ORLANDO, Florida, March 29 (Reuters) - U.S. money supply is falling at its fastest rate since the 1930s, a red flag for the economy and financial markets.

Money supply has now been shrinking year-on-year since December, an unprecedented development in modern times that should make investors sit up and take notice - growth, asset prices and inflation could all weaken.

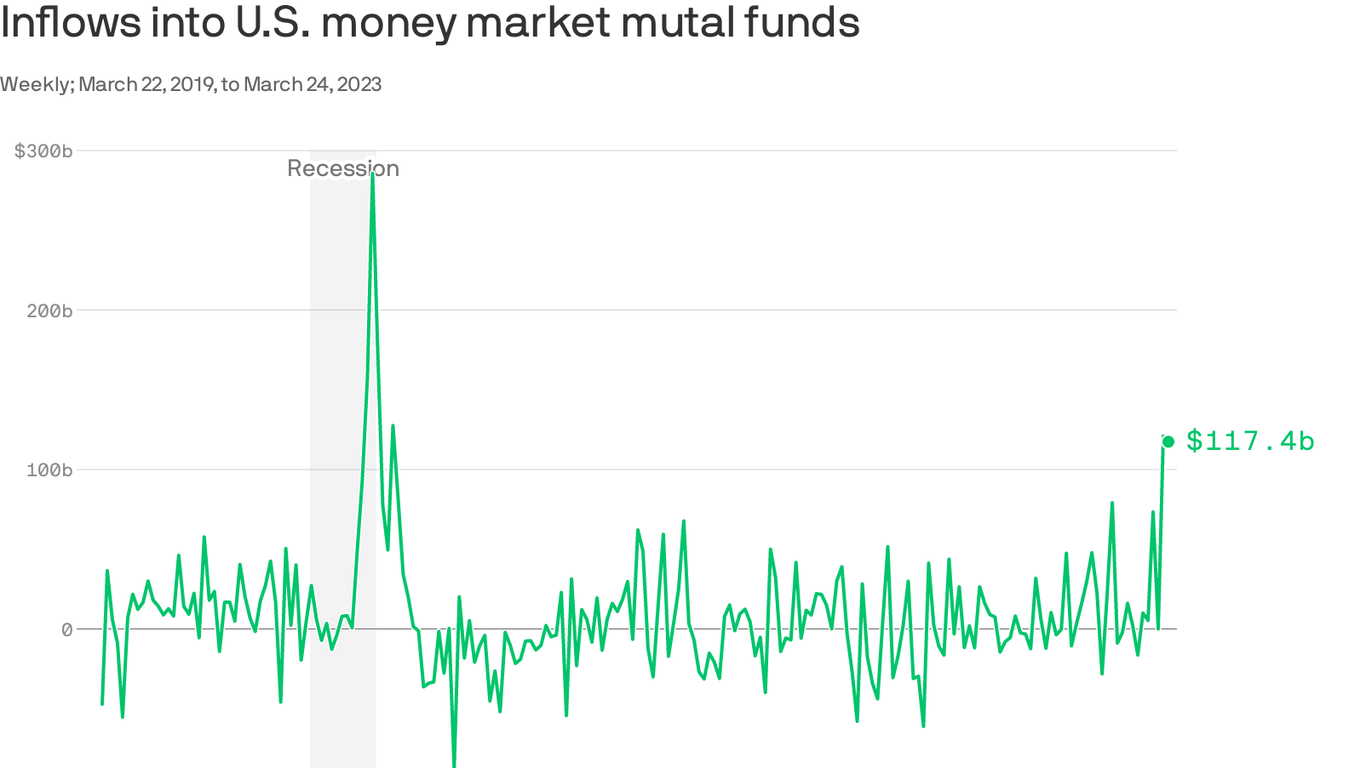

Money's moving out of the banking system — and into money market funds

Over the last couple of weeks, cash crowded into U.S. money market funds at the fastest clip since the COVID crisis hit.

Why it matters: The flow of dollars to money market funds for safekeeping highlights the anxiety that the collapse of Silicon Valley Bank introduced into the financial system.

Financial Fears in 2023: These Are the 4 Top Money Stressors for Women | GOBankingRates

GOBankingRates' 2023 Women & Money survey asked over 1,000 American women about their biggest sources of financial worry and stress — and the No. 1 stressor wasn't saving for retirement or paying for emergencies, but merely having enough money to get by on a day-to-day basis.

Polarized country unites around desire for more money

Context: In an age of hyper polarization, people are becoming increasingly isolated — and the pandemic intensified their feeling of loneliness.

Meanwhile, Americans view the economy as unsteady — and in unsteady times, money becomes more important as a reliable foundation you can rest upon.

No comments:

Post a Comment