There are 9,774 politically active tax-exempt organizations that may have failed to notify the Internal Revenue Service of their existence or submit the paperwork to operate tax-free, according to a new calculation from an agency watchdog.

The IRS could also be failing to collect millions of dollars in penalties and fees owed by these social welfare groups, the report said.

The revelation comes as the IRS is seeking to finish regulations that would allow the groups to keep their donor lists secret unless they are requested by the agency. The groups can engage in politics as long as they don't spend more than half of their money on campaign advertisements or activities to sway an election. Donors don't have to be disclosed to the public.

This may worth something:

House Democrats Push Environmental Bills but Victories Are Few - The New York Times

WASHINGTON — Speaker Nancy Pelosi on Friday delivered a triumphant message as the House moved on legislation, long sought by environmentalists, to force the Environmental Protection Agency to regulate toxic chemicals known as PFAS that can contaminate drinking water.

"The Trump Administration's E.P.A. is breaking its own promises every day that it delays and puts polluters ahead of the American people," she said, before 24 Republicans joined all but one Democrat to pass the PFAS Action Act , 247 to 159. "In stark contrast, the House is taking action."

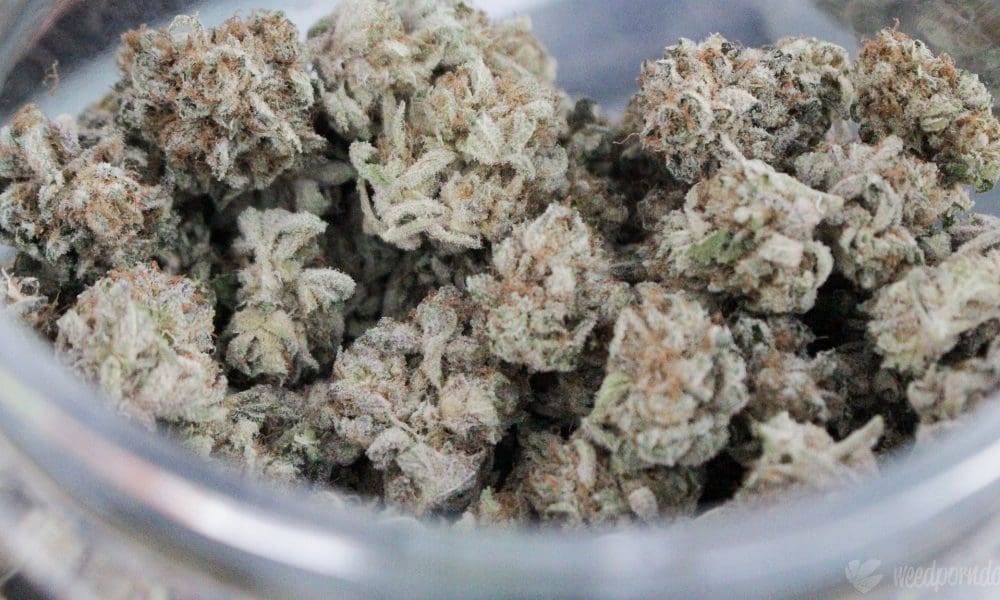

California Governor Proposes Changes To Marijuana Regulations And Taxes | Marijuana Moment

California Gov. Gavin Newsom (D) unveiled his annual budget proposal on Friday, and it contains several provisions aimed at simplifying and streamlining regulations for the marijuana industry.

The biggest proposed change concerns the state’s cannabis licensing system, which Newsom hopes to consolidate into one agency—the Department of Cannabis Control—rather than the three that are currently in charge of approving marijuana businesses.

“Establishment of a standalone department with an enforcement arm will centralize and align critical areas to build a successful legal cannabis market, by creating a single point of contact for cannabis licensees and local governments,” the administration said in a summary.

Wisconsin Department of Natural Resources Adopts Regulations to Implement, Administer Forest Tax

The Wisconsin Department of Natural Resources Jan. 6 adopted regulations relating to managed forest and forest crop programs for property tax purposes.

Many things are taking place:

IRS Prop. Reg.: Revised Applicability Dates for Guidance Related to Built-In Gain, Loss (IRC §382)

Aberdeen Global Premier Properties Fund Announces Record Date And Payment Date For Monthly

Under U.S. tax rules applicable to the Fund, the amount and character of distributable income for each fiscal year can be finally determined only as of the end of the Fund's fiscal year. However, under Section 19 of the Investment Company Act of 1940, as amended (the "1940 Act") and related Rules, the Fund may be required to indicate to shareholders the source of certain distributions to shareholders.

The following table sets forth the estimated amounts of the sources of the distribution for purposes of Section 19 of the 1940 Act and the Rules adopted thereunder. The table has been computed based on generally accepted accounting principles.

Colo. To Look At Broadening Tax Base, Lowering Rates, Gov. Says - Law360

Enter your details below and select your area(s) of interest to receive Law360 Tax Authority daily newsletters

Treasury and IRS Release Final and Proposed Foreign Tax Credit Regulations | Fenwick & West LLP -

On December 2, 2019, Treasury and the IRS released final and proposed regulations on the foreign tax credit. As expected, the final regulations finalize the 2018 proposed regulations relating mainly to the Tax Cuts and Jobs Act (TCJA) statutory changes and expense apportionment. (For a discussion of the 2018 proposed regulations, see our December 2018 article .

The new proposed regulations, on the other hand, would make significant changes to existing regulatory rules, including new rules for the allocation and apportionment of R&E and stewardship expenses, and for assigning foreign income taxes to different income groups for various purposes. These rules will take on increased importance in the post‑TCJA tax environment.

The above discussed information is very useful. We provide the Best Tax Audit in India, Reach us now to avail this service at the best price.

ReplyDelete