Joe Biden," Curt Camoni, director of Lakawanna County Convention & Visitors Bureau.

Iowa Congresswoman doesn’t want new taxes paying for infrastructure | OurQuadCities

Five Democrats and five Republicans in the United States Senate are working on a compromise they hope can reach the president.

However, there are Democrats on the progressive wing who don’t think the Republicans will go along in the end.

They’re pushing for Democrats to utilize the reconciliation process to circumvent the filibuster.

US can’t afford not to raise corporate taxes » Albuquerque Journal

... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ...

UNM Professor Allen Parkman’s article in the May 18 edition of the Albuquerque Journal points out an obvious consequence of higher corporate taxes. He appears to be against higher corporate taxes because corporations just pass costs on to consumers who buy their goods and services, thereby raising costs beyond buyers’ – foreign or domestic – willingness to pay.

You may have to repay the 2021 child tax credit. Here's what to know

The advance payments of the enhanced child tax credit are set to start next month, but a big question on many parents' minds is whether they will end up owing on their taxes next year if they immediately spend the money.

For some parents, the answer is probably yes, they will end up owing money next tax season. Others will likely be fine. But all eligible parents should review their finances before spending the payments, financial experts say.

Editorial: Cook County property taxes rose 3 times the rate of inflation.

Residents of Cook County don't need to be told that they shoulder a heavy property tax burden. Illinois has the second-highest real estate property taxes in the country, and property taxes in Cook County rose at three times the rate of inflation from 2000 to 2019.

Want to guess who is on the hook for covering most of those obligations? That's right: Property owners.

A new report by Cook County Treasurer Maria Pappas looks at the tax burden in a new way. Her office calculated the total government debt and allocated a share of it to each property on the tax rolls. This is illuminating because not all properties bear the same burden, even if their value is comparable.

Transatlantic Review: Trade, Taxes And Climate - International Law - United States

We hope you can join us for this informative program. Participants will have the opportunity to ask questions and engage with our panelists.

Thursday, June 17, 2021

4:00 – 5:00 p.m. CET

10:00 – 11:00 a.m. ET

9:00 – 10:00 a.m. CT

8:00 – 9:00 a.m. MT

7:00 – 8:00 a.m. PT

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

Sanders says no to gas taxes, electric vehicle fees to fund infrastructure deal

WASHINGTON — Sen. Bernie Sanders, I-Vt., drew his red lines on how to pay for a potential infrastructure compromise bill Sunday, as Democratic progressives continue to hesitate over joining the bipartisan deal on one of President Joe Biden's biggest legislative priorities.

Twenty-one senators, including 11 Republicans, have coalesced around a broad framework that invests in hard infrastructure spending — roads, bridges and other projects — but not in the broader proposals that Democrats are seeking in their own proposals, such as climate change mitigation and new investments in areas like child care.

Will The Folly Of Biden's 'No New Middle-Class Taxes' Pledge Scuttle A Bipartisan Infrastructure

"Mr. [Dan] Clifton [of Stratgas Research Partners] calculates that if the Biden plan becomes law the U.S. would have the highest overall tax burden on corporate income — 62.7% — in the OECD.

"The great political fakery here is that corporate taxes merely fall on CEOs and rich shareholders. But as everyone knows, corporations don't really pay taxes. They are vehicles for collecting taxes that are ultimately paid by some combination of customers in higher prices, workers in lower wages, and shareholders in lower returns on investment."

Professional services tax proposals discussed in multiple states - Journal of Accountancy

Taxation of CPA services was a hot topic in several state legislatures this year as states sought to fix expected revenue shortfalls.

"Some states will be dealing with some sort of budget difficulties going into 2021 and 2022," said Megan Kueck, lead manager–State Regulation & Legislation at the AICPA. "They are looking at expanding their tax base, and that expansion of the tax base may include taxes on professional services."

Biden's plan raises top capital gains tax rate to among highest in world

The U.S. would tax capital gains and dividends for the rich at among the highest rates in the developed world if President Joe Biden 's proposal was enacted.

The top rate high-earning Americans pay on dividends and the sale of appreciated assets would jump to nearly 49%, when combining all federal and state taxes, according to the Tax Foundation.

Ireland is the only other developed nation to levy a higher tax on investment income – 51% on dividends. But when it comes to capital gains, the U.S. would claim the highest top rate, according to Tax Foundation data .

No comments:

Post a Comment