BIRMINGHAM, Ala. (WBRC) - One the things we know we can all count on, taxes. Starting today, Monday, Jan. 27, you can officially start filing your income taxes.

* * *

The tax cuts were given out and tax exemptions have been removed. Now it's just up to you and your accountant if you use one.

Filing early also gives you a chance to see what your taxes will look like next year in case you need to make changes to your withholdings from your employer.

In case you are keeping track:

IRS opens tax season to begin processing 2019 individual returns

MONTGOMERY, Ala. (WSFA) - Tax Season is officially underway! The IRS is now accepting 2019 returns for individual taxpayers.

No major changes this year; the Tax Cuts and Jobs Act of 2017 made major reforms to our tax system, and those changes are still largely in effect. The penalty for not carrying personal health insurance has been dropped, and the standard deduction has increased - up to $12,200 for singles, $24,400 for a married couple filing jointly.

Taxes 2020: What changes to expect for filing returns

Just how eager you are to file your 2019 tax return, which the IRS begins accepting on Jan. 27 — depends on a lot of things.

Did you get socked with a bigger tax bill than usual last year after the sweeping changes under the Tax Cuts and Jobs Act? Did you suddenly owe money when you always got a refund?

* * *

Many people, of course, file early in the season because they're banking on a four-figure tax refund — including payouts from the Earned Income Tax Credit — to cover the bills.

Weston School District apologizes for over-collecting property taxes

CAZENOVIA (WKOW) -- The Weston School District apologized to tax payers after learning it collected more than half a million in extra property taxes over the past five years.

According to the district, the error happened after citizens approved an April 2015 referendum. The referendum allowed the district to exceed the state revenue limits by $715,000 a year for five years.

The district planned to spend most of those funds on operational expenses but roughly $109,000 a year went to funding HVAC upgrades.

And here's another article:

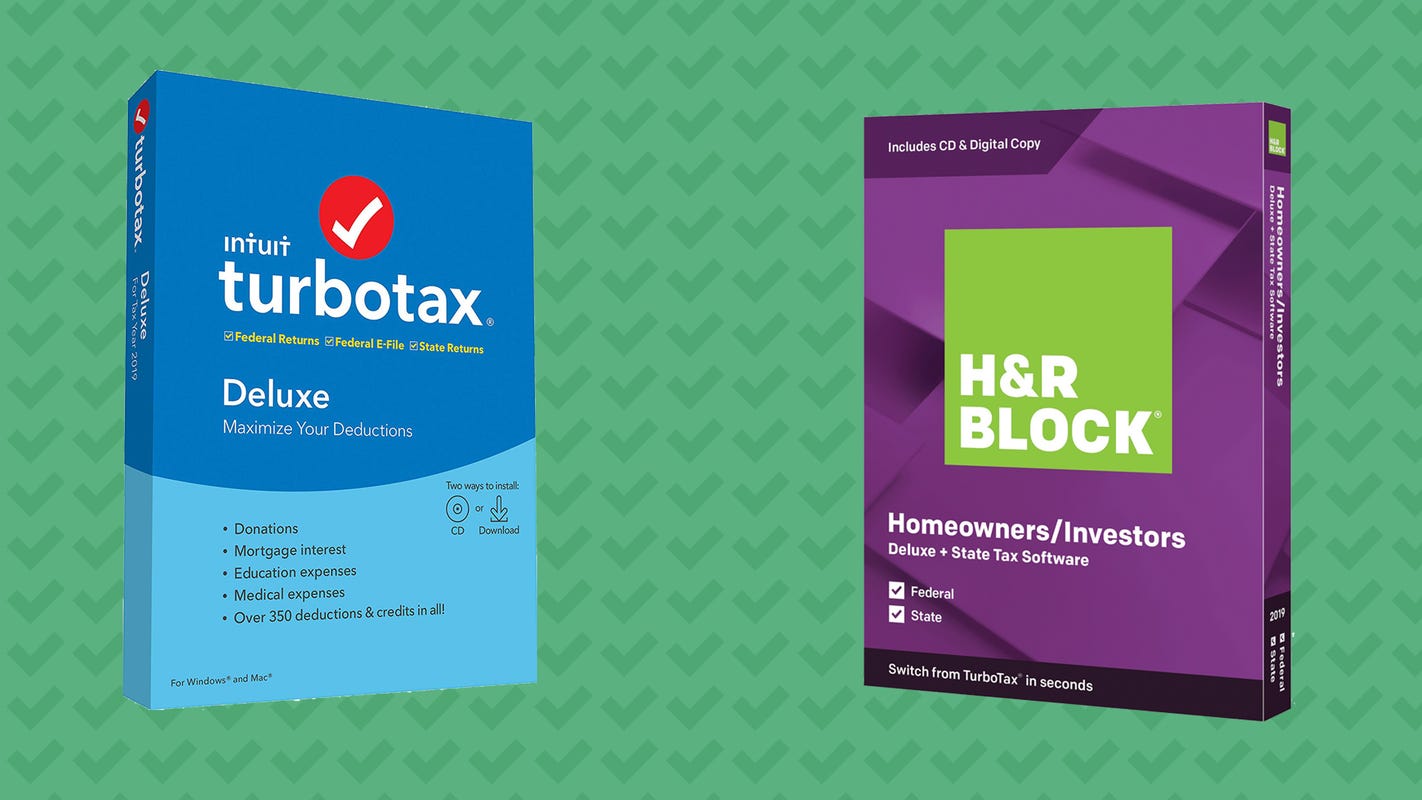

Tax Season 2019: Save on TurboTax and H&R Block software to help file your tax returns

Brace yourselves, everyone. The IRS has officially opened the floodgates to submit your tax returns starting today, January 27. Thus marks the official start of tax season, but don't let the panic set in just yet. Thanks to some sweet savings on tax software from both TurboTax and H&R Block, filing your taxes just got a whole lot cheaper—and easier.

They both took the top spots when we tested the best tax software because they're super user-friendly and will guide you on how to import all the necessary tax forms like your W-2, report your various incomes, and maximize your deductions.

New rules in Oregon, Washington as tax filing season starts | KATU

Tax filing starts today. Here's how long a refund takes - CBS News

Whether it brings dread or anticipation, the tax season is officially open today. The IRS began accepting 2019 tax returns on January 27 for the 2019 tax year, with about 150 million taxpayers expected to file this year.

The biggest question on taxpayers' minds may be how long they'll have to wait for their refunds. Last year, the IRS issued refunds for about 70% of the roughly 155 million tax returns that were filed through December 27. The average refund check last year was $2,869, or about 1.4% less than in 2018.

Steyer would have owed $18M more in taxes under lawmakers' proposal: liberal group | TheHill

Over the 10-year period from 2009 through 2018, Steyer would have owed nearly $136 million in additional taxes under the proposal, the group said. Steyer's tax returns showed that he paid almost $305 million in federal income taxes on nearly $1.4 billion in adjusted gross income during that time period, according to the group.

"The robust effect the Millionaires Surtax would have on the tax liability of one of the nation's richest men is a good illustration of how effective this simple reform would be in ensuring the super wealthy pay something closer to their fair share," American for Tax Fairness Executive Director Frank Clemente said in a statement.

No comments:

Post a Comment