The impact: Taken together, these changes could mean more take-home pay even if your salary doesn't change from December 2022 to January 2023, (assuming no other changes to withholding).

You Might Have to Pay Social Security Taxes on Another $8,100 of Your Earnings in 2023

But there's another upcoming Social Security change in 2023 that will impact all workers from those in their 20s to those who might be collecting benefits but are still working.

I'm referring to the wage base that specifies how much of a worker's wages are subject to Social Security taxes. In 2023, there is a big change coming to the wage base.

Texas' Operation Lone Star troops could owe back taxes after state error | The Texas Tribune

/static.texastribune.org/media/files/a999cc0fe9355da636b174934a774892/Migrant%20Return%20Eagle%20Pass%20SF%20TT%2011.jpg)

Eddy County collects $10 million in oil and gas taxes august 2022

Despite hitting a record high for oil and gas tax revenue collections in August, Eddy County may see diminished collections in the future as the price of oil drops, according to an economics professor at New Mexico State University.

Chris Erickson, Ph.D. anticipated tax revenues from activity in Eddy County's oil and gas fields may have peaked earlier this year as the County announced $10.1 million in tax collections during August, the second month of the 2022-2023 fiscal year.

Justice open to new constitutional amendment for taxes | News, Sports, Jobs - Weirton Daily Times

CHARLESTON — Gov. Jim Justice is a vocal opponent of Amendment 2 that would let lawmakers reduce or eliminate six categories of tangible personal property taxes, but he did say he was open to a more narrowly tailored amendment that would allow for tax cuts and protect counties.

How windfall taxes could bolster efforts to reach net-zero | World Economic Forum

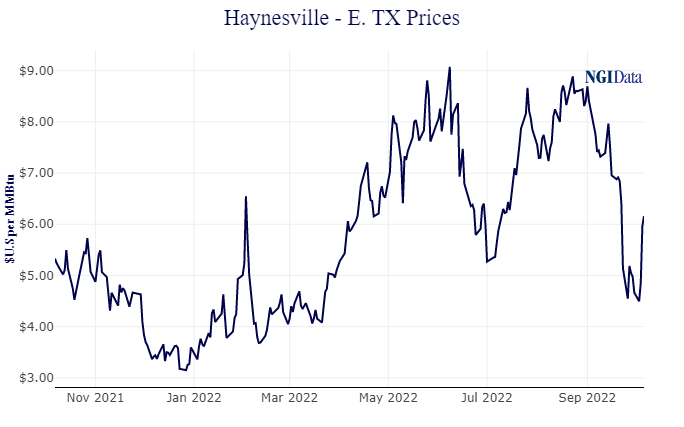

September Natural Gas, Oil Production Taxes Add $1B to Texas Treasury - Natural Gas Intelligence

Natural gas and oil production taxes generated more than $1 billion for the Lone Star State in September, the Texas Comptroller of Public Accounts reported.

The Texas Comptroller's office said the natural gas production tax garnered $480 million last month, representing a 91% year/year increase.

Millions of Brits set to pay more in stealthy taxes despite cuts, study finds

For every £1 ($1.12) given to workers under Truss' much-documented headline income tax cuts , £2 will be taken away through a freeze on the level at which they start paying tax on earnings, calculations released Thursday by the Institute for Fiscal Studies , the U.K.

Under the Conservative Party's "growth-focused" economic agenda, the threshold on the tax-free personal allowance will be frozen at $12,570 until the fiscal year 2025-26, essentially pushing more workers into a higher tax bracket as their earnings increase over time.

No new taxes in 2023 county budget, but questions linger - Chicago Sun-Times

County residents are likely to be pleased with an $8.75 billion Fiscal Year 2023 Cook County budget unveiled Thursday that neither adds new taxes nor raises existing ones.

The more than 4,000 unfilled county jobs, primarily in health care and public safety, raises the question of whether the county can fill — or will fill — all the jobs needed to provide health care.

Could you imagine how much better our government would be if Trudeau had to spend a month like a commoner. Working… https://t.co/BrYy1eVpwY CoryBMorgan (from Calgary) Wed Oct 05 19:28:58 +0000 2022

Former Treasury Secretary @LHSummers tells CNN's @wolfblitzer that the news from OPEC on oil production cuts is "no… https://t.co/NXb3UYASZ1 CNN Fri Oct 07 00:16:43 +0000 2022

Even after receiving the maximum help of £1200, people on Universal Credit are nearly £30 a week worse off than las… https://t.co/NxiXdiDgdK GordonBrown Wed Oct 05 14:25:31 +0000 2022

https://sypuber.page.link/reddcct

REDACTED ID. Click here.

No comments:

Post a Comment