It is not the thrill of finding a lost dividend, not exactly. It is more the momentary cessation of complaint, a small, tangible recognition that costs have been rising higher than the roof tiles. That $400—or less, depending on the household metrics—arrived as a gesture from the Governor's administration, a two-billion-dollar effort born from the simple truth that when inflation surges, state sales tax collections surge alongside it.

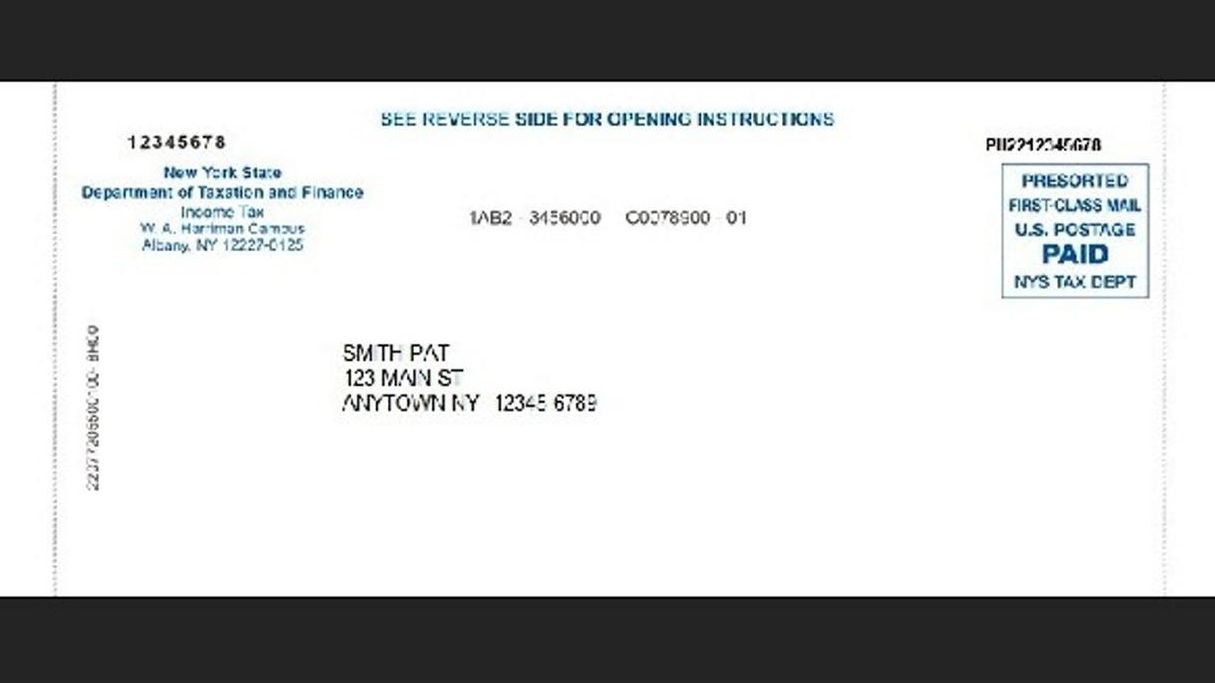

A necessary relief, perhaps. A state attempting to soften the hard edges of an unfriendly economy. Long Island saw 1.25 million of these checks arrive, a flutter of paper meant to signify financial assistance.

But assistance, in the American system, rarely arrives without its attendant obligation. This is the peculiar complexity of the state's generosity: while Albany promises no state levy on the funds, the federal mechanism still operates.

Up to $400 must be listed as income when next year's tax forms are prepared. A reality check, delivered eight months late. That temporary lightness of pocket—now shadowed by the knowledge that a portion of the relief will simply be rerouted to Washington. E.J. McMahon, studying the mathematics, calculated the transfer, estimating that anywhere from $250 million to $300 million of New York State's inflation relief will be channeled directly into the federal coffers.

Sending aid, he noted wryly, to the federal government.

There are, the experts gently suggest, better mechanisms than one-time payments that merely change the destination of the required tax remittance. Andrew Rein, speaking for the Citizens Budget Commission, highlighted the critical need for affordability; the central challenge.

But the State faces gaps. Budgetary cliffs approaching. He suggested holding funds aside, softening the impact of those looming federal cuts instead of this cyclical gesture. Better still, index the tax brackets. Tie the standard deduction to inflation. These are structural changes, the quiet kind that truly alleviate the persistent strain on a household's budget, offering lasting stability rather than a brief, taxable respite.

Imagine the ease. A permanent reduction in sales tax, immediately effective, immediately forgotten by the IRS. No paperwork required later.

The Inflation Reduction Act, a landmark legislation aimed at curbing inflation and promoting sustainable economic growth, has an unexpected twist: the checks disbursed under this act are subject to taxation. This revelation has left many recipients perplexed, as they had anticipated that the payments would be entirely exempt from federal income tax.

The checks, which range from $600 to $1,400 per individual, were designed to provide relief to low- and middle-income households struggling with the rising cost of ___. The taxation of these checks stems from the fact that they are considered "taxable income" by the Internal Revenue Service (IRS). As a result, recipients are required to report the payments on their tax returns and pay taxes accordingly.

This has sparked concerns among advocacy groups, who argue that the taxation of these checks undermines the act's intended purpose of providing financial assistance to those in need.

The complexity of tax laws and regulations has led to confusion among recipients, with some expressing frustration at being required to navigate a complex web of tax rules and regulations.

The implications of this development are far-reaching, with many recipients facing an unexpected tax liability. According to recent reports, the IRS has issued guidance on the taxation of these checks, but many questions remain unanswered.

Related materials: Check hereThe nearly 8 million New York households getting a state inflation refund this fall may be in for a reality check next year in the form of federal |●●● ●●●

No comments:

Post a Comment