HARTFORD — With the state surplus growing, Connecticut legislators are debating how to return some of that money to residents through tax cuts. Democrats and Republicans are pushing competing plans — from sending out checks to parents to slashing the sales tax.

With Lamont and the entire legislature up for reelection in November, the race is on to see which taxes might be cut this year.

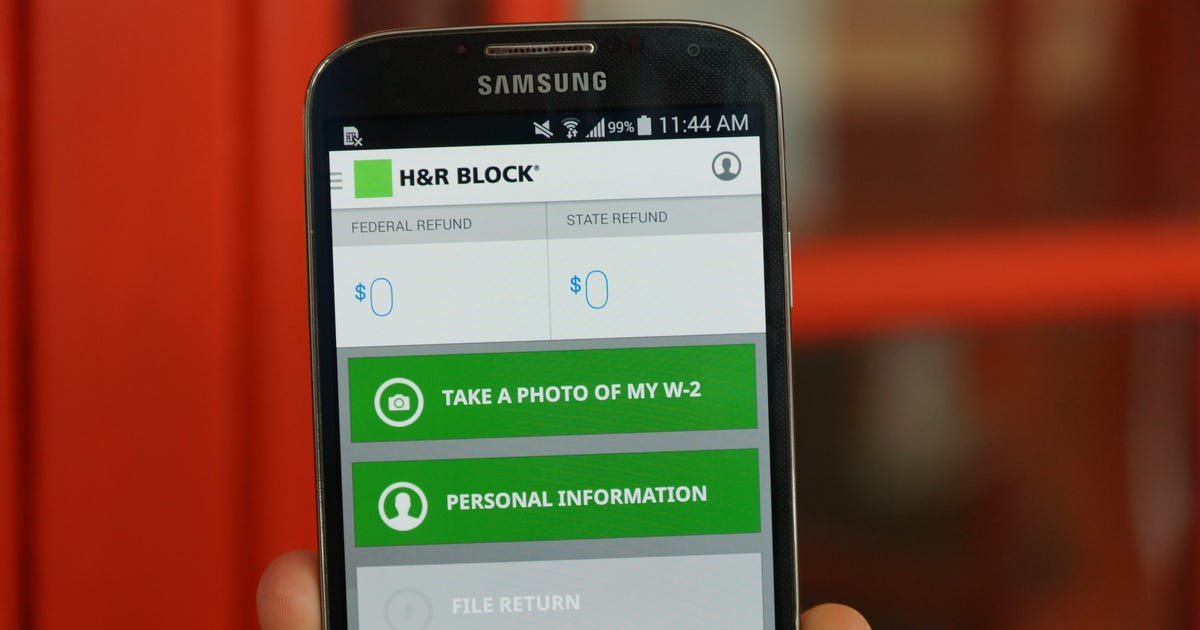

Doing taxes on your phone? Better read this first - CNET

If you're looking to file your own taxes on mobile this year, there are a few things you should know.

You might not be keen on doing taxes on your smartphone because it may seem difficult and tedious, but there are many reasons why it might be a great idea for you:

County Collector: Number of people paying taxes in-person falls again as more people use app, pay

For the second consecutive year, the line at the Franklin County Collector of Revenue's Office on the last day to pay real estate and personal property taxes was shorter than in the past.

This year, the county's longest lines weren't even on Dec. 31, when around 500 people lined up to pay. County Collector Doug Trentmann said most people, around 1,200, paid on Tuesday, Dec. 28.

Fact or fiction: The IRS is tracking payments over $600 on Paypal and Venmo in 2022 - CNET

If you own your own business or have a side hustle and get paid through digital apps like PayPal, Zelle, Cash App or Venmo, earnings over $600 will now be reported to the IRS. A provision from the 2021 American Rescue Plan, which went into effect on Jan.

Prior to this legislation, a third-party payment platform would only report to the tax agency if a user had more than 200 commercial transactions and made more than $20,000 in payments over the course of a year.

Taxes went up because government is spending more money | Elk River Star News | hometownsource.com

The Dec. 25 story "School taxes go up as do market values" describes the myth concocted to hide the real reason taxes are going up: Schools and the government are simply spending more money.

I initially believed this excuse, accepting that my taxes when up because my home value went up, as that only makes sense, right? But when you realize that it wasn't just your value that went up, that everyone's value went up, their excuse falls apart.

David Gardner: How to navigate insurance, aid and taxes amid wildfire disaster

When we think of a catastrophic loss, we think of those who have lost their homes or had them rendered uninhabitable.

Insurance has become so much a marketing game that the focus is inordinately on costs and premiums. While these should not be ignored, what you need is an insurance company that stands behind you come claim time.

What Does 2022 Have in Store for Property Taxes?

If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

Many or all of the products here are from our partners that pay us a commission. It's how we make money. But our editorial integrity ensures our experts' opinions aren't influenced by compensation. Terms may apply to offers listed on this page.

California considering insane plan to double its (already high) taxes

It's estimated that the amendment would increase state revenue by $163 billion a year, which is more revenue than California had ever seen in an entire year before 2020. (That means it's effectively doubling the state's taxes.)

How inflation will impact your 2022 taxes | Fox Business

In November, inflation rose 6.8% from a year earlier , nearly a four-decade high as measured by the Labor Department’s consumer price index. For new cars (up 11%) and fast-food restaurants (up 7.9%), the jump in prices was the largest on record.

It’s unclear whether inflation will continue or cool. But Americans can be certain that the higher inflation is, the more uneven its impact will be on taxes owed to Uncle Sam.

Breaux Bridge Woman Sentenced for Failure to Pay Taxes | USAO-WDLA | Department of Justice

LAFAYETTE, La. - United States Attorney Brandon B. Brown announced that Joan Chauvin Edgar , 71, of Breaux Bridge, Louisiana , was sentenced today by United States District Judge Robert R. Summerhays to 41 months in prison, followed by 3 years of supervised release, on tax fraud charges.

Happening on Twitter

The Boston Bruins are heartbroken by the tragic passing of Teddy Balkind. Our hearts are with Teddy's family, frie… https://t.co/5Fid4PX0gD NHLBruins (from Boston, MA) Sat Jan 08 17:23:27 +0000 2022

People in states from North Carolina to Connecticut may be treated to a NASA rocket launch Saturday night, if weath… https://t.co/67bCUcARsl CNN Sat Jan 08 19:02:05 +0000 2022

Hockey teams and players at all levels are mourning the tragic loss of Teddy Balkind and paying tribute on social m… https://t.co/rEJZ2YNszE Sportsnet (from Canada) Sat Jan 08 20:18:29 +0000 2022

No comments:

Post a Comment