If you work long hours, you should get paid for them, right? How about getting time-and-a-half for them? Good news: You might be eligible, per the Department of Labor's new overtime rule.

If you receive bonuses or commissions in your role, your employer can count 10% of those earnings toward your salary level. If you don't earn enough via bonuses or commissions over the course of the year to maintain your exempt status, your employer is allowed to make a "catch-up" payment one time.

In case you are keeping track:

DOL issues final rule clarifying how to calculate regular rate for overtime pay - Lexology

The US Department of Labour (DOL) has announced a final rule (the new rule) that updates several regulations regarding what forms of payment employers can exclude in the time-and-a-half calculation for overtime pay. The new rule clarifies that employers can exclude a range of employee perks and state-mandated payments in calculating overtime under federal law.

The Fair Labour Standards Act (FLSA) requires employers to pay non-exempt employees at least one-and-a-half times their regular rate for hours worked exceeding 40 per work week. The FLSA defines the 'regular rate' as "all remuneration for employment paid to, or on behalf of, the employee". Decades ago, the DOL issued several regulations addressing how employers must calculate the regular rate under Part 778 of the Code of Federal Regulations Title 29.

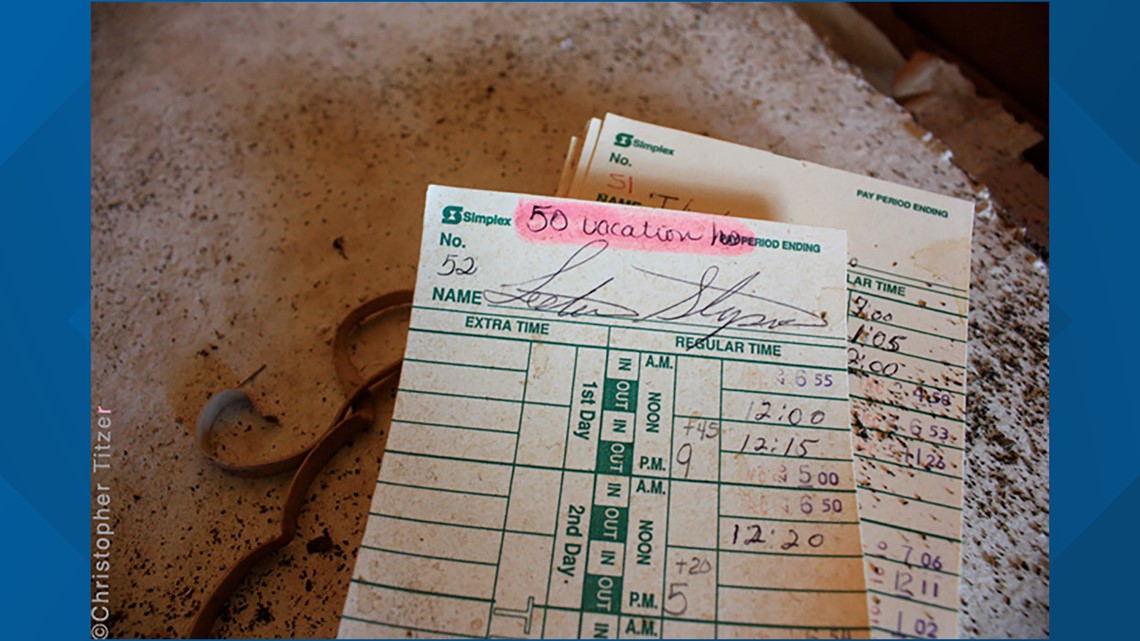

New overtime rule could affect up to 20,000 Arizona workers in new year | 12news.com

WASHINGTON — As many as 20,000 Arizona workers could be guaranteed overtime pay when they do overtime work under a Labor Department rule that takes effect Jan. 1, the first change to the rule since 2004.

But critics say the change does not go far enough to protect workers, noting that it would affect only a fraction of those who would have been covered by an Obama administration change that was blocked in court.

* * *

There's a reason for that, said Garrick Taylor, a spokesman for the Arizona Chamber of Commerce. He said the previous rule would have created a huge burden for employers by vastly expanding overtime pay.

Top Compliance Tips For New Overtime Rules

What should you do to be in compliance with the new overtime pay rules ? Leading HR experts inside and outside the industry offer their best strategies.

1. Analyze Your FLSA Exemptions: Look at all your job categories and make sure you have the correct designation for each job, advises Melissa Rearick, senior manager of HR shared services, total rewards and talent acquisition at PCNA (asi/78897).

2. Determine Salaries: Once you confirm the jobs are classified correctly, Rearick says, you can elect to adjust the salaries for exempt employees to keep them exempt or you can elect to move them to nonexempt status and follow overtime payment rules.

Not to change the topic here:

East Huntingdon landscaper fined $74,290 over allegedly failing to pay Mexican workers overtime,

An East Huntingdon landscaping company has paid nearly $75,000 in back wages and fines to settle allegations that it committed labor violations involving a foreign worker program, according to the U.S. Department of Labor.

Silvis Group, located on Schultz Road, signed a consent agreement with the Labor Department on June 14 that alleged the company violated provisions of the H-2B temporary visa program governing the employment of foreign workers. The company has paid $45,068 in fines for what the government alleged was “substantial and willful failure to comply with H-2B provisions” and $29,222 in back wages, said Leni Fortson, a Labor Department spokeswoman.

Top 10 Things To Know About The New FLSA Overtime Calculations - Employment and HR - United States

Beginning January 15, 2020, new, more employer-friendly regulations determine how overtime pay is calculated under the Fair Labor Standards Act.

There are new regulations affecting overtime calculations under the Fair Labor Standards Act (FLSA). The US Department of Labor (DOL) has promulgated these to "provide clarity and to better reflect the 21st-century workplace." Their effective date is January 15, 2020.

As a reminder, the FLSA requires that employers pay overtime at one and one-half times an employee's "regular rate" of pay for hours in excess of 40 per week. There are, of course, some jobs that are exempt from overtime under the FLSA; these regulations affect only overtime-eligible jobs.

Minimum wage and overtime changes come with unintended consequences | The Maine Wire

On January 1, the state's minimum wage and overtime exemption thresholds increased by more than nine percent. More specifically, the minimum wage was raised from $11 per hour to $12 per hour and the overtime exemption threshold grew from $33,000 to $36,000 annually.

According to a working paper from the University of Washington, the average low-wage employee lost $125 per month after the minimum wage was increased to $13 per hour in Seattle in 2016. This occurred because employees lost more income through a reduction to their hours (9.4 percent) than they gained from the minimum wage increase (3.1 percent).

Massachusetts state employee salary database 2020 - masslive.com

Two University of Massachusetts employees took home more than $1 million in 2019, topping the comptroller's list of state employee pay for the year.

University of Massachusetts Medical School chancellor and senior vice president of health sciences Michael Collins earned $1.096 million, while dean of UMass Medical School Terence Flotte, who is also provost and executive deputy chancellor, took home $1.076 million.

As usual, UMass employees dominated the top of the state payroll, with all but one of the 65 highest-paid employees working for UMass. Only a portion of the UMass budget comes from tax dollars, though.

Happening on Twitter

NEW: 'Launch, launch, launch': Inside the Trump administration as the Iranian missiles began to fall. An updated v… https://t.co/2j6weD894U DanLamothe (from Northern Virginia) Thu Jan 09 01:44:05 +0000 2020

Updated top-100 Draft Board. https://t.co/GmiEVDIYKI dpbrugler (from Northeast Ohio) Tue Jan 07 16:01:41 +0000 2020

No comments:

Post a Comment