Higher taxes for the rich edged closer to reality on Wednesday morning, after Senate Democrats passed a $3.5 trillion budget plan along party lines.

The blueprint would raise taxes on wealthy Americans and corporations and beef up tax enforcement to fund additional spending on education, paid leave, childcare, health care and climate initiatives, according to a framework issued Monday.

Ban on local income taxes gaining traction - The Lens

The Washington State Court of Appeals struck down the city of Seattle's graduated income tax two years ago, but at the same time overturned a 1984 state law prohibiting local income taxes.

The latest to do so is the Union Gap City Council, which voted in favor of its resolution at an Aug. 9 meeting . Just a week earlier, the Yakima City Council voted to send a proposed charter amendment to voters that would prohibit a local income tax.

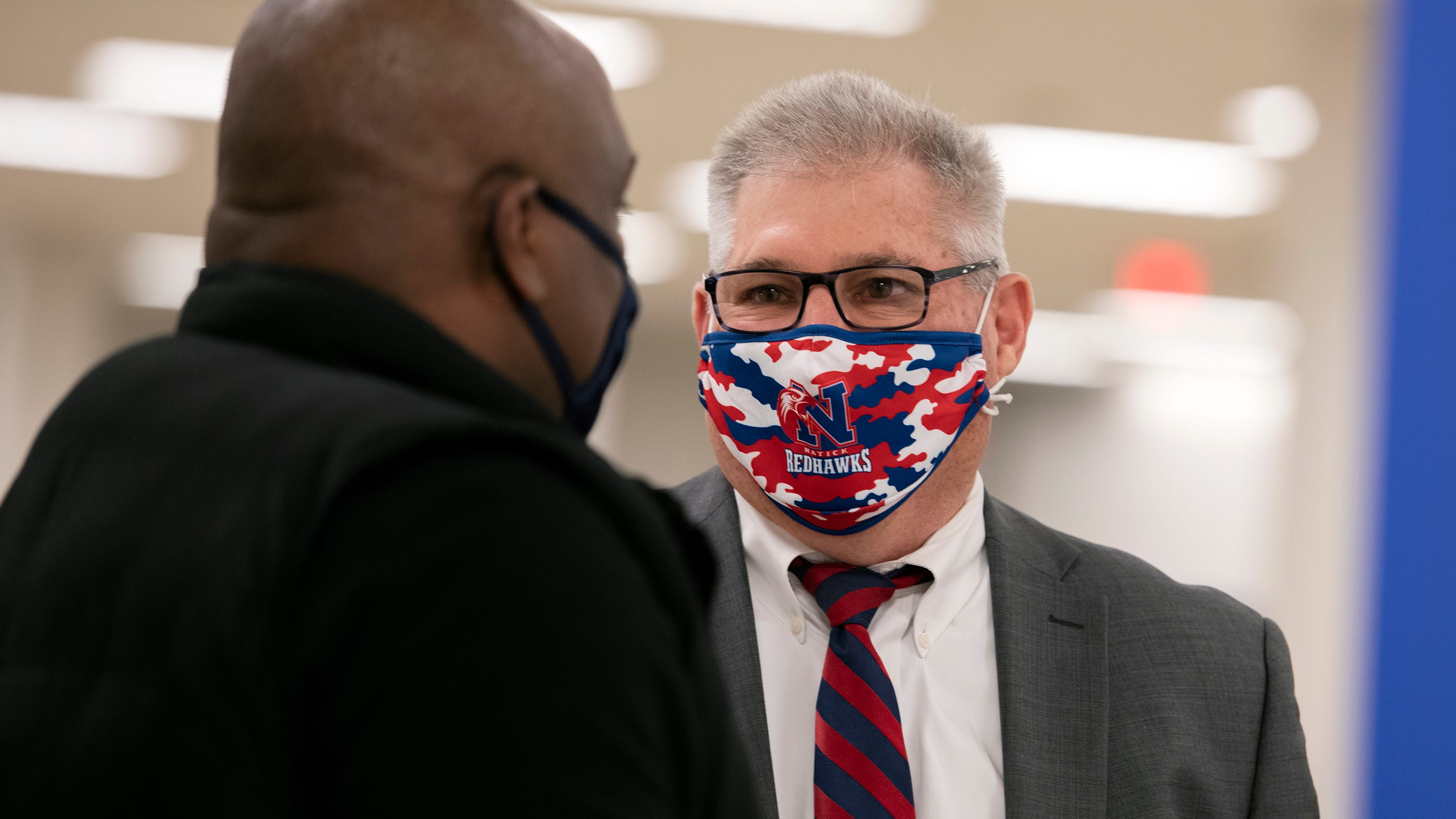

State Rep. David Linsky racked up $154,000 in unpaid federal taxes

BOSTON – The Internal Revenue Service has filed a hefty lien against a state representative for nonpayment of taxes, but the lawmaker said he has paid some of the money, expects the lien to be lifted, and vowed to give the federal government "every dime" he owes.

How Will the U.S. Pay for the $3.5 Trillion? Taxes, Mostly. | Barron's

The day after voting to approve the $1 trillion infrastructure bill, the Senate early Wednesday passed the broad outline for the second half of President Joe Biden's economic agenda: a sweeping 10-year, $3.5 trillion budget resolution to invest in what the president calls "human infrastructure.

House Democrats can get some of Trump's tax records from accounting firm Mazars USA, judge rules

(CNN) The US House should be able to access some of Donald Trump's tax records through a subpoena to his accounting firm Mazars USA, a federal judge in Washington, DC, ruled on Wednesday.

Repeal of the cap on state and local tax deduction still in play

Voting along party lines, Democrats blocked an amendment from Sen. Chuck Grassley, R-Iowa, that would have stopped changes to the $10,000 limit on the deduction for state and local taxes, known as SALT.

However, repealing the SALT tax cap has been controversial, with opponents saying removing the limit may primarily benefit the wealthy.

China slashes fuel export quotas by 73% following new taxes | Reuters

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RHMLZQCPYBNC3GSPMQIRGISBEA.jpg)

China National Petroleum Corporation (CNPC)'s Dalian Petrochemical Corp refinery is seen near the downtown of Dalian in Liaoning province, China July 17, 2018. Picture taken July 17, 2018. REUTERS/Chen Aizhu//File Photo

SINGAPORE/BEIJING, Aug 10 (Reuters) - China has cut export quotas for refined fuels by 73% year-on-year for the second batch of quotas issued for 2021, as new taxes on imports of key blending fuels are set to boost sales of domestically refined fuels.

State Rep. David Linsky, D-Natick owed back taxes to federal government

BOSTON - The Internal Revenue Service has filed a hefty lien against Natick state Rep.

"I've been on a payment plan for quite a while," the Democratic legislator told the News Service, referring to a period of "several years."

The lien, filed July 16 in the Middlesex South Registry of Deeds, itemizes four years of unpaid federal income tax: tax year 2016 ($52,623.65), tax year 2017 ($11,005.34), tax year 2018 ($53,304.48), and tax year 2019 ($37,133.83).

The big risks of 'after-the-fact' nanny taxes | Accounting Today

Figuring out nanny taxes and payroll for your clients with household help can be a hassle, not to mention time-consuming. But you need to keep your clients compliant so calculating nanny taxes "after the fact" may seem to be a way you could save time and energy that can be spent elsewhere.

What Gen Z Needs To Know About Estate Taxes

Despite the pandemic, many Gen Z'ers are graduating from college and setting their course for success.

Once their 401K plan and IRAs are set up, many Gen Z'ers turn their focus to their parents' financial planning. They want to make sure mom and dad have also maximized their tax savings so they can get the most out of their inheritance.

Happening on Twitter

Democrats are engaged in a $9.5 TRILLION spending spree. This week, they're spending nearly $5 TRILLION. $1,200,0… https://t.co/rWkL8ATOUP tedcruz (from Houston, Texas) Tue Aug 10 22:10:30 +0000 2021

JUST IN: Senate Democrats approve a $3.5 trillion budget resolution in a key step toward passing a major economic p… https://t.co/Je2xTJZB6I CNN Wed Aug 11 08:04:48 +0000 2021

Sen. Elizabeth Warren and her allies are proposing a minimum tax on the profits of the nation's richest companies,… https://t.co/ILj5IkBnOO kylegriffin1 (from Manhattan, NY) Tue Aug 10 22:00:00 +0000 2021

No comments:

Post a Comment