You may want a big house, but don't buy based on emotion. A house is a place to build memories, not an asset that will automatically appreciate in value. Maybe it will; maybe it won't. If you find your dream home, make sure you can afford the mortgage payments. Separate the beauty from the cost of the house - they are two different things. One is for you to enjoy; the other you need to pay for.

* * *

Simply put, if you decide to invest your money, remember this: only invest in things you understand. Don't invest in a "hot stock" because you read about it online or saw it on TV. Understand what you are buying and assess the underlying risks. Don't take someone else's recommendation. Do your own independent research. Warren Buffett invests in stocks and business models that he understands. This doesn't mean you can't learn about a new industry or business. Just spend the necessary time to

In case you are keeping track:

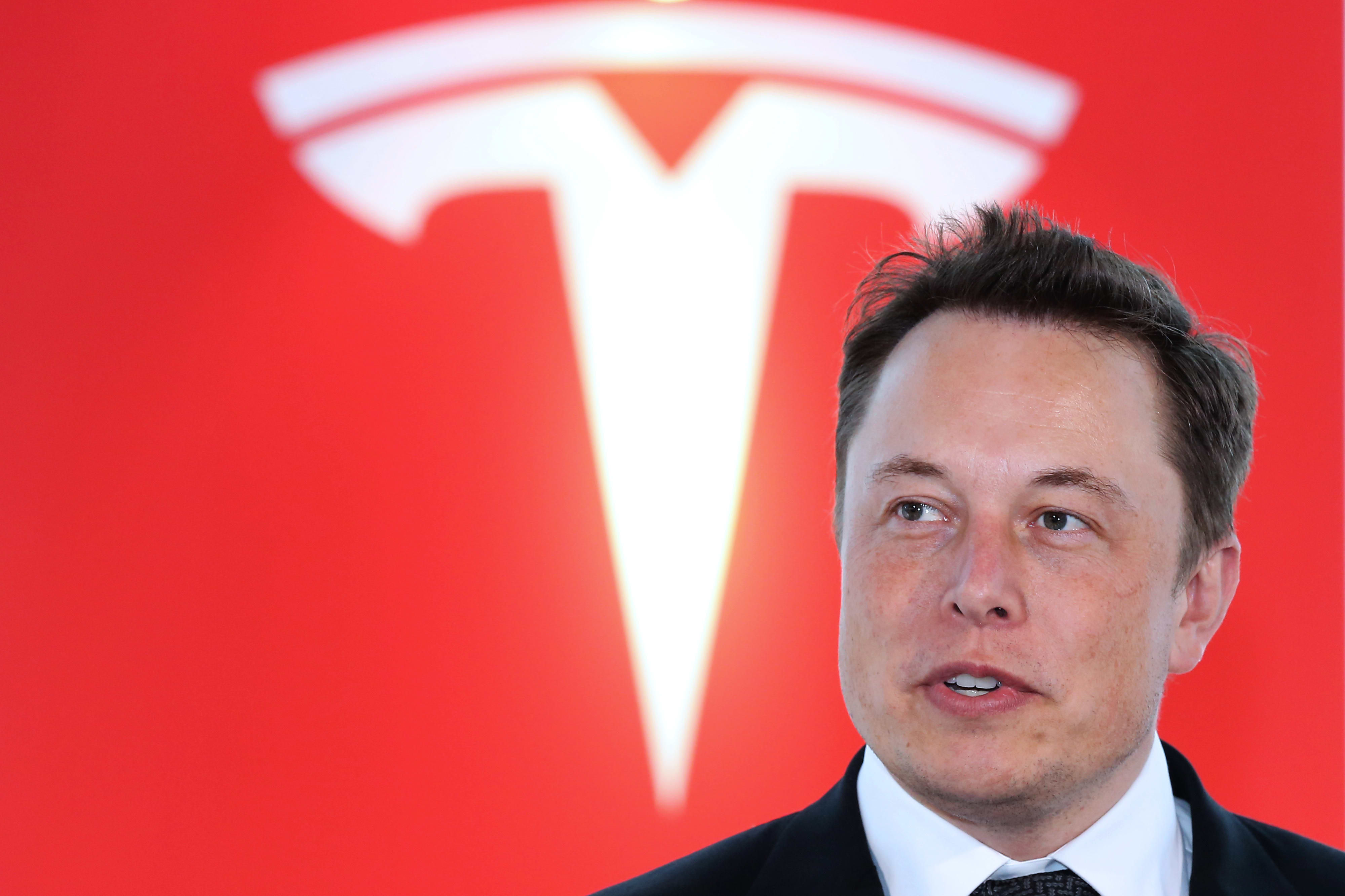

One options trader bets big money on Tesla's stock cracking $800

Tesla is absolutely speeding into Wednesday afternoon's earnings report. The electric automaker's share price has more than doubled since the company's last report in October, climbing 124% during that time.

Whether Tesla's next earnings announcement can kick-start the next leg higher for the stock remains to be seen, but whatever happens, we're likely to see the stock move quite a bit over the next few days, according to Michael Khouw, president of Optimize Advisors.

Learning from retirees' top money regrets | News, Sports, Jobs - Daily Press

Metro photo Money woes can strike at any age, but seniors entering retirement have financial needs that can only be met with thorough planning before retirement hits.

Now we’ll cover the money moves retirees wish they hadn’t made. The big ones, of course, are starting to save too late and not saving enough, but there are other common regrets, according to certified financial planners from the Financial Planning Association and the Alliance of Comprehensive Planners.

7 Ways My Kids Have Cost Me More Money Than Expected

It's no secret that raising children costs money. The typical middle-income family will spend a whopping $233,610 to bring up a child, not including paying for college.

I always knew that having kids of my own would put a huge strain on my budget. But through the years, I've been downright shocked to see just how expensive some of the costs associated with them have been. Here are a few in particular that have caught me off-guard. Repeatedly.

* * *

I had twin daughters three years after having my son and I transitioned back into freelance work so I could do my job from home. Frankly, the cost of full-time daycare for three children would've virtually wiped out my salary, and it wasn't worth it.

And here's another article:

5 money mistakes I made in my 20s that still haunt me - Business Insider

Years from now, when I'm looking back on my 20s, I expect I'll wrap up everything that happened and file it under a section of my brain called "learning experience." It was a stretch of 10 years when I had more mistakes on my record than accomplishments.

I graduated college with a major (poetry) that had no logical next step, I moved back home to my parents' house and stayed far too long, I blew my savings on moving to New York City for a job that paid minimum wage, and I never got comfortable with the word "budget ."

What to Do When a Friend Owes You Money and Is Avoiding You - VICE

If someone has owed you money for two months, it's easy to get very worked up about what a bad friend they are. But so often, the person has just forgotten about the situation entirely, and would be mortified to know you were stressed about bringing it up to them.

So give them the benefit of the doubt and approach them with an open, neutral tone. If the socially acceptable padding of a few days has gone by when you make this ask, giving them a firm deadline a few days out is a nice thing to do. So you could say, "Hey, I'm not sure if you saw my Venmo request from Monday for the Airbnb, but would you mind accepting that?"

90% of Americans Stress About Money, According to Study Results

The majority (90%) of Americans say that financial considerations have an impact on their stress levels, according to a study from Thriving Wallet , a new partnership between Thrive Global and Discover.

The goal of Thriving Wallet, which launched today, is to: "Reframe our relationship with money so that we can reduce financial stress and achieve positive behavior changes," Arianna Huffington, founder and CEO of Thrive Global, tells CNBC Select.

Is Social Security Really Running Out of Money?

Now let's get back to Social Security's trust funds. Right now, those funds can be tapped to bridge the gap between what Social Security owes in benefits and the revenue it takes in. But many fear that once those funds are exhausted, benefits will no longer be payable.

Thankfully though, that's not true, and the reason is this: Social Security gets the bulk of its revenue from payroll taxes. Currently, wages of up to $137,700 are subject to a 12.4% Social Security tax. The tax is split evenly between employees and employers, though self-employed workers pay the whole thing. As such, Social Security is not at risk of running out of money, because as long as we have a workforce and continue taxing wages, the program will have revenue coming in.'

Happening on Twitter

Using footage of LeBron James to memorialize Kobe Bryant may not even crack the top 5 of worst things I've seen tod… https://t.co/tQS9Fd3Hox SirajAHashmi (from DC) Mon Jan 27 00:41:35 +0000 2020

No comments:

Post a Comment