Davies's visit to Zaatari, a massive, hastily built camp for Syrian refugees in Jordan, is fascinating reportage on its own terms and also a brilliant illustration of Adam Smith's observations about the power of the natural human tendency to "truck, barter and exchange one thing for another."

Davies describes a setup in which aid organizations give each family a kind of debit card that controls five separate accounts — one for food, one for clothing, etc. — that can be used at whichever of the camp's two supermarkets a family prefers. Since donors don't want to support unhealthful habits like smoking, there is no account for cigarettes. And since the accounts are segregated from one another, there is no way to economize on food to get extra clothing or vice versa.

And here's another article:

Opinion: Keep Georgia's end-of-course test in economics

Mike Raymer is a former teacher of the year at Starr’s Mill High School in Fayette County, a former Georgia Council Economics Teacher of the Year and a former Georgia Council for the Social Studies Outstanding Social Studies Educator Award winner.

Suffice to say, he values economics education. In a piece today, he explains why he fears that education is at risk.

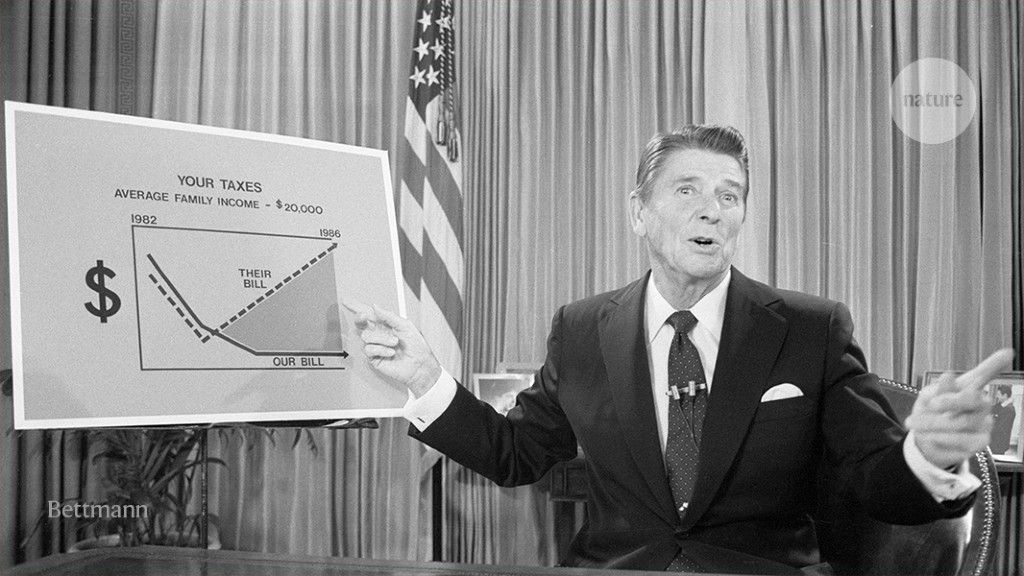

The dangers of fringe economics in government

US president Ronald Reagan based his tax cuts of the 1980s on questionable ideas. Credit: Bettmann

Arguing with Zombies: Economics, Politics, and the Fight for a better Future Paul Krugman W. W. Norton (2020)

* * *

I thought of Shlakman, and how far we have strayed from such integrated analyses of economic realities, while combing through Simon Bowmaker's 2019 When the President Calls . Over the past half-century, Bowmaker shows, economic advisers to US presidents from Richard Nixon to Donald Trump have enabled central bankers and treasury officials to implement untethered ideas.

Worry Over the 'Japanification' of the U.S.

Economists have been warning for years that the U.S. economy could start to look like Japan's, using the term "Japanification" to describe that change. But Bernstein Research is questioning the comparison.

From a distance, there are obvious similarities between the U.S. and Japan. Both countries implemented ultra-loose monetary policies after debt-fueled financial crises. And, despite their central banks' best efforts, both have experienced relatively sluggish and inconsistent economic growth.

While you're here, how about this:

Here's How Much Money Economists Make In Every State

According to the Bureau of Labor Statistics, the average salary for an economist in the U.S. is ... [+] $116,020, well over double the average wage for all occupations in the country.

Using occupational data from the Bureau of Labor Statistics, we've analyzed and compiled a round-up of the average economist salary by state in the U.S. Read on for a full breakdown of where economists make the most money, and where they're making the least.

* * *

New York average economist salary : $127,520 Virginia average economist salary : $126,080 Ohio average economist salary : $125,490 California average economist salary : $124,430 Massachusetts average economist salary : $117,680 Maryland average economist salary : $116,870 Missouri average economist salary : $112,240 Georgia average economist salary : $111,570 Illinois average economist salary : $108,690 Texas average economist salary : $106,480

Iran's Grim Economy Limits Its Willingness to Confront the U.S. - The New York Times

Iran is caught in a wretched economic crisis. Jobs are scarce. Prices for food and other necessities are skyrocketing. The economy is rapidly shrinking. Iranians are increasingly disgusted.

Crippling sanctions imposed by the Trump administration have severed Iran's access to international markets, decimating the economy, which is now contracting at an alarming 9.5 percent annual rate, the International Monetary Fund estimated. Oil exports were effectively zero in December, according to Oxford Economics, as the sanctions have prevented sales, even though smugglers have transported unknown volumes.

Bloomberg - Are you a robot?

What economists see for the Chicago housing market in 2020

If the nation’s longest recorded economic expansion somehow hasn’t already set off sparks in the housing market, three economists who spoke at real estate forecast events said last week, don’t expect this year to be any different.

* * *

William Strauss, senior economist at the Federal Reserve Bank of Chicago, echoed them the next day.

“Housing has been improving at a modest pace for years, and it’s expected to do the same,” Strauss said at a separate forecast hosted by the suburban Mainstreet Organization of Realtors at the Medinah Shriners banquet facility in Addison on Jan. 10.

No comments:

Post a Comment